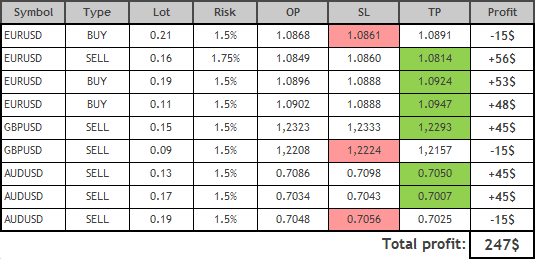

Today I present to you an overview of the trades made using the Owl strategy – smart levels for the currency pairs EURUSD, GBPUSD and AUDUSD for the week from January 30 to February 3, 2023. Now is not an easy period for trend strategies because the market has been stuck in a small channel for a long time and is not moving anywhere. This means that trending strategies can give many false signals. But let’s see what we have.

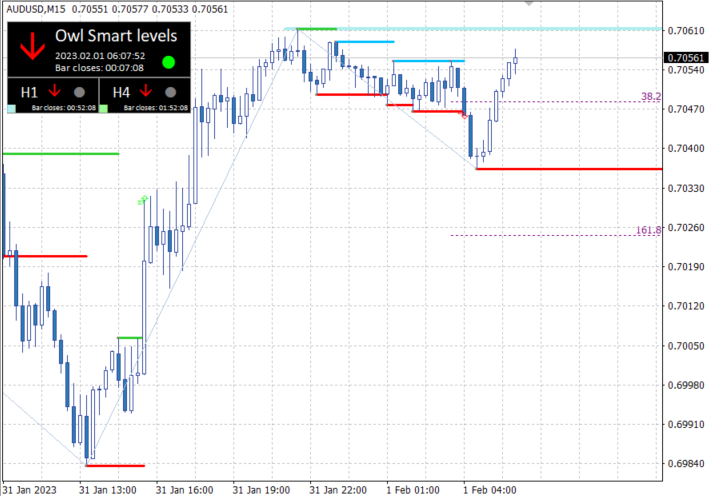

For convenience and timely reception of signals I use it Smart owl level indicator. The main trading time frame is M15, while H1 and H4 time frames are used to confirm the trend direction of the higher time frame.

EURUSD review

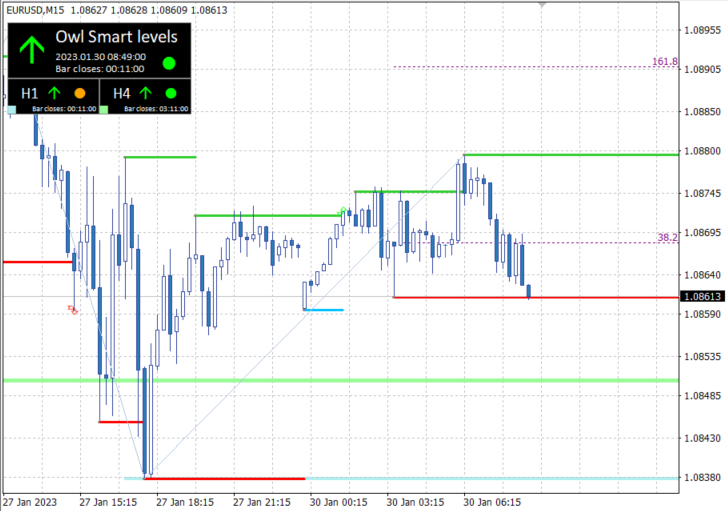

The beginning of the week for the Euro was in the “Dead Zone” (the red zone of the owl smart levels indicator, in which trading is not recommended), but already at 7:00 on January 30 the first signal to buy appeared the Euro against of the dollar. The trade closed with losses. Because of this the new rule was added – no trading on Monday morning. The market is just opening, there are very few major players and many traders are just trying to take a close look at the market and form a trading plan for the week.

