I was surprised to hear that some traders cannot trade calendars on indicators.

This may be due to certain brokerage firms, countries or account types.

Or it could be because certain brokerages calculate calendars differently, requiring additional margins or additional options trading privileges.

While some market-neutral butterfly strategies (such as M3.4U and V32) do not require the use of calendars, many butterfly strategies (such as rhinoceros and A14) typically use calendars as upward adjustments.

Rhino trades on the RUT and SPX indices.

The alternative to use calendars on these indices is to buy logs on the respective ETFs (such as IWM and SPY, respectively).

However, this entails larger fees because you have to buy ten times as much, since ETFs are 1/10 the size of the index.

In this article, we will explore using it butterflies as incremental adjustments in Rhino instead of calendars.

Contents

First, we’ll look at standard calendar customization.

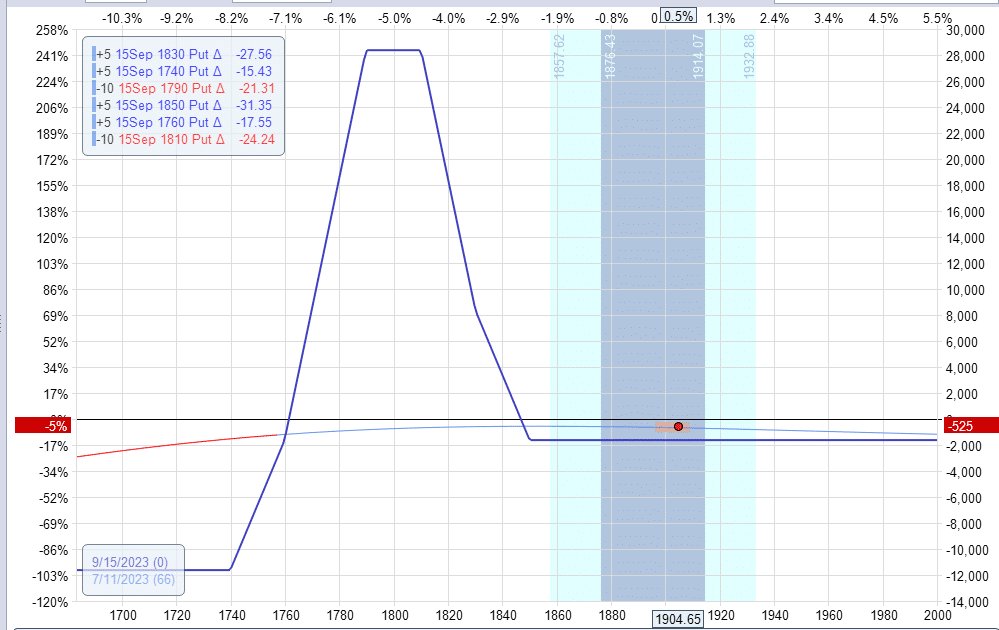

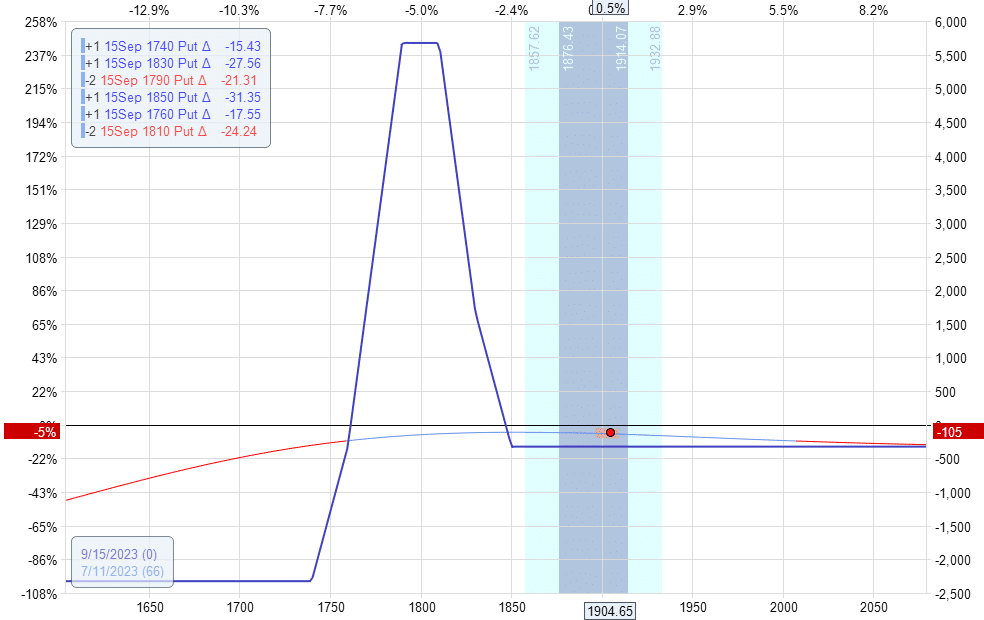

Consider this RUT Rhino already scaled to ten butterflies that form this base. Graph through OptionNet Explorer.

Delta: -4.2

Theta: 18

Vega: -92

The price continued to rise, requiring a typical upward adjustment to add logs above the current price.

Adding three calendars in 1940 will give us the following:

Delta: 0.39

Theta: 27

Vega: 7.83

We reduced our delta to make it flat.

The maximum risk on this trade increased to $14,000.

Calendars give us extra theta and neutralize its size vega.

However, it can change the trade from negative vega to slightly positive.

Yes you can.

