Grab a coffee or tea and enjoy this read ☕️. If trading and thinking about games and strategies is something you like, you’ll love it!

A few weeks ago I came across an interesting game idea, more or less related to trading and risk management in general.

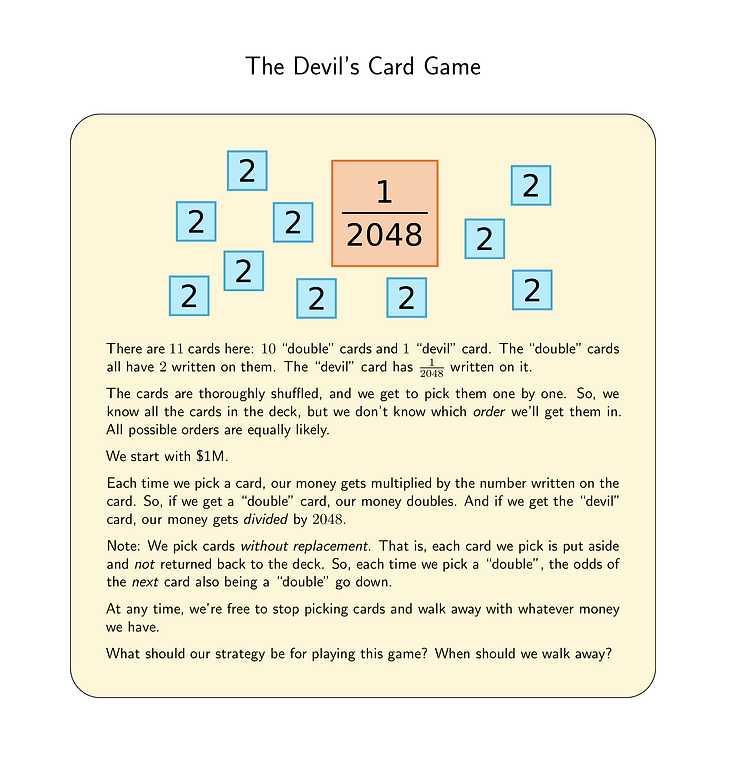

Imagine we have 11 cards. You mix them up and choose one from the stack. If you get a yellow, your balance increases by 2 times. If you get blue, the Devil Card, your balance will be multiplied by 1/2048. So essentially a Margin Call. 💥 We start with $1 million in capital.

In the Devil’s Card Game, the ONLY thing we have control over is when we leave.

Our hope is: we’ll double the $1 million a few times and then be safe before the “devil” shows up.

At the beginning, there are 11 cards in the deck: 10 “doubles” and 1 “devil”.

So, the odds of pulling a “double” are 10/11 = ~90.9%. Those are pretty good odds.

But as we draw more and more doubles, the chances of the next card being a double decrease.

For example, suppose we draw 6 doubles.

Now, there are 5 cards left in the deck: 4 “doubles” and 1 “devil”.

The chance of drawing a “double” is now only 4/5 = 80%.

Still very good odds, but not as high as when we started the game.

If we ever draw the “devil”, we know for sure that everything remaining The cards in the deck are double — as there is only 1 “devil”.

So, after pulling the “devil”, we must NOT leave. We should stay for the 11 draws, which will leave us with $500K.

![]()