Fig 1. BUY EURUSD 0.21, OpenPrice=1.0868, StopLoss=1.0861, TakeProfit=1.0891, Profit= -$15

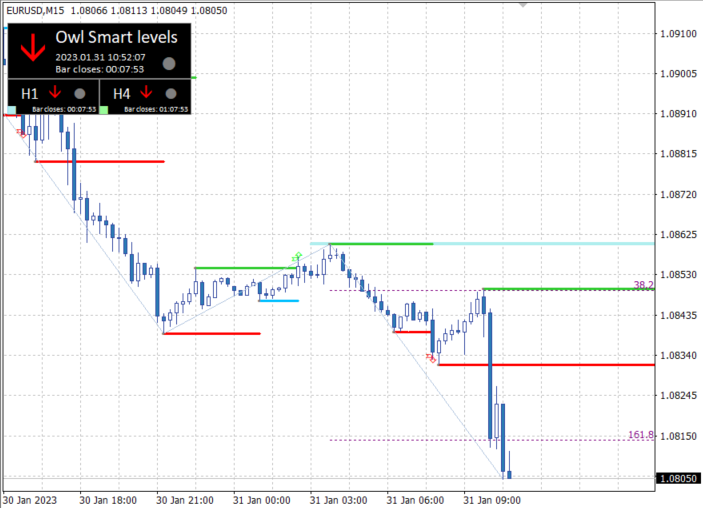

After chaotic fluctuations on January 31, the EURUSD market fell and formed a signal, but already for sale: OpenPrice=1.0849, StopLoss=1.0860, TakeProfit=1.0814. The transaction was opened with a risk of 1.75% of the deposit (the first one was 1.5% of the deposit), because the previous one was unprofitable. The Euro worked this signal very well and the profit was fixed at the open trade.

Fig. 2. EURUSD SELL 0.16, OpenPrice=1.0849, StopLoss=1.0860, TakeProfit=1.0814, Profit= +$56

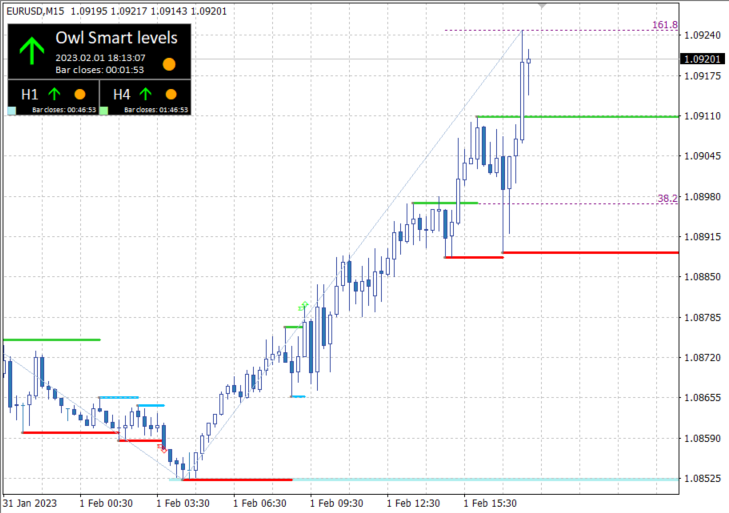

After some fluctuations and another move into the neutral zone, the uptrend resumed. On February 1st at 15:03 GMT, he opened a Buy trade with a minimum stop size of only 8 units (digits = 4). Profit was set on this trade very quickly and the market is already tuned for another move up.

Fig. 3. BUY EURUSD 0.19, OpenPrice=1.0896, StopLoss=1.0888, TakeProfit=1.0924, Profit= +$53

