Calculating the net delta of an options position is a critical skill for traders seeking a comprehensive understanding of their portfolio’s risk and potential reward.

Most trading platforms can calculate the net position delta of a compound options position consisting of multiple legs.

This position delta will tell you how bullish or bearish the options position is.

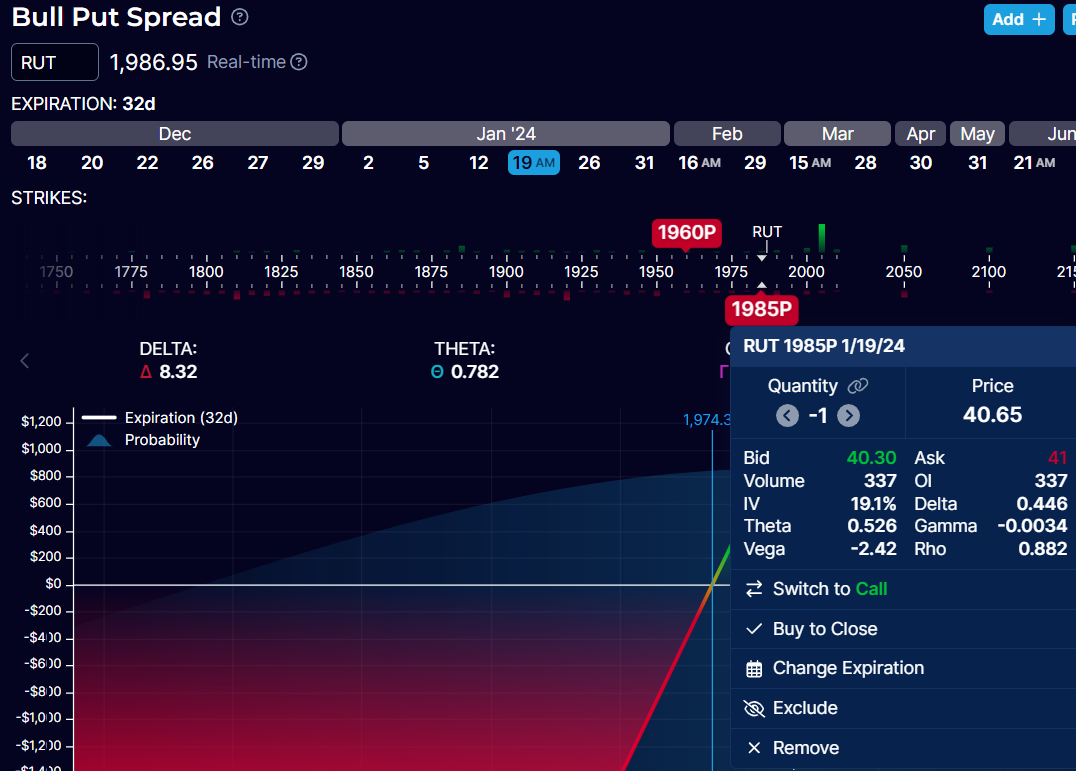

For example, this bull put on a clothesline has a net worth delta of positive 8.32, as shown by OptionStrat below:

As part of net worth Greeksthis number is only available on OptionStrat with a paid subscription.

Because the net delta is a positive number of 8.32, it is a bull trade that wins if the underlying price goes up.

The larger the size of this delta, the more bullish the trade.

If the delta is negative, then the trade will be bearish.

This bull put spread consists of buying one put and selling another put option with a higher strike.

Both options have the same expiration date of January 19, 2024.

The put option was purchased at a strike price of 1960 on the RUT index.

The details of individual Greeks of this option appear in OptionStrat as follows:

The option sold had an exercise price in 1985 of the following Greeks:

While net position Greeks are available with a paid subscription, individual Greeks options are available for free.

Based on the delta of each option, we can calculate the net delta of the bull put spread.

How?

Summing up the individual deltas.

The 1960 long put option has a delta of -0.363. This makes sense because the long put is bearish, so the delta should be negative.

The short 1985 put option has a delta of 0.446. This makes sense because a short position is bullish, so the delta must be positive.

Always check to make sure the delta symbol makes sense before summarizing.

Some platforms do not reverse the Greek signal depending on whether you are buying or selling, while other platforms do.

So the net position delta of the spread bull put is:

-0.363 + 0.446 = 0.083 delta per share

These numbers are presented on a “per share basis”, similar to how option prices are reported.

Since an option contract includes 100 shares, we multiply by 100 to arrive at the delta is this on a per-contract basis:

0.083 x 100 = 8.3 delta per contract

This matches the number that OptionStrat had shown as the net position delta.

If an option leg has more than one contract, then you must multiply by that number for that leg.

How bullish is this credit spread?

It is as bullish as if you owned 8.3 shares of the underlying RUT.

