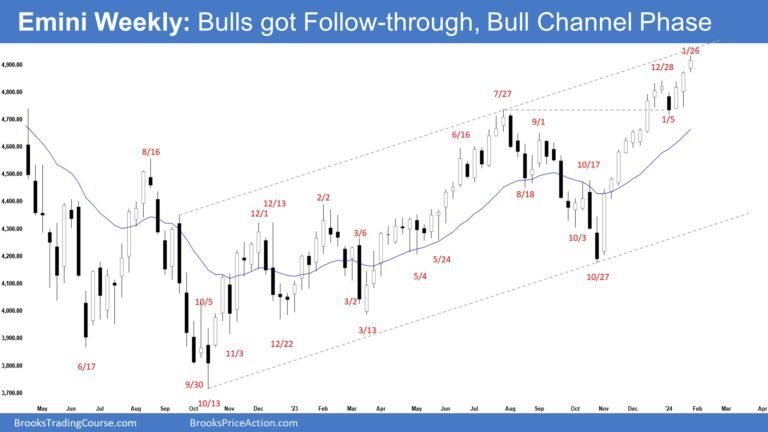

Market Overview: S&P 500 Emini Futures

The weekly chart is likely forming a bull Emini channel after the recent pullback. The next target for the bulls is the all-time high. They want a strong breakout to new all-time highs, hoping it will lead to multi-month sideways trading. Bears want a reversal from a lower high reversal of the main trend (with the all-time high) and a large wedge pattern (February 2, July 27 and January 26).

S&P500 Emini Futures

The Weekly S&P 500 Emini Chart

- This week’s Emini candlestick was a bull bar with a small tail above it.

- Last week, we said the odds were slightly in favor of the market still being Always In Long. Traders will see if the bull can create a breakout bar and continue the move higher.

- Bulls received continued buying after last week’s close above the December 28 high.

- The rise since October has been in a tight bullish channel. This means strong bulls.

- The next target for the bulls is the all-time high. They want a strong breakout to new all-time highs, hoping it will lead to multi-month sideways trading. (Side note: The SPX cash index or ETF SPY has already broken out above its all-time high with consecutive buying this week).

- Swing bulls would continue to hold their position in the market that has established itself at lower prices, believing that any pullback is likely to be small and the market has entered a bull channel phase.

- Bears hope the strong rally is just a buy-gap test of what they believe is a 37-month high trading range.

- They want a reversal from a major trend reversal of a lower high (with an all-time high) and a large wedge pattern (February 2, July 27 and January 26).

- They are hoping to get at least a TBTL (Ten Bars, Two Legs) pullback.

- The problem with the bear hypothesis is that the rally is too strong. The only bear bar in the rally had no follow-through sales.

- They would need a strong reversal bar or at least a micro double top before they would consider selling aggressively.

- If the market is trading higher, bears want the Emini to stop around the trend channel line area or below the all-time high area.

- Since this week’s candlestick is a bull bar that closes in its upper half, it is a buy signal line for next week.

- Traders will see if the bull can create another bullish bar and continue the move higher.

- For now, the odds are slightly in favor of the market always being Always In Long.

- The market may have moved into the bull channel phase after the recent pullback. The odds are slightly in favor of the upsets being small.

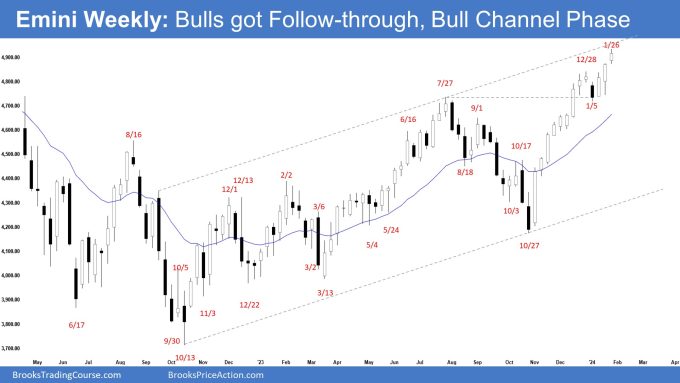

The Daily S&P 500 Emini Chart

- The market traded higher for the week. The Thursday and Friday candlesticks were doji(s).

- Last week, we said they are slightly favoring the market to always be Always In Long. Traders will see if the bulls can generate sustained buys above the December 28 high, which will increase the chances of reaching the all-time high.

- The bulls got the follow-on buy they wanted.

- They got a reversal from a double bottom flag (January 5 and January 17) or a bull wedge flag (December 20, January 5 and January 17).

- They hope that the current rally will be a spike and a channel that will last for many months after the recent pullback.

- They want a retracement of the trend to retest the all-time high followed by a breakout above. (Side note: The SPX cash index or SPY ETF has already broken out above all-time highs with buying following this week).

- If the market is trading lower, they want the 20-day EMA or uptrend line to act as support. They want an endless pullback bull trend.

- Bears are hoping the strong rally is just a retesting of the market gap in what they believe is a 37-month high trading range.

- They want a reversal down from a lower major trend reversal high (against the all-time high), a big wedge pattern (February 2, July 27 and January 26) and what they hope (recent pullback) is the last flag of the movement.

- They also see a micro double top (January 24 and January 26).

- If the market trades higher, the bears hope that the Emini will stop around the trend channel line area or below the all-time high.

- Bears will need to build consecutive bear bars that close near their lows and trade well below the 20-day EMA to increase the chances of a deeper pullback.

- For now, the buying pressure remains stronger (tight bull channel, small pullback) compared to the selling pressure (eg weaker bear bars without further selling).

- The odds are slightly in favor of the market still being Always In Long.

- Traders will see if the bulls can continue to build sustained buys to reach the all-time high.

- The market has probably moved into a bull channel phase after the recent pullback. Traders should be prepared to see small reversals forming more frequently.

Trading room

Al Brooks and other presenters talk about detailed real-time Emini price action every day in the BrooksPriceAction.com trading room. We offer a free 2-day trial.

Archive of market analysis reports

You can access all of the weekend reports on the Market Analysis page.