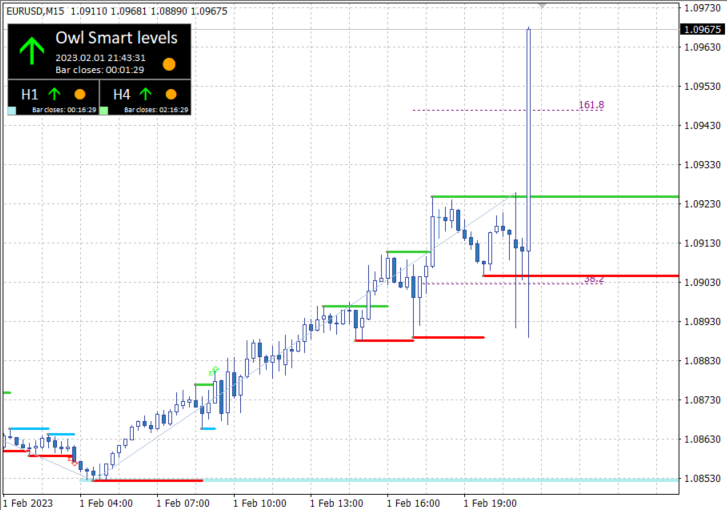

At 21:01 he opened another buy trade which closed fairly quickly but made everyone nervous as the market fell and was literally 1 point away from the StopLoss. Then the EURUSD pair went up a lot and the correction had to wait until the next day. And on February 2, the dead zone appeared again and did not allow trading until the end of the week. As of 13:30 on the Non-Farm Payrolls news, all EURUSD time frames started to show a bearish trend. But after such news it is better not to enter the market because it is very volatile and unpredictable.

Fig. 4. BUY EURUSD 0.11, OpenPrice=1.0902, StopLoss=1.0888, TakeProfit=1.0947, Profit= +$48

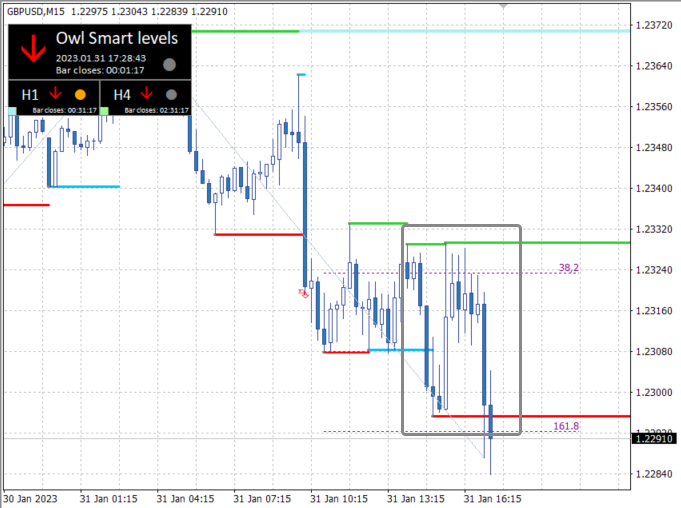

GBPUSD Review

The British pound, like the euro, opened the week in the red zone, which did not allow it to trade all day on January 30. And because of the chaotic multi-directional traffic, the first tarde opened only at 9:45 on January 31. It created a nervous atmosphere as it moved from the profit zone to the loss zone for a long time, but in the end it reached TakeProfit.

Fig. 5. GBPUSD SELL 0.15, OpenPrice=1.2323, StopLoss=1.2333, TakeProfit=1.2293, Profit= +$45

The next sell signal was not long in waiting, but I have a rule – not to open a trade earlier than 10 candles after the close of the previous one. So I skipped the next transaction.

Fig. 6. The rule – do not open a trade earlier than 10 candles after the closing of the last

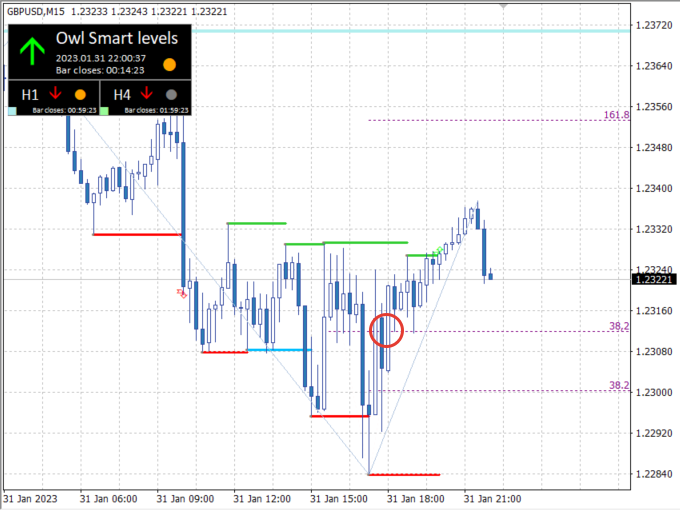

Moreover, the market behaved chaotically. The strategy gave no entry signals and eventually the dead zone formed in the afternoon. Only on February 2 after 17:00, the British pound managed to break out of the dead zone, but on this day the strategy did not form signals.