You cannot own shares of RUT (because it is an index).

But this is how you can think of net worth delta.

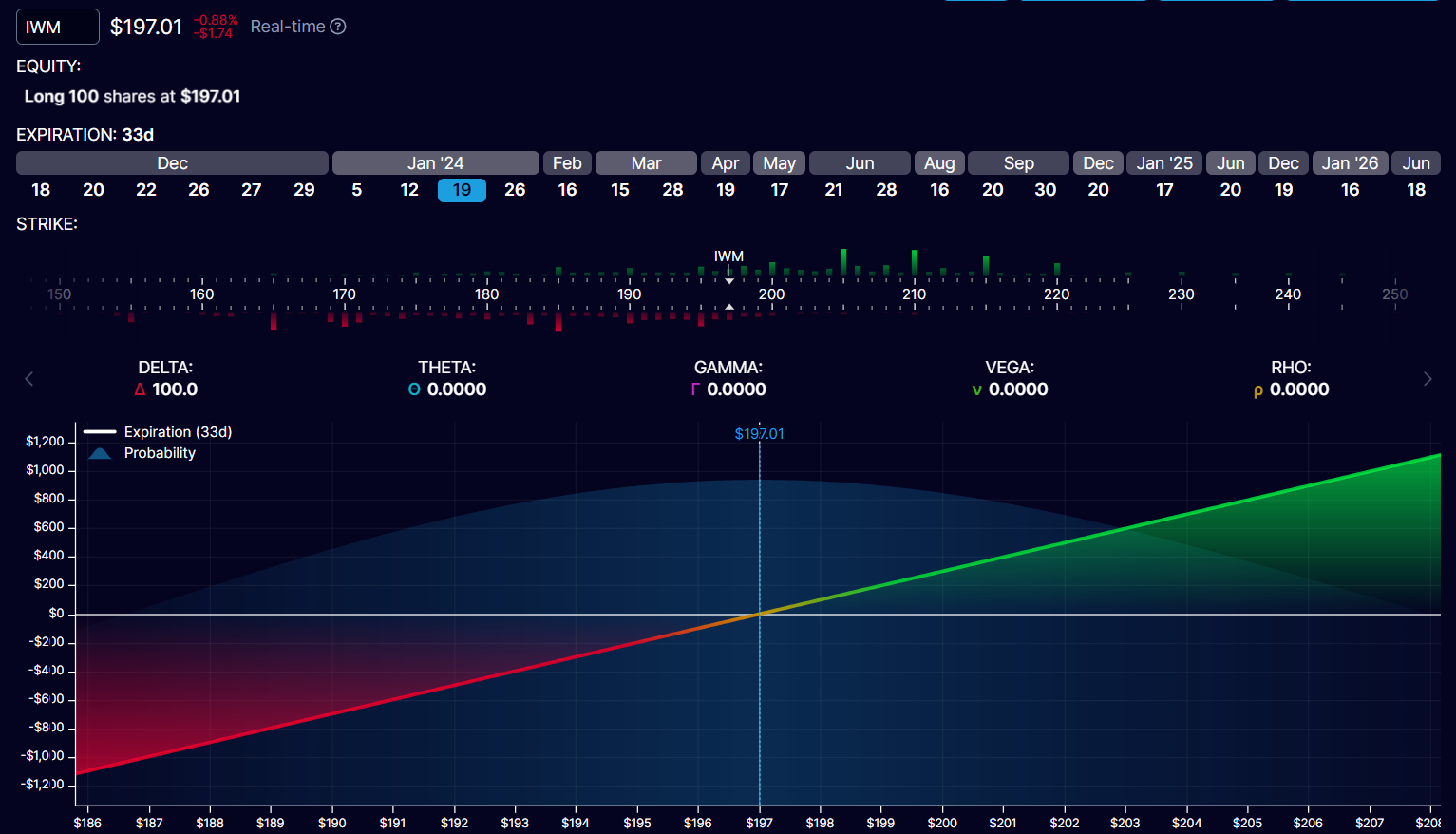

You can own 100 shares of IWM (the ETF that tracks RUT).

If you asked OptionStrat what the net delta is from owning 100 shares of IWM, it would tell you that it is 100 delta.

In this example, we calculated net worth delta.

But you can follow the same procedure to calculate the other Greeks, such as e.g theta and vega.

While it is possible to manually calculate the net position in Greeks so you don’t have to pay for the OptionStrat subscription to calculate it for you, some active traders who need these numbers regularly for complex positions may find it a time saver. and less prone to errors if the platform was able to calculate them.

We hope you enjoyed this article on how to calculate the net delta of a position.

If you have any questions, please send an email or leave a comment below.

Trading Vault!

Disclaimer: The above information is about educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with stock trading options. Any reader interested in this strategy should do their own research and seek advice from a licensed financial advisor.