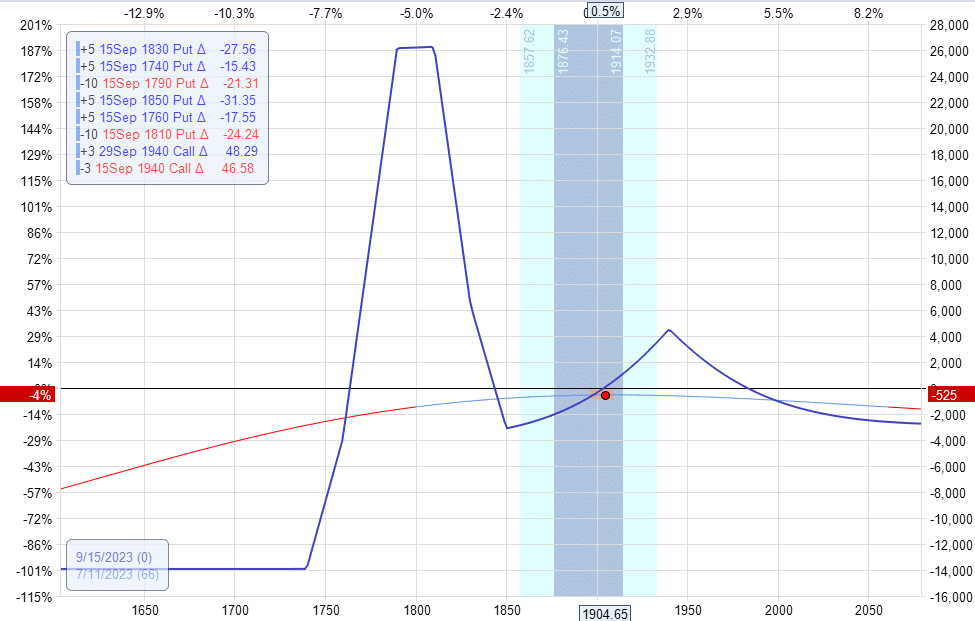

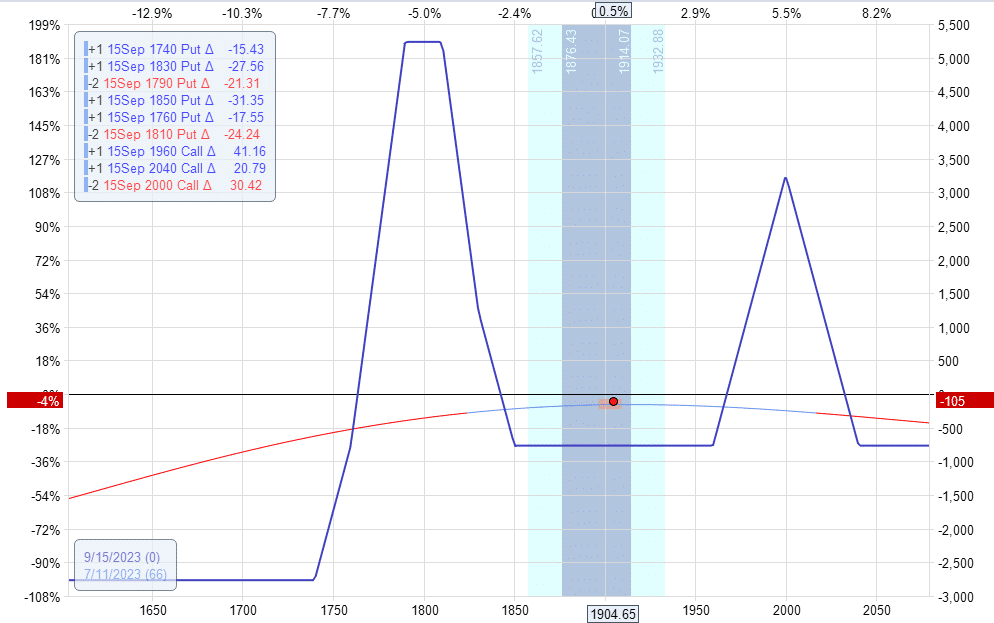

Instead of calendars, let’s add two calls butterflies with broken wings with 50 points lower wings and 40 points upper wings. We used the same lower wing width as the original butterfly.

Buy two September 15 RUT 1890 call

Sell four September 15 RUT 1940 call

Buy two call 15 September RUT 1980

This brings the total trade delta to almost zero:

Delta: 0.46

Theta: 23

Vega: -150

The maximum risk on this trade was increased to $14,000, just like on the calendars.

Theta is a little less.

Negative vega has increased significantly and is more negative. Increased media vega greater exposure to volatility.

Negative vega means the trade prefers volatility to fall.

This can be good in a highly volatile environment, where volatility can fall.

But in a low-volatility environment with potential for volatility to rise, the larger amount of negative vega can become a liability.

One can offset this by having some negative delta because a fall in the price of the underlying usually accompanies an increase in volatility.

