Every once in a while, I’ll check in to show items circulating in Wall Street circles and blogs.

-

Long-term trends in markets and the economy.

-

More details on what seems undervalued or overhyped.

-

Link to some great concept explainers.

**All from 01/08/2023

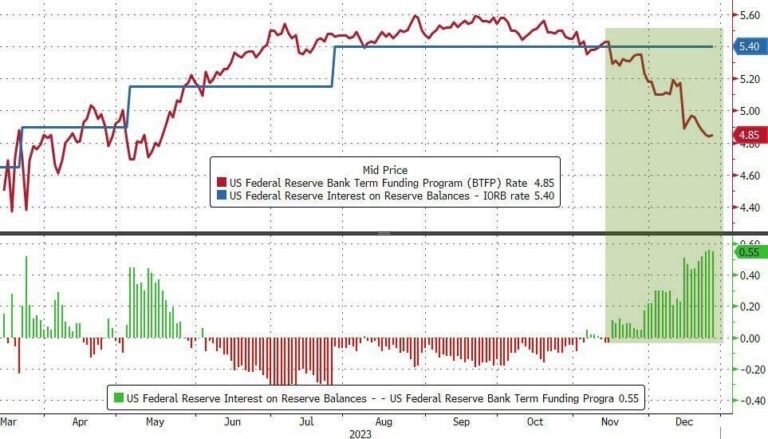

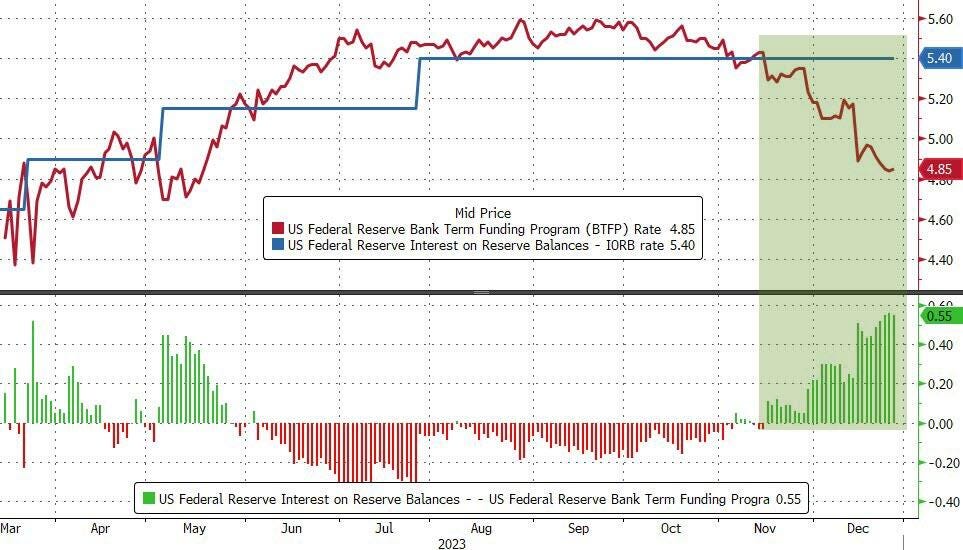

A funky thing started in November 2023. Money market traders and other funding agencies realized that there is arbitrage in the various programs of the Federal Reserve.

-

Using the new Bank Finance Facility Program (BTFP), banking institutions can take any government bond they own, pledge it at face value (no haircut) and the Fed will give them a STUDENT LOAN for up to 1 year at interest 4.85%. price

-

Banking institutions can also DEPOSIT CASH with the Federal Reserve Bank to RECEIVE 5.40% interest. This rate is called interest on remaining reserves. (IORB)

This results in a free 0.55% profit for any institution able and willing to handle the trade.

Following the collapse of Silicon Valley Bank (SVB) in March 2023, the Federal Reserve announced the creation of a new and temporary Bank Financing Program (BTFP). BTFP offers loans of up to one year, to a floating percentage — the OIS exchange rate + 10 bps —- at banks, savings banks, credit unions and other eligible depository institutions.

The program was intended to provide cash to banks that lost deposits as customers moved cash to higher-earning money market mutual funds. The favorite part of this program came from the clause that the securities will be valued at 100 (par) regardless of their open market value.

On the other hand, after the Great Financial Crisis, banks can receive interest on deposits at the Federal Reserve Bank. The percentage is steady and is set by the Federal Reserve Board. It exists to put a cap on interest rates. In the worst case, banks can always put their excess money at the Fed and collect the IORB rate instead of cutting rates by flooding the open market with cash to lend.

November 2023

After the October inflation report showed that inflation has finally come down enough, market expectations quickly adjusted to expect a Fed Fund rate cut soon. Bond and other money market rates fell rapidly forcing the benchmark exchange rate—-is used to find the BTFP floating rate — to fall too.

Meanwhile, the IORB has never changed and will not change until expressly adjusted by the Federal Reserve. This means that the arbitrage will continue to exist until either the Fed lowers the IORB rate or the markets raise money market rates.

On the one hand, congratulations to the trading desks. Bankers and traders fully, legally and smartly take advantage of an arbitrage opportunity the way they were taught in 1st year intern class. I would do the same if I could.

On the other hand, Jimmy Stewart enters It’s a wonderful life– is not.

Moving cash around on a balance sheet isn’t exactly the spirit of the fund allocation game for economic productivity. I also still don’t understand why every institution using one program would be allowed to use the other program at the same time. But here we are, so all we can do now is watch and see how it ends.

Interested in joining the Trader Dads Podcast in 2024? Send me an email! I would love to have subscribers sit down for a chat

Thoughts; Questions? comments;

I arrive! Maybe I’ll do a full post on the topic or as a Q&A

traderdads@substack.com