Before we list my top ten ETFs for the Wheel, let’s take a look and see why I like using ETFs for the Wheel selection strategy.

ETFs trade just like stocks and have options like some stocks.

ETFs are not subject to earnings movements like individual stocks.

So I can avoid big moves in the stock price during earnings announcements.

Since the Wheel is a slightly bullish strategy, I don’t want the underlying to decrease in price during winnings.

Even if the stock price goes up, I may not be able to take full advantage of the move if I have a covered call that limits my profit.

This will be clearer when we look at the expiration charts in a quick example.

Contents

An investor sells an out-of-the-money cash-backed put option with the mental preparation to take ownership of the stock upon assignment.

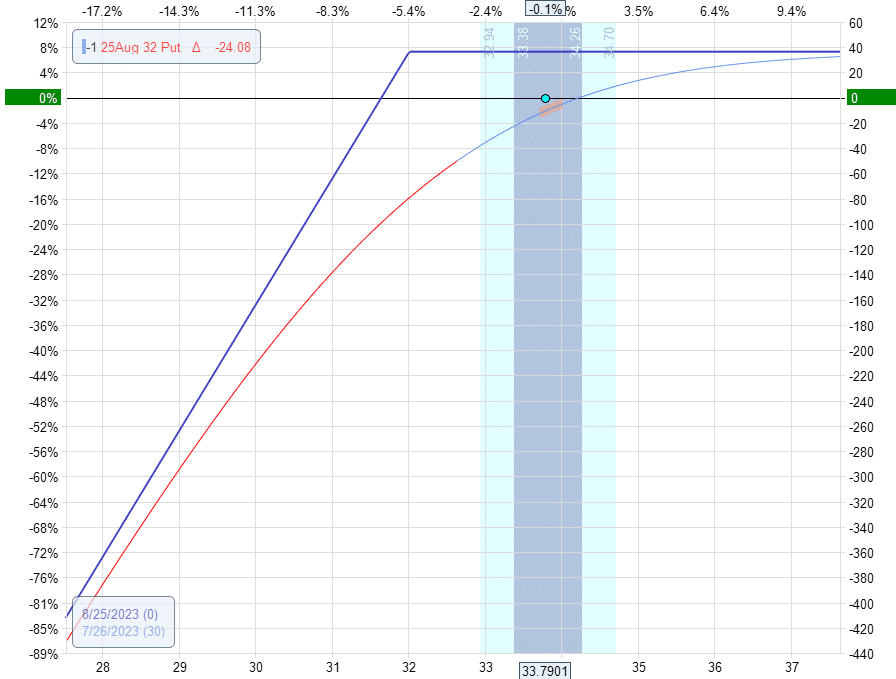

Suppose that on July 26, 2023, if investor sells the $32 strike put option that expires on August 25th (about 30 days away).

By selling approximately 25-delta in the option chain, the premium collected for selling this put is $0.36 (on a per share basis).

With the ETF priced at about $34 per share, the premium collected in this example is about 1% of the share price.

We have the following bullish expiration chart:

Often, the put option expires worthless at expiration and the investor keeps the premium received.

I chose this example to show what happens when the ETF price ends up below the strike price at expiration.

The price closed at $31.31 on August 25, which is below the strike price of $32.

The investor must buy 100 shares of EWZ at $32 per share.

While this may seem like a loss of $69, it’s only a net loss of $33 when you factor in the $36 originally raised,

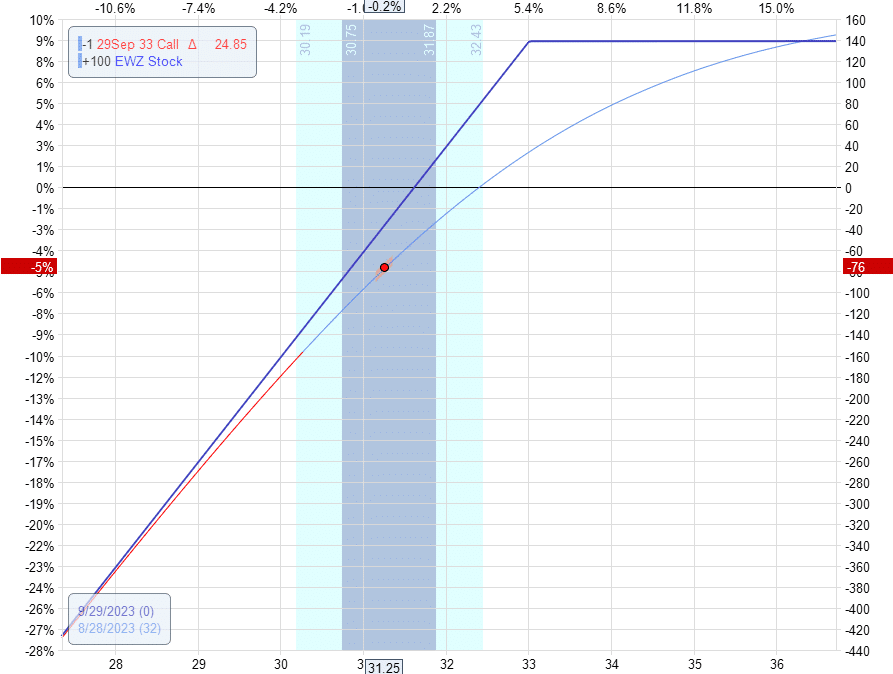

The following Monday, August 28, the investor owns 100 shares of EWZ and sells an out-of-the-money call option with a strike price of $33, which expires on September 29.

Collecting a premium of $0.38 per share is nice, but the investor wants the ETF’s price to appreciate, as seen in this covered call expiration chart.

If the price does not appreciate enough, the call expires worthless at expiration and the investor sells another covered call.

If the ETF retires, start the Wheel again by selling another one put with cash collateral.

The symbols I like to run this strategy on are:

EWA – Australia Index Fund

EWZ – Brazil ETF

EEM – Emerging markets

EWU – United Kingdom

ARKK – Innovation ETF

FXI – Large cap China

XLU – Fund of the public utility sector

IYR – Real estate

XLK – Technology sector fund

XLF – Financial sector fund

Can I sell calls that are in-the-money?

Yes, you can if you want to increase the exit probability of your shares by withdrawing your shares.

If this happens, you will still receive the extrinsic value of the call option.

But if the asset price rises significantly, you may not be able to take advantage of the profits because the call option limits your profits.

Can I sell cash collateralized sales?

Yes, you can if you want to increase the probability of allotment and ownership of the shares.

You collect a larger premium up front to account for the higher strike price than the current price, this represents the intrinsic value of the put option.

Plus, you collect a bit more in terms of time value (or extrinsic value of the option).

Can I use these ETFs for iron condors?

Yes you can.

But because the price per share of some of these ETFs is low, you may have to sell a lot of contracts to collect enough of a premium to make it worthwhile.

The extra number of contracts adds to your transaction costs.

And there you have it.

Don’t just copy my list.

Find your own best candidate wheels.

Some investors like to perform technical analysis and fundamental analysis to look for bullish assets.

Having a diverse set of ETFs for trading the Wheel strategy will help diversify your portfolio.

We hope you enjoyed this article on the top ten ETFs for the wheel strategy

If you have any questions, please send an email or leave a comment below.

Trading Vault!

Disclaimer: The above information is about educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with stock trading options. Any reader interested in this strategy should do their own research and seek advice from a licensed financial advisor.