Quantpedia in February 2024

Good evening to all,

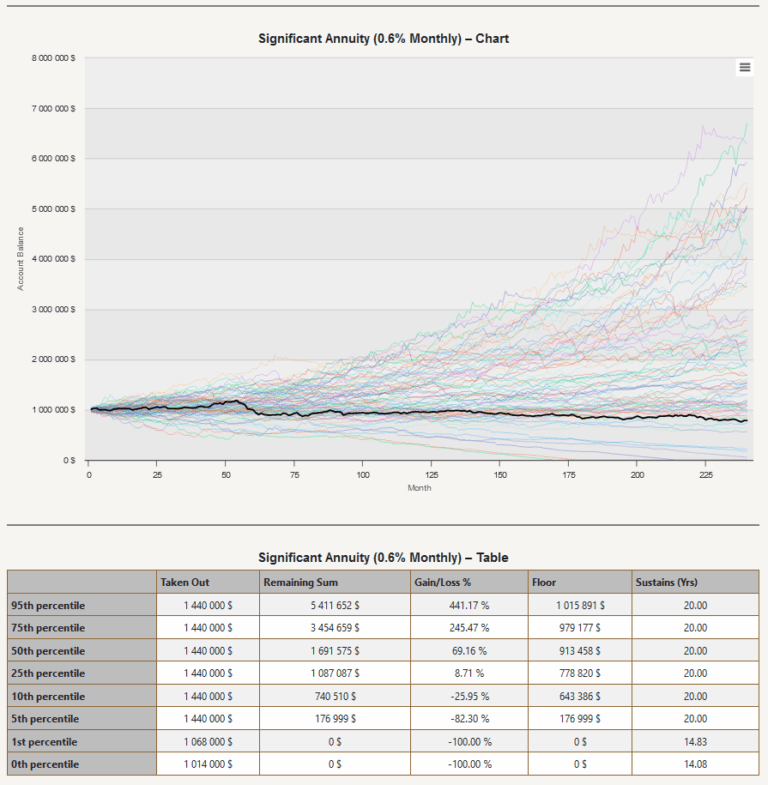

In the field of portfolio management, annuity simulation is an essential tool in the investor’s and trader’s toolbox. All of us will retire sooner or later (some already have), and it is very valuable to have a model that helps estimate how long a stock of money will last if invested in a diversified portfolio of ETFs, mutual funds, or trading strategies. And this is what we have prepared for our Quantpedia Pro customers as our next report.

The Annuity Simulation Report explores spending patterns for your model portfolio (created from any combination of our strategies, ETFs, or your uploaded equity curves) over a 20-year period, with 5 different spending levels:

– among the most conservative (0.2% of the model portfolio is withdrawn on a monthly basis, 2.4% on an annual basis)

– through the balanced annuity (0.4% monthly withdrawal rate, 4.8% annually)

– the substantial annuity (0.6% monthly withdrawal rate, 7.2% annually)

– the aggressive annuity (0.8% monthly withdrawal rate, 9.6% annualized)

– and the very aggressive annuity (1.0% monthly withdrawal rate, 12.0% annualized)

As usual, at the beginning of the analysis, we use our state-of-the-art multivariate model to create a 100-year synthetic portfolio history based on your model portfolio to extend the limited historical time window typically available for most ETFs and trading strategies . We then sample the synthetic equity curve and generate approximately one hundred 20-year (240-month) historical time periods that are initially used to study how the one-time investment of $1,000,000 in the underlying model portfolio at the beginning of each period combined with the monthly annuity will evolved over time. The results can be reviewed in the table and visualized at the top of the report, where the most recent 20-year time period is highlighted.

Users can study the entire distribution of results, be it the total amount that can be received as annuity, the final portfolio value at the end of the 20-year period, the total % profit, the floor (the minimum amount that was in a portfolio over the 20-year period) and how long the portfolio would maintain a chosen withdrawal rate.

Secondlywe would like to remind you all of ours Quantpedia Awards 2024 competition. Time passes, and the end of April is here very soon. Don’t forget to enter our race for a $15,000 prize 🙂

And as usual, let’s also quickly recap Quantpedia Premium development:

In addition, 6 new research articles were published on the Quantpedia blog last month:

How to better estimate long-term expected returns

Authors: Rui Ma, Ben R. Marshall, Nhut H. Nguyen, Nuttawat Visaltanachoti

Title: Estimation of Long-Term Expected Returns

How much Bitcoin should we allocate in the wallet?

Authors: Juliana Javorska, Radovan Vojtko

Title: How much Bitcoin should we allocate in the wallet?

Robustness Testing Country and Asset ETF Momentum Strategies

Author: Jiang Du

Title: Robustness Testing Country and Asset ETF Momentum Strategies

Measurement of existing technical fundamentals through mutual information

Authors: Gabriel Kingsley-Nyinah, Sergei Egorov

Title: Measurement of existing technical fundamentals through mutual information

The distribution of stock market concentration in the US over history

Authors: Logan P. Emery and Joren Koëter

Title: The Size Premium in a Granular Economy

Yours …

Radovan Vojtko

CEO & Head of Research

Looking for more strategies to read? Visit our Blog or Screener.

Want to learn more about the Quantpedia Pro service? Check out its description, watch videos, check out our reporting features and visit our price quote.

Want to know more about us? Check out how Quantpedia works and our mission.

Looking for historical data or backtesting platforms? Check out our list of Algo Trading discounts.

Do you have an idea for a systematic/quantitative trading or investment strategy? Then register for Quantpedia Awards 2024!

Or follow us at:

Facebook Group, Facebook Page, TwitterLinkedin, Medium or Youtube

Notification toLinkedInTwitterFacebookRefer a friend