Examining the Strong RSI Indicator:

A Trader’s Tutorial

The Relative Strength Index (RSI) is a cornerstone tool in a trader’s arsenal. Developed by J. Welles Wilder Jr., the RSI helps measure an asset’s momentum and identify potential overbought or oversold conditions. This tutorial will break down the RSI, explore its mechanics and delve into how traders use it, along with insights from experts.

Revealing the Formula:

The RSI lies between 0 and 100, reflecting the relative strength of recent price movements. Here’s the magic under the hood:

- Average profit/loss: The RSI takes into account average gains and losses over a specified period (usually 14 days). It calculates average gain (AG) for up days and average loss (AL) for down days.

- Relative strength: To account for price fluctuations, RSI uses Relative Strength (RS) which is the ratio between AG and AL normalized by a factor (often set to 1). Guy:

RS = AG / (1 – AL)

- Smoothing the path: Crude RS can be volatile. RSI applies a smoothing factor to create a more manageable value. A common approach is to use the previous day’s RSI value and the current RS to calculate a new RSI:

RSI = (Previous RSI) + (1 – (Previous RSI)) * RS

Application of RSI:

Now that you understand the mechanics, let’s see the RSI in action:

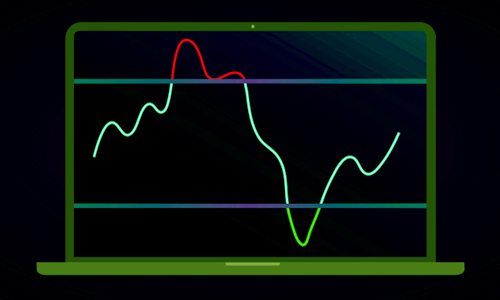

- Overbought/Oversold Levels: Traditionally, readings above 70 indicate an overbought condition and values below 30 indicate an oversold condition. These levels may need to be adjusted based on the specific asset and market conditions.

- Deviations: When the price reaches a new high but the RSI fails to follow suit (bearish divergence), it may signal a potential reversal. Conversely, a price makes a new low while the RSI does not (bullish divergence) may indicate an upcoming upward movement.

- Voltage Confirmation: RSI can be used in parallel trend indicators. For example, during an uptrend, the RSI should ideally stay above 30 and often touch 70. Conversely, in a downtrend, the RSI rarely crosses 70.

Combining RSI with other indicators for stronger signals

The RSI is a powerful tool, but it can benefit from being used in conjunction with other technical indicators. Here are some popular combo strategies to consider:

1. RSI and moving averages:

Voltage Confirmation:

- Combine the RSI with a short-term moving average (eg 50-period) and a long-term moving average (eg 200-period).

- In an uptrend, look for the RSI to remain above 50 and the short-term moving average to cross above the long-term moving average (bullish crossover). This reinforces the bullish signal.

- Conversely, in a downtrend, look for the RSI below 50 and a bearish crossover (the short-term moving average falls below the long-term moving average).

2. RSI and Support/Resistance:

Overbought/Oversold at key levels:

- Identify support and resistance levels on the price chart.

- If the RSI reaches overbought territory (above 70) near a resistance level, it may indicate a greater possibility of a price reversal to the downside.

- Conversely, an oversold RSI (below 30) near a support level could indicate a possible price recovery.

3. RSI and Divergence:

Identifying Trend Reversals:

- This strategy focuses on the divergence between the RSI and price action.

- If the price reaches a new high but the RSI fails to make a new high (bearish divergence), it indicates a weakening of the upward momentum and a possible trend reversal.

- Conversely, if the price makes a new low but the RSI fails to make a new low (bullish divergence), it could signal strengthening bullish momentum and a possible trend reversal.

4. RSI with Stochastic Oscillator:

Dual momentum indicator: Both RSI and Stochastic Oscillator measure momentum. When both signal overbought (or oversold) conditions, it strengthens confidence in the signal.

I remember:

- These are just a few examples and there are many more combinations you can explore.

- Double-check any strategy against historical data before developing it with real capital.

The experts weigh in

While the RSI is a valuable tool, here’s what the experts have to say:

- Incorrect signals: RSI can generate false signals in strong trends. Consider the prevailing trend when interpreting RSI readings.

- It is not a standalone tool: The RSI should be used in conjunction with other technical indicators and fundamental analysis for a well-rounded trading strategy.

- Overbought/oversold levels have not been corrected: These limits may vary by asset and market context. Backtesting can help identify the most relevant levels for your particular strategy.

The bottom line

By understanding the structure, interpretation and limitations of the RSI, traders can use this powerful tool to make informed trading decisions. Remember, RSI is a valuable piece of the puzzle, not the whole picture, and with proper risk management practices it is very applicable to any trading strategy.

Denial of responsibility: This article is for informational purposes only and should not be considered financial advice. Consult a qualified financial advisor before making any investment decision.

Good trading

may the dice always be in your favor!