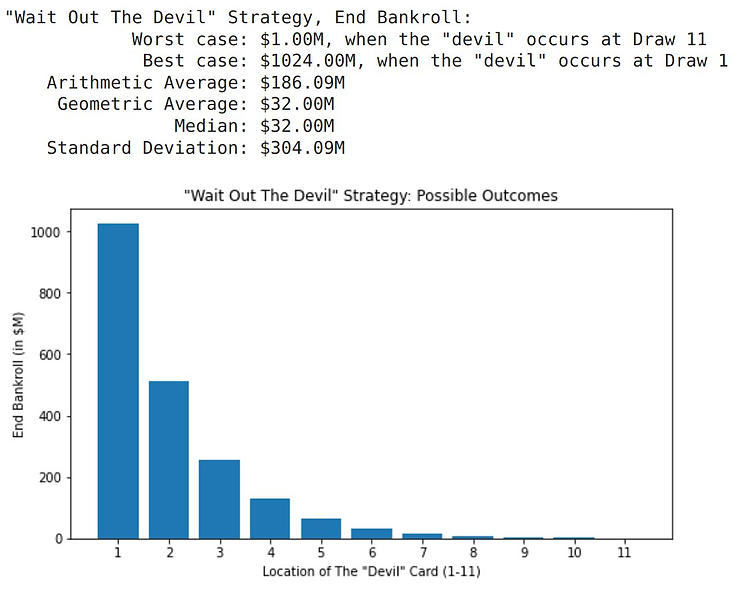

So this is our worst case scenario: we walk away with $500,000.

What is the best case? That is if we draw 10 straight doubles. We will then take home $1 million * (2^10) = $1.024 billion.

(After 10 straight doubles, we know for sure that the last remaining card is the “devil”. So, we won’t draw it.)

Let’s take a look at the results according to the number of good cards received before the “devil” card appeared:

Expanding the rules: We decide the size of the bet!

Now, let’s take a step closer to the real deal. Let’s change the rules. Now we are able to decide our bet size on each draw.

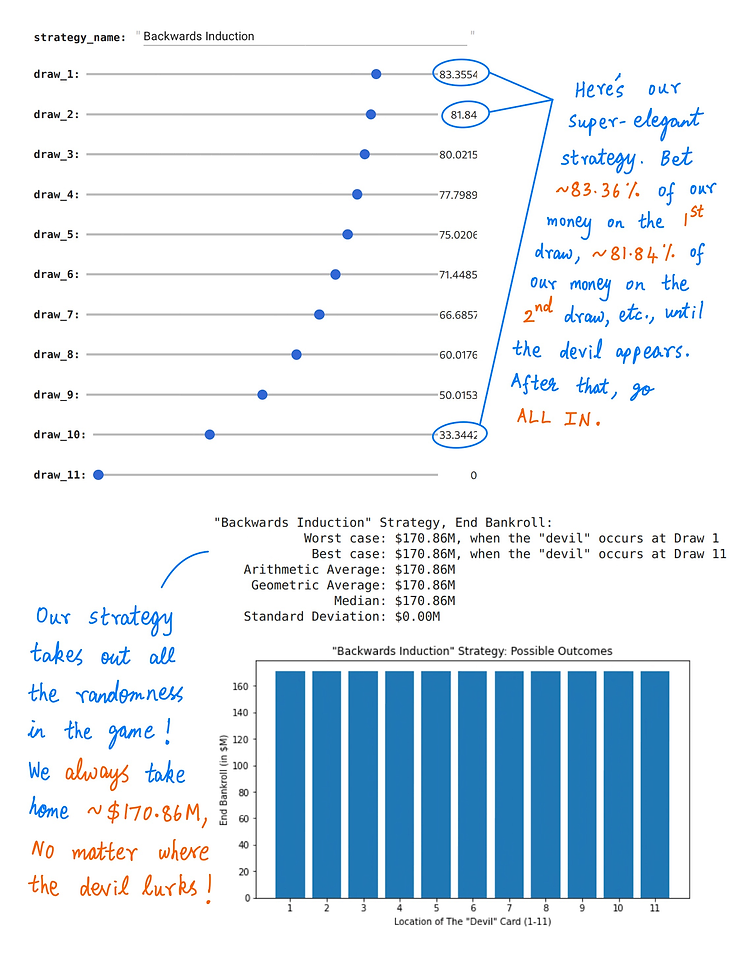

Then there is an optimization trick called “Induction backwards“. Awesome stuff for nerds. Here’s a quick summary:

With each new card, the probability of getting the “devil” increases. Thus, we reduce the size of the bet.

