merchants,

I am excited to introduce many new ideas, all of which have the potential to make significant directional moves. I will share my thought process and feasible trading plans with you as always.

The market continues to melt higher and is fresh off new all-time highs on Friday. While one could argue that we are overbought in the short term, I certainly don’t want to get in front of that freight train. Instead, my focus will continue to be on what works in the current environment: buying breakouts and getting into day two with momentum continuation plays.

So, with that in mind, here are my top swing ideas for the week.

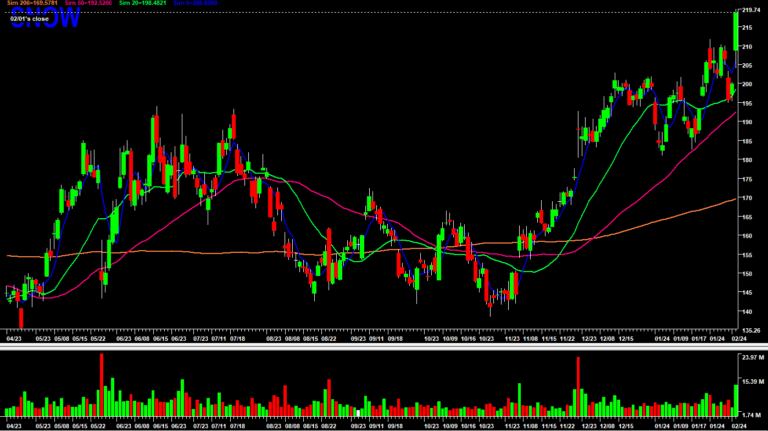

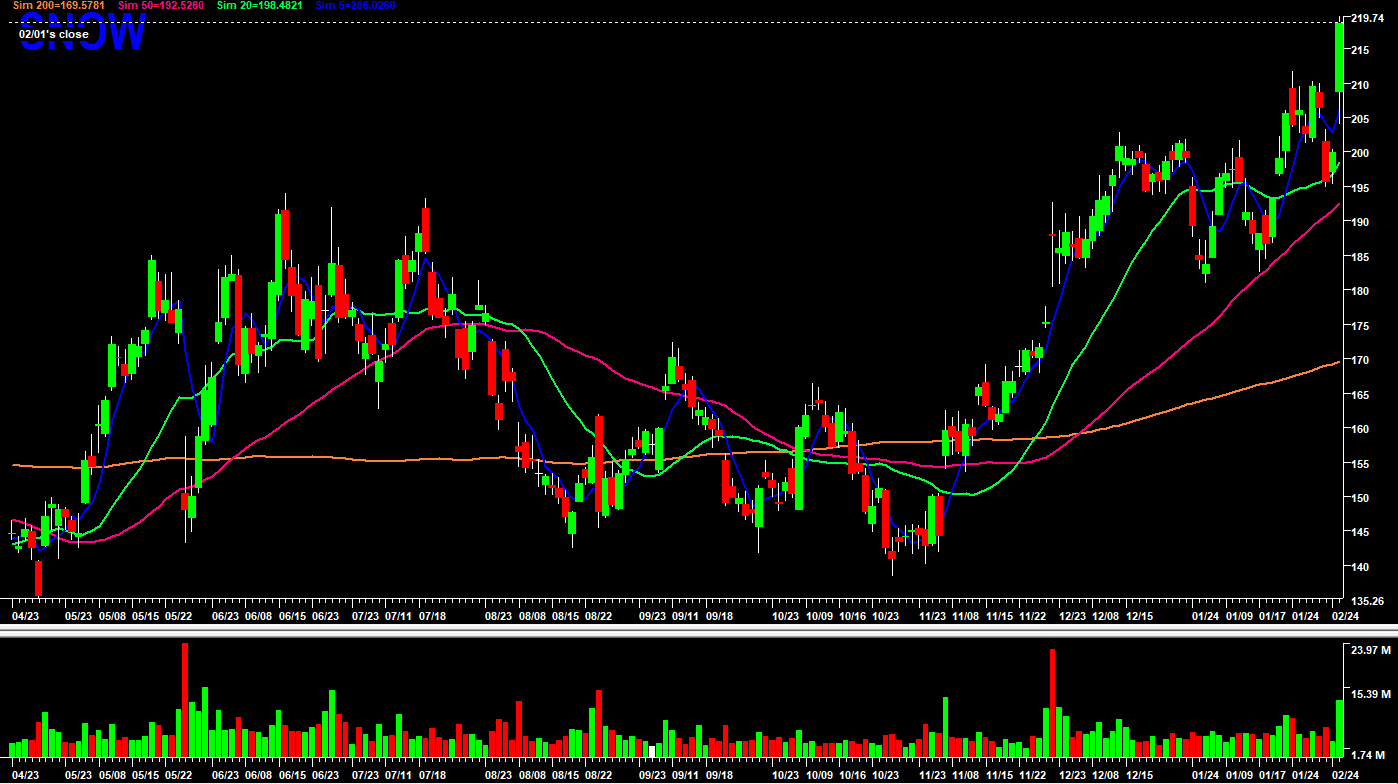

Continued outbreak of SNOW

SNOW broke out on Friday and saw a significant spike in volume, thus confirming the breakout and adding an element of authority to it.

The stock broke out of a huge, higher time consolidation and base. This move may have legs ahead of its upcoming earnings later this month.

*Please note that the prices and other statistics on this page are hypothetical and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and fees.

Here is my exact plan for SNOW:

This is a stock with a high ATR of 7.59. Therefore, size/risk should be carefully considered and adjusted accordingly.

After breaking out convincingly on Friday, I’m looking for a dip / higher low to enter long after confirmation for continuation.

I will target a dip towards the 2-day VWAP, around $215, for a higher low and confirmation that buyers have increased. If confirmation is received, I’ll go long with a stop near $210 – where the stock broke out intraday on Friday, along with previous resistance on a higher timeframe. My first target for this position would be a 1 ATR move above Friday’s high towards $227.

I plan to take off most of my position on this target. After that, I will trail my position conservatively using the higher lows of the 15-minute chart and exit my position to higher intraday highs in the same time frame, with an ultimate target of $230 – $235 for what I intend to it is a maximum three-day wait.

