Music sentiment and stock returns around the world

There was a time in history when researchers believed that we, as a human species, ultimately act logically and rationally (for example, when dealing with financial matters). What arrived with the emergence of Animal spirits (Keynes) and later pioneers of Behavioral Finance such as Kahneman and Tversky was the realization that it is different from that. We often do not do what is in our best interest. exactly the opposite. These emotions are hard to reconcile with common sense, but result in market anomalies.

Researchers love to find causes and reasons and link behavioral anomalies to stock market performance. Many abnormalities are related to various sentiment measuresderived from a alternative data sources and today, we present an interesting new potential relationship – investor sentiment and sentiment derived from musical sentiment!

This study introduces a new measure of investor sentiment that captures actual sentiment rather than shocks to sentiment. The main result (Edmans et al., 2021) is a positive and significant relationship between music sentiment and contemporary market returns, controlling for global market returns, seasonality and macroeconomic variables.

Interestingly, they also found a significant price reversal in the following week. Overall, their findings are consistent with emotion-induced temporary mispricing that subsequently reverses. A series of validation tests show that seasonal factors, such as mood-lowering months, increases in cloud cover, and COVID-related restrictions, are associated with a significant decrease in music-based emotion measurement. The relationship between music sentiment and market returns is stronger when countries implement trading restrictions, such as short selling bans during the COVID-19 pandemic, consistent with more significant limits to arbitrage.

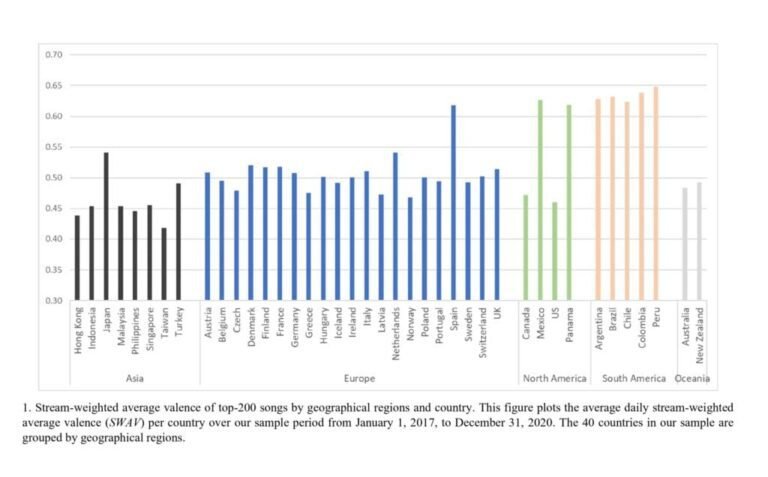

Fig. 1 shows a graph of the full sample mean SWAV [stream-weighted average valence] to all countries. Musical sentiment also predicts increases in net mutual fund flows and decreases in government bond yields, and absolute sentiment precedes increases in stock market volatility. Overall, our study provides evidence that an indicator of the real sentiment of a country’s citizens is significantly correlated with asset prices.

Authors: Alex Edmans, Adrian Fernandez-Perez, Alexandre Garel and Ivan Indriawan

Title: Music sentiment and stocks are coming back around the world

Link: https://ssrn.com/abstract=4057537

Abstract:

This work introduces a real-time continuous measure of national sentiment that is language-free and thus globally comparable: the positivity of the songs individuals choose to listen to. This is a direct measure of sentiment that does not predetermine certain events that affect sentiment or assume the extent of their effect on investors. We validate the music-based emotion measure by relating it to mood swings induced by seasonal factors, weather conditions, and COVID-related restrictions. We find that music sentiment is positively correlated with same-week stock market returns and negatively correlated with next-week returns, consistent with sentiment-induced temporary mispricing. The results also hold on a daily basis and are stronger when trading restrictions limit arbitrage. Musical sentiment also predicts increases in net fund flows, and absolute sentiment precedes increases in stock market volatility. It is negatively correlated with government bond yields, according to a flight to safety.