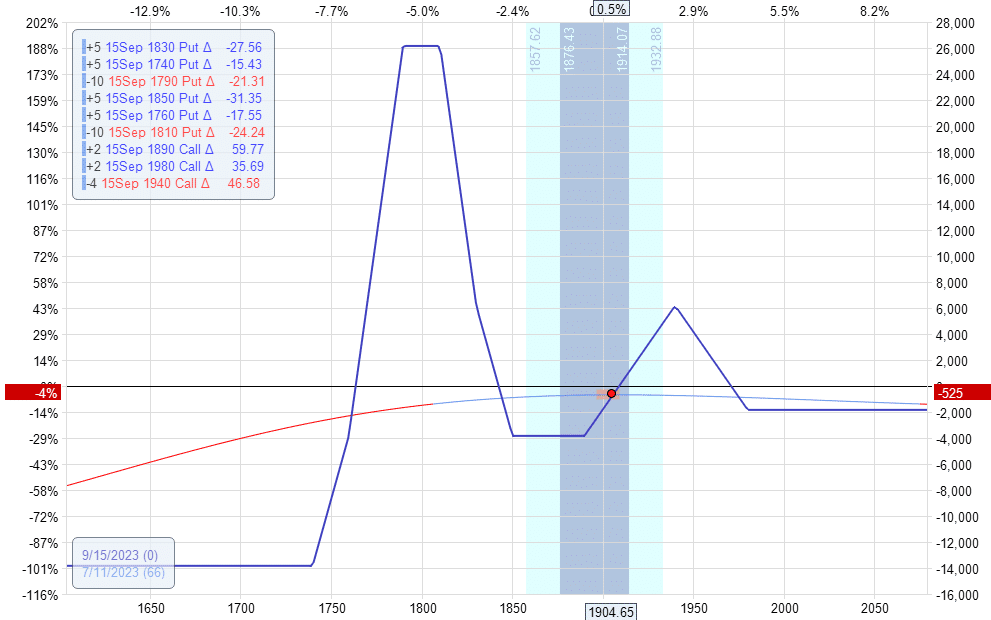

You can get the delta setting you want with just one butterfly.

We just need to make the butterfly more upward with a 30 point upper wing and a 50 point lower wing.

Buy a call on September 15 RUT 1890

Selling two September 15 RUT 1940 call

Buy a call on September 15 RUT 1970

Delta: 0.71

Theta: 18.5

Vega: -114

The call butterfly is smaller than the base.

So you get less theta and less negative vega exposure (ie, less volatility risk).

Because we buy fewer butterflies, there is less downside risk.

And there is less upside risk as well.

Take a look at the two expiration charts.

The maximum downside risk here is -$13,100. Upside risk is -$1,100.

Unlike a calendar adjustment, this expiration chart does not change as volatilities change because this trade has no time margin.

With one batch instead of a batch of ten, you’ll have less opportunity to perfect it adjustments.

However, it can work if you make the back fly shorter and longer.

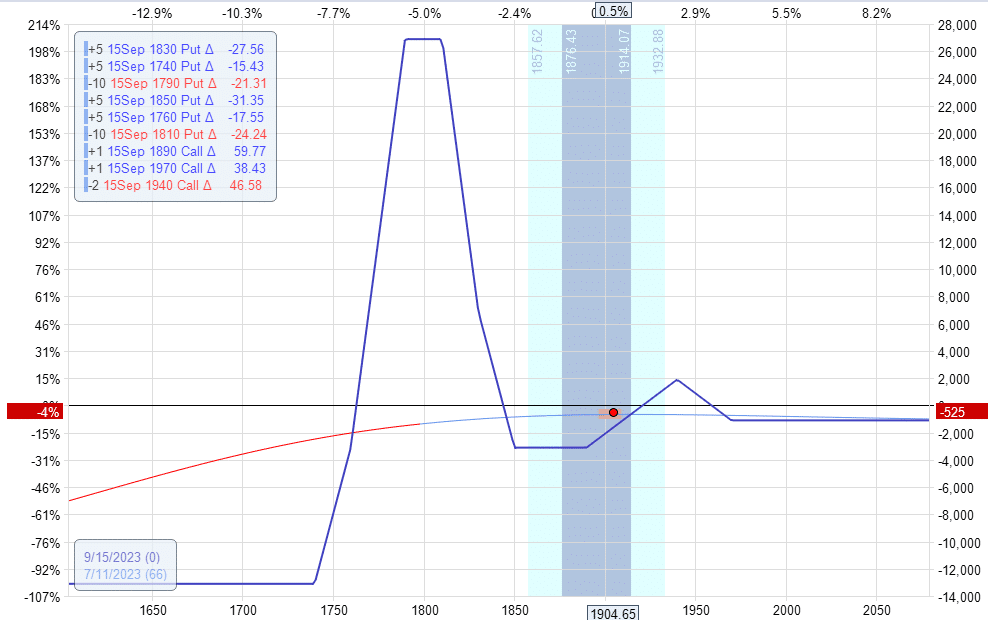

If the one reverse break-wing-butterfly call is still too bullish, you may need to make it a symmetrical butterfly.

