It’s the end of one month and the beginning of another, so it’s time for my favorite update: my dividend update. These dividend updates reflect all dividends I receive through my investment pursuits. I hope they can inspire you to take control of your own finances and invest to create a passive income stream. The use of this stream is up to you, be it funding early retirement, just provide some money from FI/FU or even for annual leave. The key is that it can offer options and open up all kinds of possibilities. You can check mine dividend income the progress pages to see what commitment to an investment plan can get you.

While retreating from January’s results, February continued its solid start to 2024. My FI portfolio generated $595.57 for the month with my Loyal 3 FolioFirst Interactive Brokers portfolio with another $6.86. My Roth IRA added $74.13 and Rollover IRA generated $365.73. For the month I received $602.43 in all my taxable accounts and $1,042.29 in all bills.

Making money while I sleep

The power of being in the ownership class is that these companies can work much harder for you than you can. Think about it. Alone I have to devote my own time to a job to make money. However, by buying a stake in a high-quality business, I can now leverage my own time that I traded for money in companies that work around the clock to produce products or provide services to their customers. These companies work 24/7/365 which means I’m making money even when I sleep.

In February the companies I own paid me $37.22 per day or $6.51 per hour assuming 8 hours of work 5 days a week. YTD which is $43.13 per day and $7.55 per hour.

FI Portfolio

As I mentioned above, my FI portfolio produced $595.57 in dividends in February. It came *that* close to crossing the $600 level. FebruaryIts results were an outstanding 16.4% increase compared to February 2023 and even more so as this was mainly just from dividend reinvestment and dividend increases over the last year. Full year results compared to 2023 have 2024 being 12.0% higher.

Roth IRA

My Roth IRA continued its strong start to 2024. In February it produced $74.13 in dividends. Compared to February 2023, this is an outstanding 44.3%. Full year results have 2024 26.0% ahead of 2023.

IRA rollover

In March 2019 I mentioned that I would start reporting my Rollover IRA. Most of these funds are invested in dividend growth companies, although there are some that are not, so to give the clearest picture I will only show dividend growth investments during my monthly reports. That said, I’m not too concerned about any particular month/quarter of dividends, as my current plan is to be a bit more active with these funds than in my taxable accounts.

My Rollover IRA produced a total of $365.73 in dividends in February, which is an outstanding 29.5% increase compared to February 2023.

Dividend increases during the month

February was a great month for dividend increases with 15 of my FI portfolios increasing their dividends. Combining these 15 companies increased their trailing 12-month dividends by $149.74. Unfortunately there were some pretty disappointing increases, but overall it was a very strong month.

Source of Dividend Increase

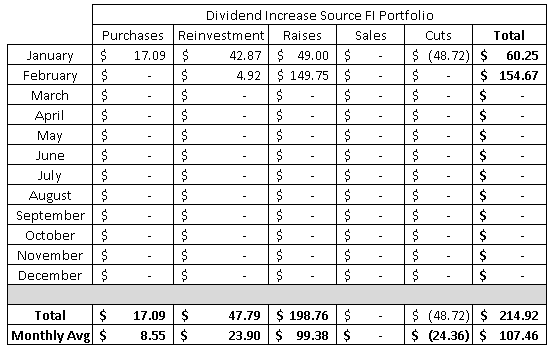

I’ve begun to break down the monthly dividend increase into its components: purchases, reinvestment, and dividend increases. This allows me to see who is the biggest contributor each month to my pursuit of financial independence. I only track it for my main FI portfolio as that is the portfolio I want to ultimately provide most of our income.

February was a pretty strong month, especially considering that once again we didn’t add any new cash to the portfolio. We have prioritized saving cash over new investments because we now have 3 kids in daycare and are looking at other potential opportunities.

That said, I’m still very happy to note that we were able to increase over $150 in forward 12 month dividends without adding any capital to the portfolio.

Markets have continued to lag as they have in 2023. For the most part, markets have only come from reinvesting cash dividend payments into other holdings.

Fortunately, dividend growth investments are not built to rely solely on one source of dividend growth. When one is missing, you can still count on the other two to help.

The dividend increases were amazing adding $149.75 to our forward 12 month dividends.

The reinvestments were a little disappointing adding just $4.92 to our forward dividends.

That’s why it’s so nice to finally achieve some scale with your investments and dividends. Dividend reinvestment and organic dividend growth can help and will eventually far exceed what you can do with saving alone.

In February our 12 month forward dividend was up $154.67 and for the year was up $214.92. We are currently tracking an average monthly increase of $107, although I know it will drop lower as the year goes on.

I look forward

My future 12 month dividends for my FI Portfolio closed January at $12,351.73 while mine Faithful 3 FolioFirst Interactive Brokers dividend futures are at $247.56. This pushes the total taxable bill forward 12 months dividends to $12,599.29. My Roth IRA’s trailing 12-month dividends are at $1,308.54. My Rollover IRA’s trailing 12-month dividends are at $5,163.33.

Across all 4 accounts, assuming no dividend cuts or position size changes, I expect to receive at least $19,071.16 in dividends next year.

Monthly average

The chart below shows the monthly dividend totals for each year I have invested as well as the monthly average. It’s not always an increase, as some companies have weird pay schedules as we saw above, and eventually some positions will drop, but the long-term trend is what matters.

The 12-month monthly rolling average for my FI portfolio ended January at $993.38 per month, which is $14.78 higher or a 1.5% increase compared to the 2023 monthly average of $978.60 .

Analysis of Dividends Received

I have updated mine Dividend income page reflecting February’s changes.

How did your dividends go in February? Are you off to a strong start in 2024?

Let me know in the comments below!