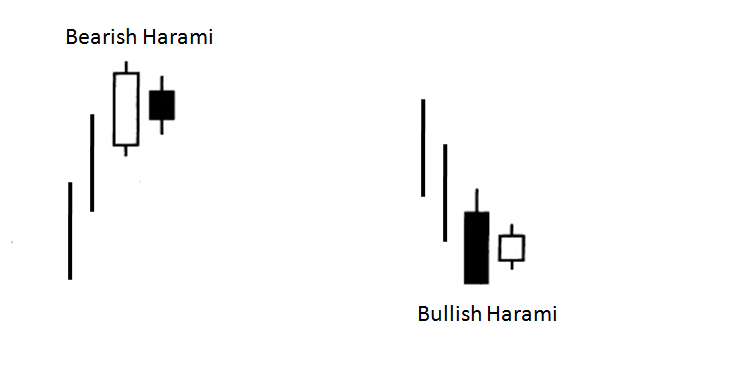

The harami price action The pattern is a two candlestick pattern that represents indecision in the market and is mainly used for trading. It can also be called an “inside candle formation” as a candle is formed within the range of the previous candle, from high to low. Here is an example of what a bearish and bullish harami candlestick pattern looks like:

A bearish harami is formed when the high to low range of a seller’s candle develops within the high and low range of a previous buyer’s candle. With no continuation to form a new high, the bearish harami represents the indecision in the market that could lead to a breakout to the downside.

A bullish pattern is formed when the high to low range of a buyer’s candle develops within the high and low range of a previous seller’s candle. As there is no continuation of the formation of a new low, the bullish harami represents indecision in the market that could lead to a rise.

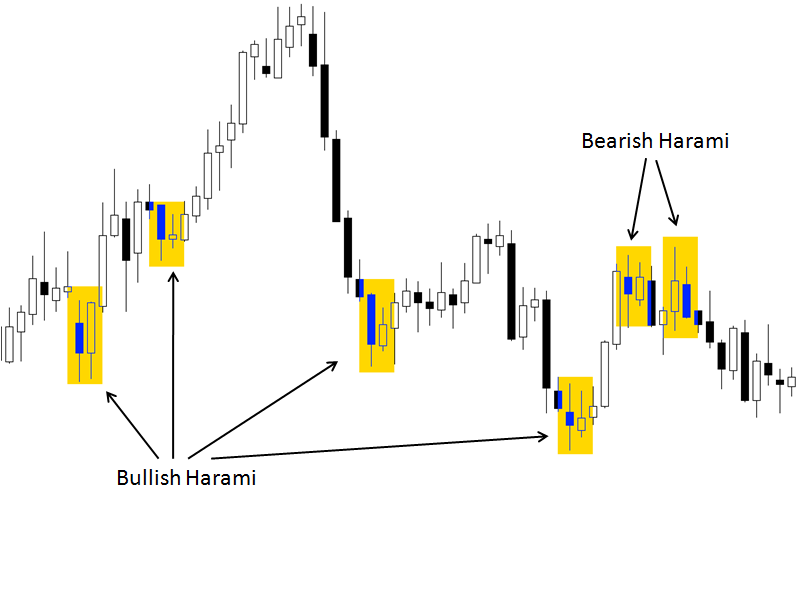

Here are some examples of bullish and bearish harami patterns formed over a period of time:

So how could you trade these patterns as a price action trading strategy? There are many ways and no perfect way. However, many traders use it as a standalone breakout pattern. Here are some possible rules you can rely on:

Trading The Bullish Harami Pattern:

1. Identify the bullish harami pattern (the high and low range of a buyer’s candle that develops within the high and low range of a previous seller’s candle).

2. Enter a pip above the last high candle.

3. Place a stop loss one pip below the low of the previous candle (to give the trade some room to breathe).

4. Aim for a one-to-one reward to risk meaning you aim for the same number of pips you risk from the entry price to the stop loss price.

5. If the trade has not been activated since opening a new candle, cancel the order. If the trade is triggered, leave it in the market until the stop loss or target levels are reached.

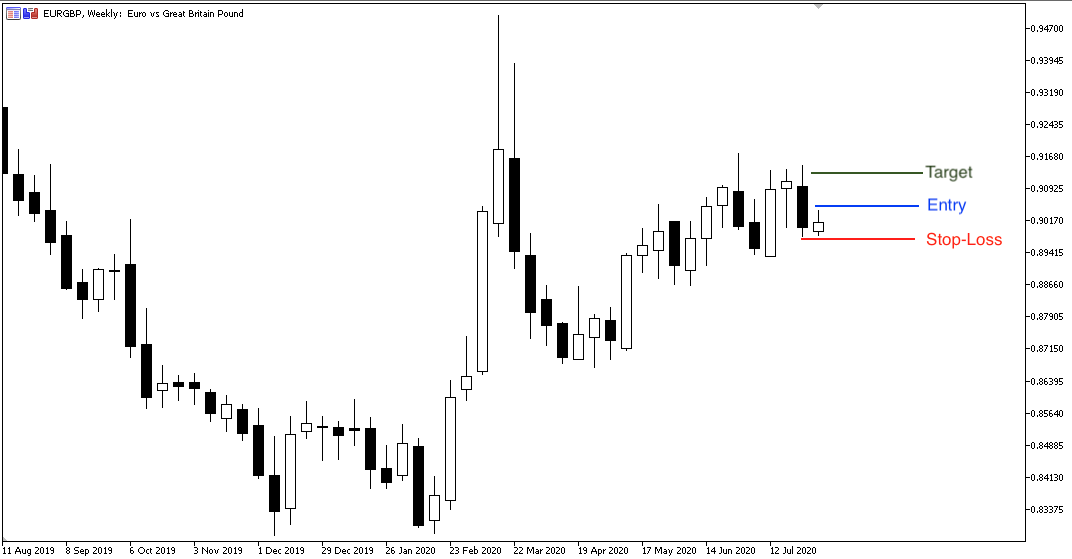

Based on these rules above, here’s an example of what it would look like on a chart:

On the EUR/GBP chart above, a bullish pattern has formed. Using the rule above, one could have an entry price above the high of the last candle, with a stop loss at the low of the previous candle. If the order is not triggered by the opening of the next bar, then one can simply cancel the order placed and look for the next trade. If it has enabled it, then the stop loss or target levels will give you profit or loss.

Trading The Bearish Harami Price Action Pattern:

1. Identify the bearish harami pattern (the high and low range of a seller’s candle that develops within the high and low range of a previous buyer’s candle).

2. Enter a pip below the low of the last candle.

3. Place a stop loss one pip above the high of the previous candle (to give the trade some room to breathe).

4. Aim for a one-to-one reward to risk meaning you aim for the same number of pips you risk from the entry price to the stop loss price.

5. If the trade has not been activated since opening a new candle, cancel the order. If the trade is triggered, leave it in the market until the stop loss or target levels are reached.

Learn more about price negotiation and other trading topics by subscribing to our channel.