For example:

Before setting:

After adjusting the addition of a symmetrical 40-point butterfly in 2000:

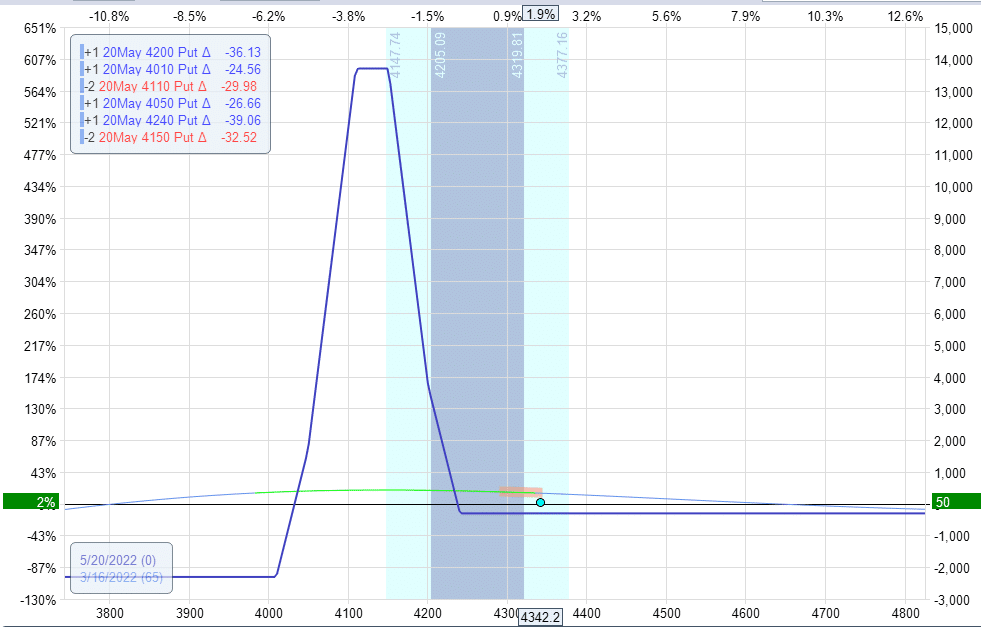

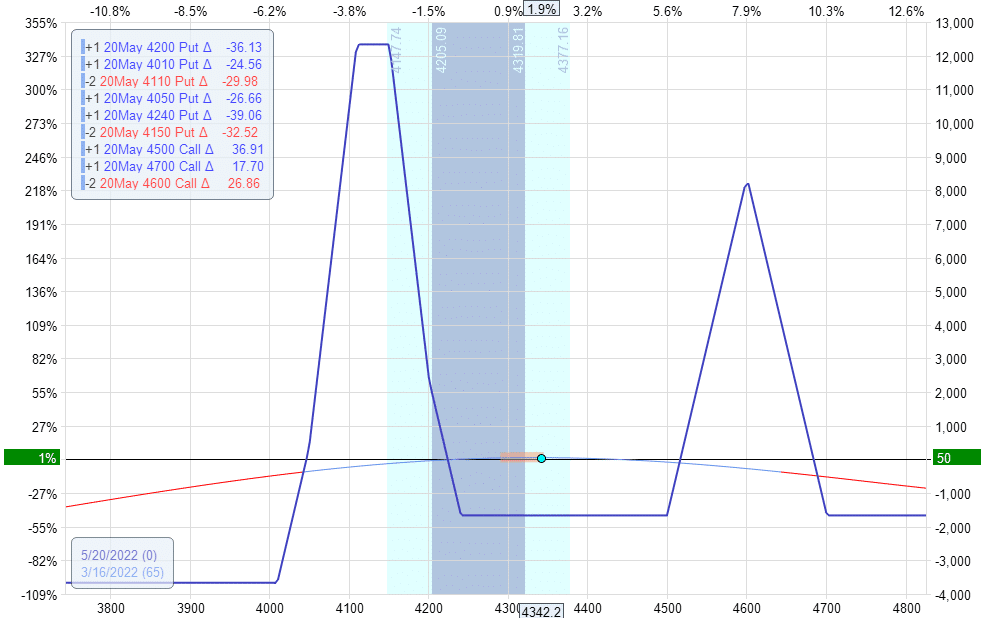

Yes, let’s consider the following SPX Rhino.

