Transaction update: Thursday, February 15, 2024

S&P Emini pre-open market analysis

Emini daily chart

- The Eminis rallied yesterday, creating a bad continuation for the bears. This increases the chances of sideways trading for the next few days.

- While the selloff on Tuesday was good for the bears, the daily chart has been in an uptrend since early November. This increased the market’s chances of overtaking and taking profits at the moving average.

- Bulls have a High 1 buy signal line with today’s high. The Bears hope there will be more sellers above its high point than buyers.

- Right now, the odds favor the Bears to get a second leg down. However, because the market is at the moving average, which is the support on the daily chart, the pullback could be very deep before the bears get their second leg.

- Overall, traders should expect sideways trading in the coming days.

5 minute Emini chart and what to expect today

- The Globex market moved mostly sideways during the overnight session.

- The bulls hope that today, they will continue to rally. However, traders should expect plenty of trading range price action today.

- This means traders should pay close attention to the opening of the day.

- Traders should also pay attention to yesterday’s high as it will likely be a major magnet to start the day.

- Traders should also consider not trading during the first 6-12 bars as the day is likely to form an open trading range.

- Bulls today want to form a bull trend from the open, which would create a follow-through above yesterday’s High 1 buy signal line.

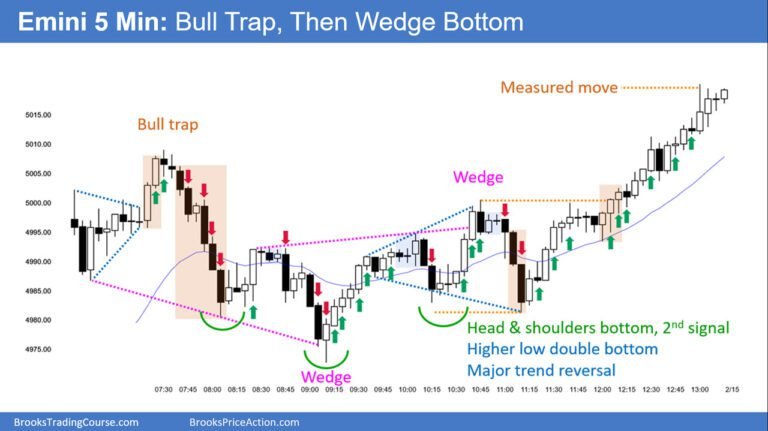

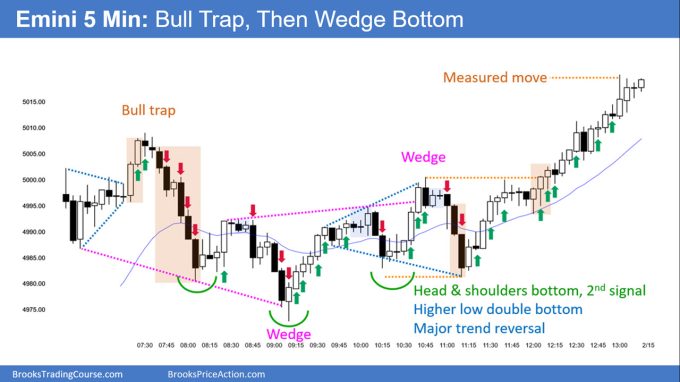

Yesterday’s Emini settings

Al created the SP500 Emini charts.

Here are reasonable stop entry settings from yesterday. I show each buy entry line with a green arrow and each sell entry line with a red arrow. Buyers of both the Brooks Trading Course and the Encyclopedia of Chart Patterns have access to a nearly 4-year-old library of more detailed explanations of swing trade setups (see Online Course/BTC Daily Setups). Encyclopedia members receive the current daily charts added to the Encyclopedia.

My goal with these charts is to present an Always In perspective. If a trader was trying to be Always In or almost Always In on a position throughout the day and was not currently in the market, these entries would be reasonable times to enter. So these are floating shares.

It is important to understand that most swing setups do not lead to swing trades. Once traders get frustrated, many leave. Those who exit prefer to exit with a small profit (scalp), but often have to exit with a small loss.

If the risk is too much for your account, you should wait for lower risk trades or trade an alternative market like Micro Emini.

Trading strategies in the EURUSD forex market

EURUSD Daily Forex Chart

- EURUSD is making a strong reversal after yesterday’s bull reversal bar.

- The first target for bulls is the moving average and the next target is February 12thu high.

- Bears are optimistic about the negative gap created with January 16u and February 5u The breakout is a sign that the market is now in a small downtrend.

- While the market is in a small downtrend, bulls are gaining strong reversal leverage. This will increase the chances that the market is forming a trading range and that the market will soon start to go sideways.

- Bulls must eventually close above the moving average to convince traders that the market is in a trading range.

Summary of today’s S&P Emini price action

Al created the SP500 Emini charts.

See the weekly update for a discussion of price action on the weekly chart and what to expect next week.

Trading room

Al Brooks and other presenters talk about detailed real-time Emini price action every day on the BrooksPriceAction.com trading room days. We offer a free 2-day trial.

Charts use Pacific Time

When times are given, they are US Pacific Time. Daily Emini charts start at 6:30 AM. PT and end at 1:15 p.m. PT, which is 15 minutes after the close of the NYSE. You can read information about market reports on the Market Update page.