As always, we present quite impressive figures and tables:

Notable quotes from the academic research paper:

“Our main analyzes explore the relationship between music sentiment and stock market returns. We find a positive and significant correlation between music sentiment and current returns, controlling for past returns, global market return, seasonality, weather, and macroeconomic variables. A one standard deviation increase in music sentiment is associated with a higher weekly return of 8.1 basis points (bps), or 4.3% annualized. This effect reverses in the following week: a one standard deviation increase in music sentiment predicts a 7.0 bps or -3.7% annualized underperformance in the following week. Both results are consistent with sentiment-induced temporary mispricing and previous theoretical and empirical findings that negative investor sentiment causes prices to temporarily fall but then correct (De Long et al., 1990; Baker and Wurgler , 2006, 2007; Edmans, Garcia, and Norli, 2007; Ben-Rephael, Kandel, and Wohl, 2012).

We obtain similar results with a daily analysis – musical sentiment is associated with significantly higher contemporaneous stock returns, which then reverse. Our results hold for both dollar and local currency returns when we exclude one country at a time to ensure they are not country-driven and when we exclude the 50 most streamed songs per country to address the concern that Spotify recommends songs to users.

Music-based sentiment measurement also involves subjectivity, as the valence algorithm was initially trained based on expert opinion. However, the sentiment measure applies to songs worldwide, which increases comparability. While equivalent words in different languages have different meanings, music is less ambiguous: as is often emphasized, “music is a universal language.” Mehr et al. (2019) studied 315 cultures and found that they use similar types of music in a similar context, suggesting that music has universal qualities that likely reflect common elements of human cognition around the world. Thus, a measure of song valence is likely to be universally applicable. Moreover, music captures ineffable feelings that a word-based emotion cannot measure.

This work is also related to studies investigating high-frequency sentiment indicators using non-textual sources. Obaid and Pukthuanthong (2021) estimate sentiment in the US through a sample of editorial news photographs. Like them, we study a measure that can convey emotion more effectively than words, but one that is audible rather than visual. Our analysis also differs by considering an endogenous measure of disposition, studying 40 countries and analyzing equity capital flows and government bond returns in addition to stock returns.

Finally, our study is part of a new stream of literature using big data in finance. Musical emotion satisfies the three characteristics of big data identified by Goldstein, Spatt, and Ye (2021). It’s large in size, aggregating listening behavior across all Spotify listeners with a country each day. It is of high dimension, as a song has multiple characteristics that feed into its measure of valence. It is also unstructured, and requires an algorithm to evaluate its positivity. All three features mean that music streaming is an aggregate measure of consumption available at high frequency, the positivity of which can be estimated to form a proxy for national sentiment.

We notice that South American countries have a higher average SWAVwhile Asian countries have a lower average SWAV. Fig. 2 plots daily SWAV over time for three countries: USA, Brazil (which has one of the highest average SWAV), and Taiwan (which has one of the lowest). Although SWAV it is persistent, it also exhibits variations over time that we can exploit to create a music-based measure of emotion. The coefficient of variation (standard deviation divided by the mean) of the daily SWAV it is 5.5% when calculated separately for each country and then averaged. His persistence SWAV means that the music-based measurement of emotion is based on changes in SWAV.

To match our music sentiment metric with stock market and macro data, we aggregate it on a weekly basis to avoid the non-synchronicity between market open and close times and the time of day that Spotify reports its daily statistics. Such non-synchronicity would lead to daily counting SWAV it partially leads daily stock returns for some indices and lags for others. We define our measure of sentiment as the weekly change in sentiment, both to control for country-level differences in the average level of sentiment, as shown in Figure 1, and because we expect change in sentiment to cause changes in stock prices.” .

Looking for more strategies to read? Subscribe to our newsletter or visit our Blog or Screener.

Want to learn more about the Quantpedia Premium service? Check out how Quantpedia works, our mission, and our Premium Pricing offer.

Want to learn more about the Quantpedia Pro service? Check out its description, watch videos, check out our reporting features and visit our price quote.

Looking for historical data or backtesting platforms? Check out our list of Algo Trading discounts.

Or follow us at:

Facebook Group, Facebook Page, TwitterLinkedin, Medium or Youtube

Notification toLinkedInTwitterFacebookRefer a friend