Delta: -0.95

Theta: 7.14

Vega: -32.64

If we use a calendar customization:

Sell an SPX 4600 May 20 call

Buy one SPX 4600 call on May 31st

Charge: -$770

We would get the following:

Delta: 0.65

Theta: 12.01

Vega: 36.14

If we instead add a fly:

Buy a SPX 4500 call on May 20

Sell two SPX 4600 May 20 call

Buy a SPX 4700 call on May 20

Charge: -$1360

We get the following:

Delta: 0.04

Theta: 11.22

Vega: -74.70

The cost of the fly is a little more than the calendar.

And it has a little less theta.

To adjust the fly, we had doubled our negative vega.

To adjust the calendar, we flipped the sign of vega to positive vega.

Overall, trading with the calendar adjustment has less exposure to volatility.

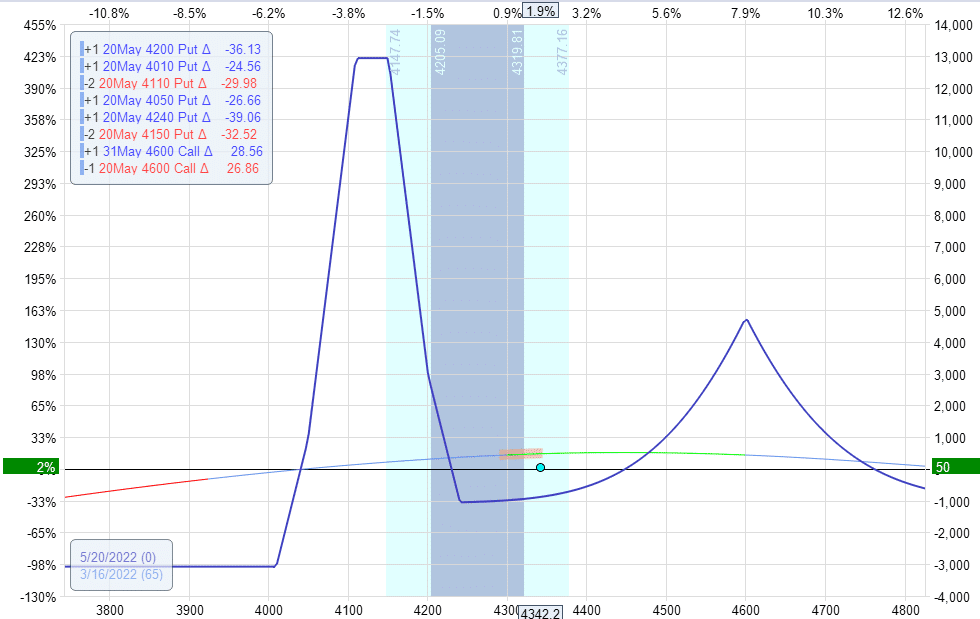

In this case, the base of your butterfly is even smaller.

So your upside down butterfly should be smaller with smaller wingspans.