It was not until February 3 at 9:00 that it became possible to enter the market. GBPUSD closed my trade at a loss and fell back into the red zone. After that, I decided not to trade the GBPUSD currency pair this week, moreover, the strategy did not give any more signals.

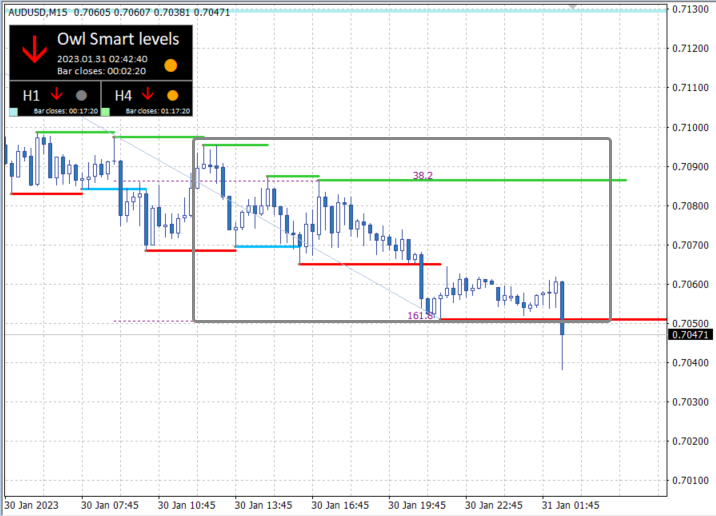

AUDUSD Review

The first Australian dollar trade opened at 10:00 on January 30 and closed in profit just before 00:30 the next day. Another sell signal appeared almost immediately, but according to the rule of not trading 10 candles after the close of the trade, this signal was ignored.

Fig. 7. AUDUSD SELL 0.13, OpenPrice=0.7086, StopLoss=0.7098, TakeProfit=0.7050, Profit= +$45

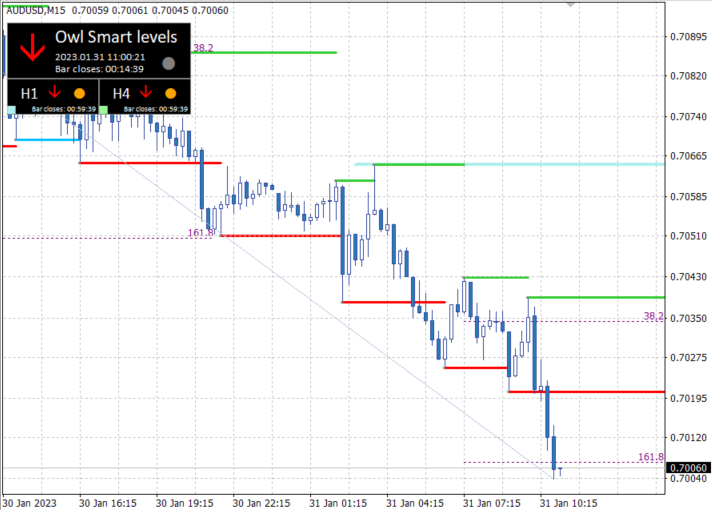

The next perfect signal occurred on January 31st at 7:45. Profit was fixed on the open position within one hour. This is what I call the “Perfect Entry Signal”, when the market does not move from one side to the other, but immediately after a rebound from the level goes to TakeProfit.

Fig. 8. AUDUSD SELL 0.17, OpenPrice=0.7034, StopLoss=0.7043, TakeProfit=0.7007, Profit= +$45

The market then began to correct upwards and after a false signal, in which a loss was taken, the Australian dollar entered the Dead Zone. The market broke out of the red zone only on Friday, but after the US employment news, I do not recommend trading, moreover, there were no other messages.

Fig. 9. AUDUSD SELL 0.19, OpenPrice=0.7048, StopLoss=0.7056, TakeProfit=0.7025, Profit= -$15

Results:

The week from February 6 to February 10, 2023, I think, will be more intense for signals related to the owl strategy. Last week there were 2 fundamental news: the US interest rate decision and non-farm payrolls. I believe this will set the direction for the dollar corrective move that we have been waiting for so long.

Let’s see what next week brings and how the Owl Smart Levels perform.

Check out other Owl Smart Levels strategy reviews:

I am Sergey Ermolov, follow me and don’t miss more useful tools for profitable Forex trading.