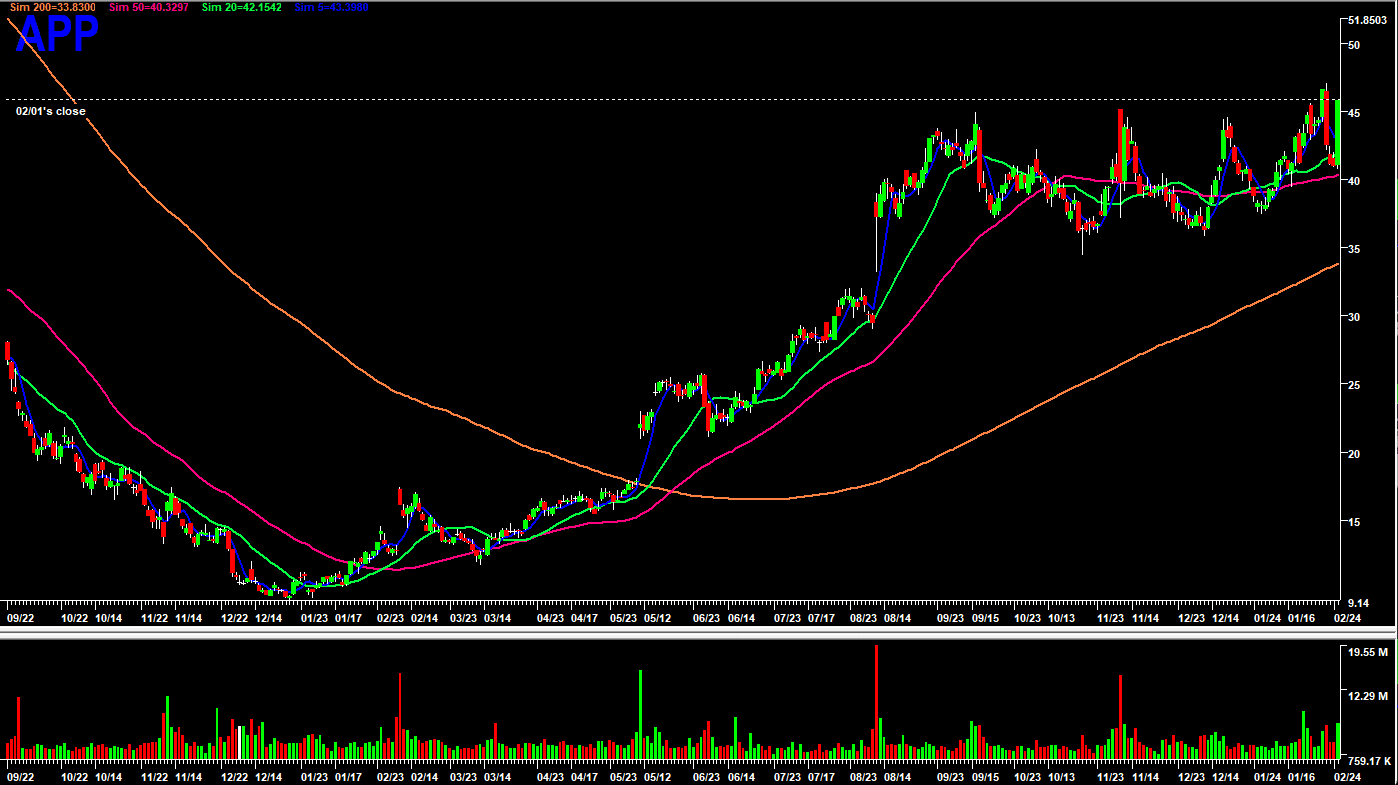

Split APP integration

Another stock that is due to report earnings later this month on February 14th. It is currently consolidating into a multi-month, broad-based consolidation.

Another stock where risk and size should be carefully adjusted and considered as a stock has a Beta of 1.69 and an ATR of 2.05.

*Please note that the prices and other statistics on this page are hypothetical and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and fees.

Here is my design for the APP:

Steady bounce from Friday’s converging SMA’s, along with a noticeable uptick in volume and range extension. Buying highs in the stock didn’t work during this consolidation, and as such, my focus is on buying a higher low…something similar to my SNOW plan.

I will go long if the stock pulls back near the 2-day VWAP and confirms a higher low. Once confirmed and entered long, undersized to take a wider position given the stock’s high Beta, I’ll set my initial stop near Friday’s low to give it some breathing room. Once the stock hits Friday’s high, I will move my stop to the previous higher low and target a move near $50 to take out half of my position. I will follow my position here using higher 15-minute lows and exit the position for a maximum of three days by selling new higher intraday highs in the same time frame.

Additional Backburner Ideas:

Several ideas I’ve set alerts on, but they’re highly conditional and will take up less of my focus than the two ideas above and other intraday strategies and focuses:

Netflix: Consolidation after power gains move. Alerts were set near the $570 resistance should the stock break above on a surge in volume, providing an opportunity for a two-day momentum rally.

Mara: Good bounce back from a previous watchlist idea. It is now entrenched in a narrow range. Alerts are set for a hold above $19 for a possible 1 – 2 day move to $20 – $22.

Goldman Sachs: significant consolidation on the daily chart. Alerts have almost resistance for a potential breakout move. One that I will be watching closely over the next few days.

Important Disclosures