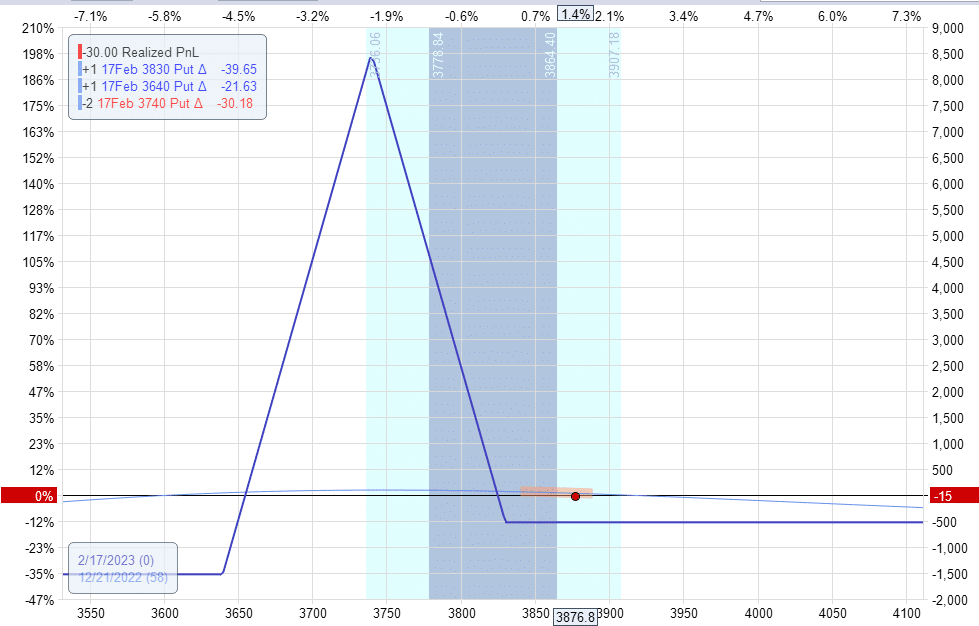

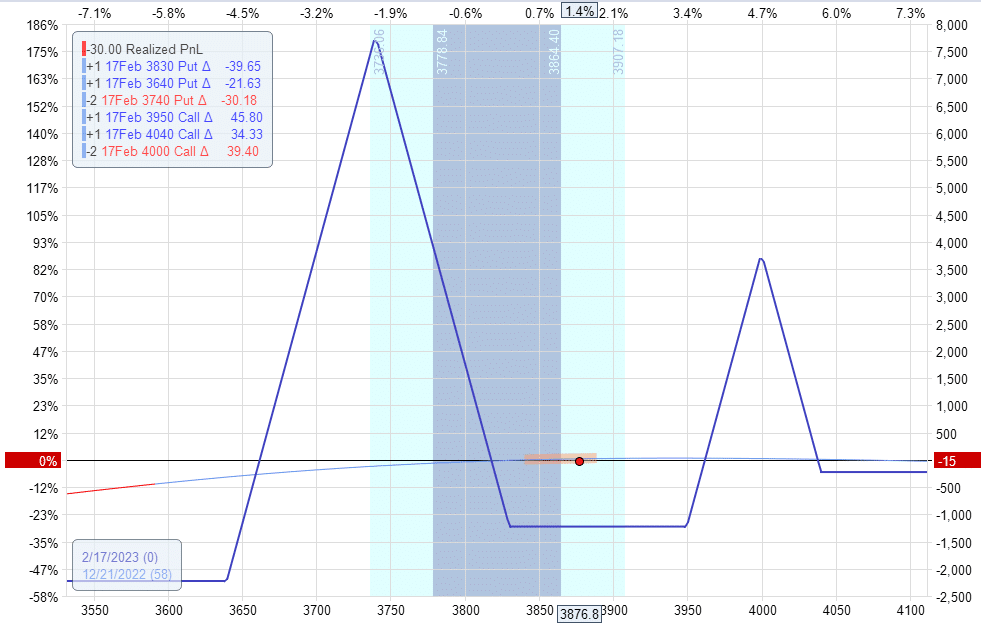

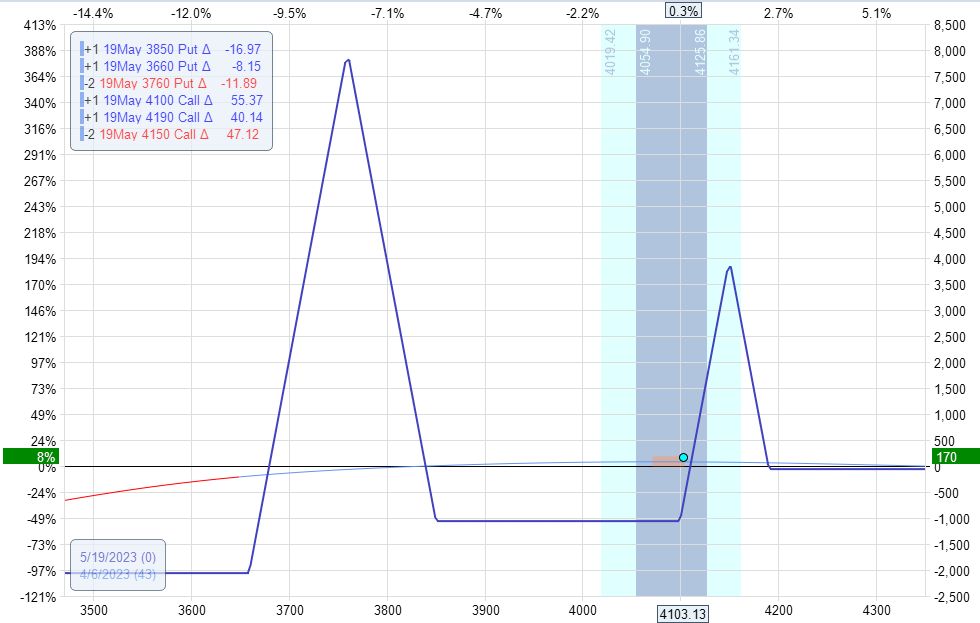

Here is an SPX Rhino where the trader decided not to scale, or maybe scaled and then took off. In both cases, we have only one butterfly.

Delta: -0.92

Theta: 6.76

Vega: -29.66