To win the devilish card game and to end it no matter what $170m result, we start the first bet with 83% of our capital. The second bet with 81.84% etc

Earning money 📈

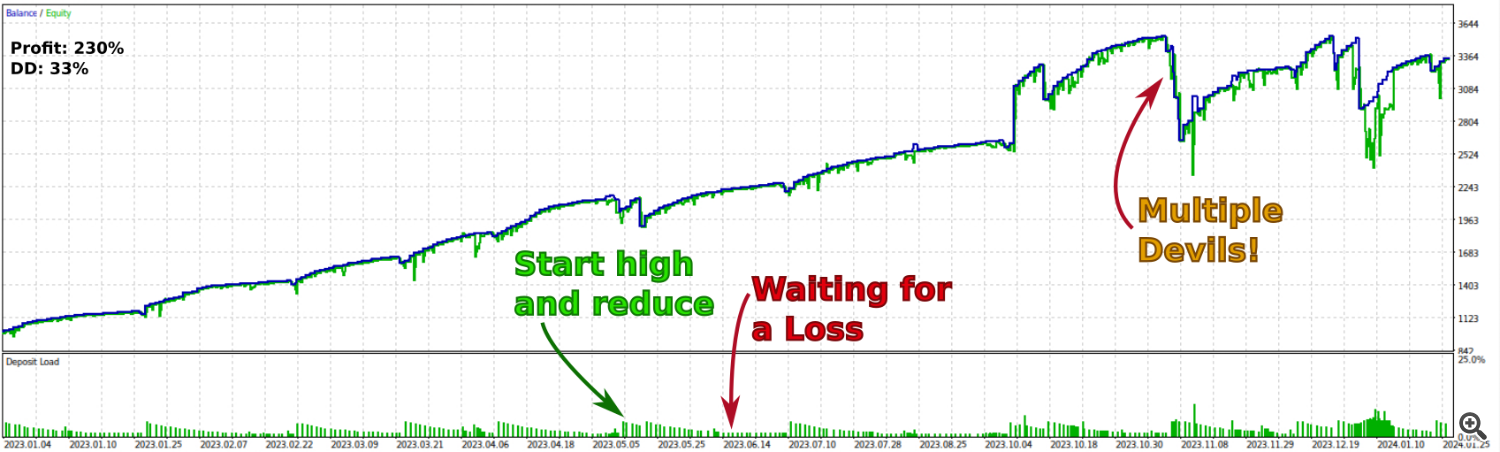

Let’s use this logic to make money with Forex. To get close to the “devil’s game” I choose a strategy, which has a high win rate and quite a large loss (SL much larger than TP).

Using fixed batch size, it will look like this:

the diagram above shows a strategy, which has been optimized (read about safe optimization) to have a high profit rate. So he has many wins but at times there is a bigger loss. I imagine, you’ve already seen quite a few of these around. We can also see that there is a time when multiple devils (losses) cry out quite close to each other. These are the times that kill the account if users apply martingale strategies.

Let’s see how we can make good money from this strategy.

Similar to the Devils Game solution, we define the following settings:

-

Maximum position size is 11×0.01=0.11 lots – which is fair enough for a $1000 bill I think.

-

We reduce the positions by 10% after every win. So it’s the first one 0.11the second is 0.11*0.9=0.10etc

conclusion

When we used the naive strategy (the one with the scared monkey), we would have received 75% with a withdrawal of 33%. However, using the new risk management we get 230%.

This is the mega-booster for all strategies, where you win often, but sometimes a high draw can occur. I guess you know some of them. So thank you, researchers who invented Backwards Induction for trading! 🙂 (Baum, former IBM scientist and CTO of Renaissance Technologies).

Inverse induction for risk management is part of the yet unpublished BFG 9000 EA. I can’t tell you how excited I am for its release! 🚀

Let’s see it in action soon Sign up in the newsletter or at BFG9000 Telegram Group

![]()