Market Overview: S&P 500 Emini Futures

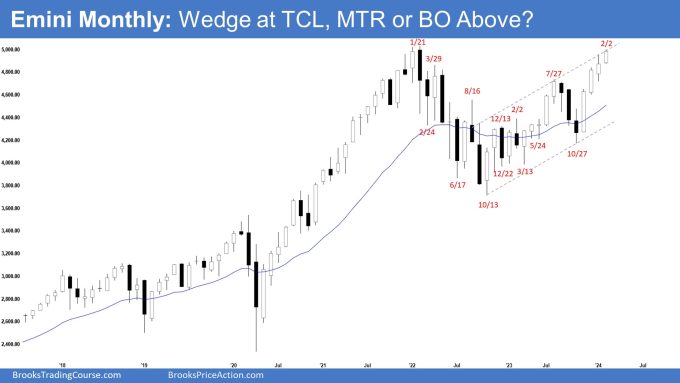

The monthly chart forms a high Emini test level. Bulls hope the market will reach an all-time high and break out higher. Bears want a reversal from a lower major trend reversal high or a double top and a large wedge pattern (December 2, July 27 and February 2) forming in the trend channel line area.

S&P500 Emini Futures

The Monthly Emini chart

- The January monthly Emini candlestick was another continuous bull bar with a prominent tail above.

- Last month, we said the odds slightly favor January trading at least a little higher. The all-time high is quite close and could be tested in January.

- January traded higher but fell short of an all-time high.

- Previously, the bulls managed to create a tight bull channel from March to July.

- This increases the chances of at least a small second leg to the upside after the withdrawal from July to October. The second leg is currently underway.

- February traded above the January high. Bulls hope the market will reach an all-time high and break out higher.

- Bears see the current rally as a repeat of the January 2022 all-time high and want a reversal from a lower high main trend reversal or a double top.

- They also see a large wedge pattern (December 2, July 27 and February 2) forming in the trend channel line area.

- Due to the strong rally over the last 3 months, a strong signal bar or micro double top will be needed before traders are willing to sell more aggressively.

- If February stops around the January high or just above it, it may form a micro double top.

- Since January closed above the middle of its range, it is a buy signal line albeit a weaker one.

- For now, the odds are slightly in February to trade at least a little higher as it did.

- The market remains Always In Long and the uptrend remains intact (higher highs, higher lows).

- However, the rally has also been long and is slightly topping.

- A small pullback may begin within a few months before the market pulls back to higher levels.

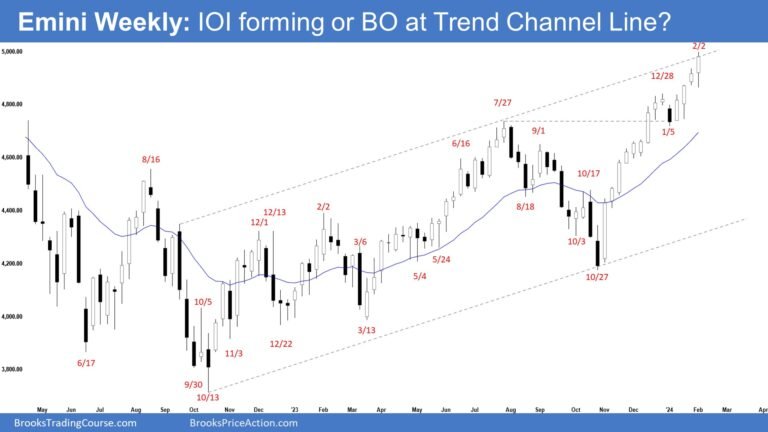

The Weekly S&P 500 Emini Chart

- This week’s Emini candlestick was an outside bull bar that closed near its high with a long tail below.

- Last week, we said the odds were slightly in favor of the market still being Always In Long. Traders will see if the bull can create another bullish bar and continue the move higher.

- Bulls continue to have sustained purchases above the December 28 high.

- The rise since October has been in a tight bullish channel. This means strong bulls.

- The next target for the bulls is the all-time high. They want a strong breakout into new all-time high territory, hoping it will lead to months of sideways trading.

- Swing bulls would continue to hold their position in the bull market at lower prices, believing that any pullback is likely to be small and the market has moved into a bull channel phase.

- Bears are hoping the strong rally is just a buy-gap test of what they believe is a 38-month high trading range.

- They want a reversal from a major trend lower reversal high (with the all-time high) and a large wedge pattern (February 2, July 27 and February 2) from the trend channel line area.

- They are hoping to get at least a TBTL (Ten Bars, Two Legs) pullback.

- The problem with the bear hypothesis is that the rally is too strong. The only bear bar in the rally had no follow-through sales.

- They would need a strong reversal bar, a micro double top or a reasonable signal bar for a Low 2 setup before they would consider selling aggressively.

- Bears hope next week to form an inside bear bar, forming an ioi (inside-outside-in) followed by a breakout below, starting the TBTL pull phase.

- If the market is trading higher, bears want the Emini to stop around the trend channel line area or the all-time high area.

- Since this week’s candlestick is an outside bull closing near its high, it is a buy signal line for next week.

- Sometimes the candlestick after an outside line is an inside line, forming an ioi (inside-outside-in) pattern, a breakout mode pattern.

- While the market continues to be Always In Long, the rally has been long and is slightly topping.

- Traders expect a small pullback (even if it lasts for weeks) and look for signs of it.

- Traders will see if the bull can create another bullish bar and continue the move higher. Or will the market stop around the trend channel line area?

Trading room

Al Brooks and other presenters talk about detailed real-time Emini price action every day in the BrooksPriceAction.com trading room. We offer a free 2-day trial.

Archive of market analysis reports

You can access all of the weekend reports on the Market Analysis page.