Adding a butterfly with a 50 pt wide lower wing (half the size of the original fly) and a 40 pt upper wing.

Buy a February 17 SPX 3950 call

Sell two February 17 SPX 4000 call

Buy a February 17 SPX 4040 call

We end up with a butterfly with a fly:

Delta: 0.42

Theta: 6.9

Vega: -37.6

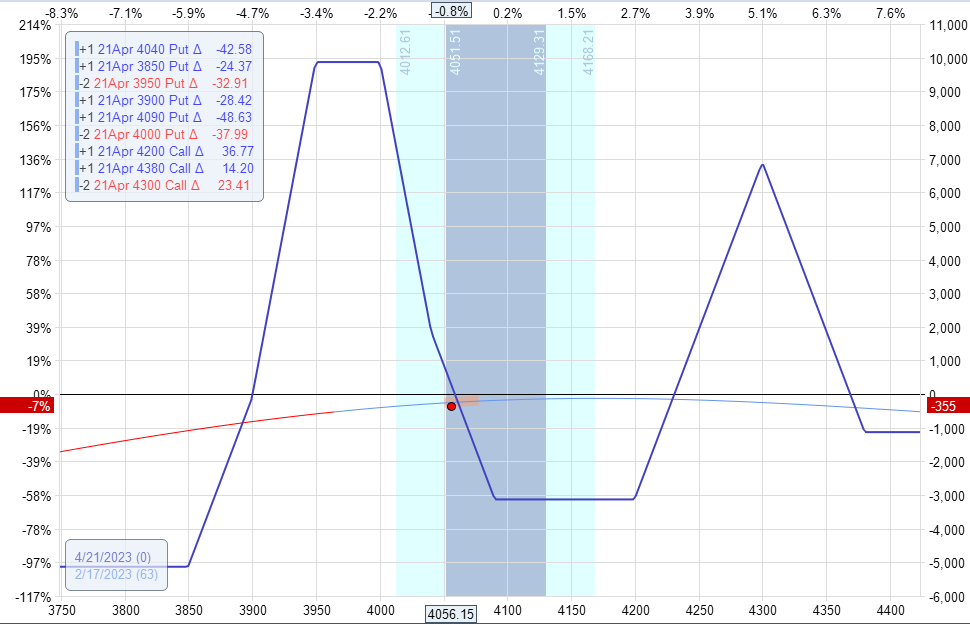

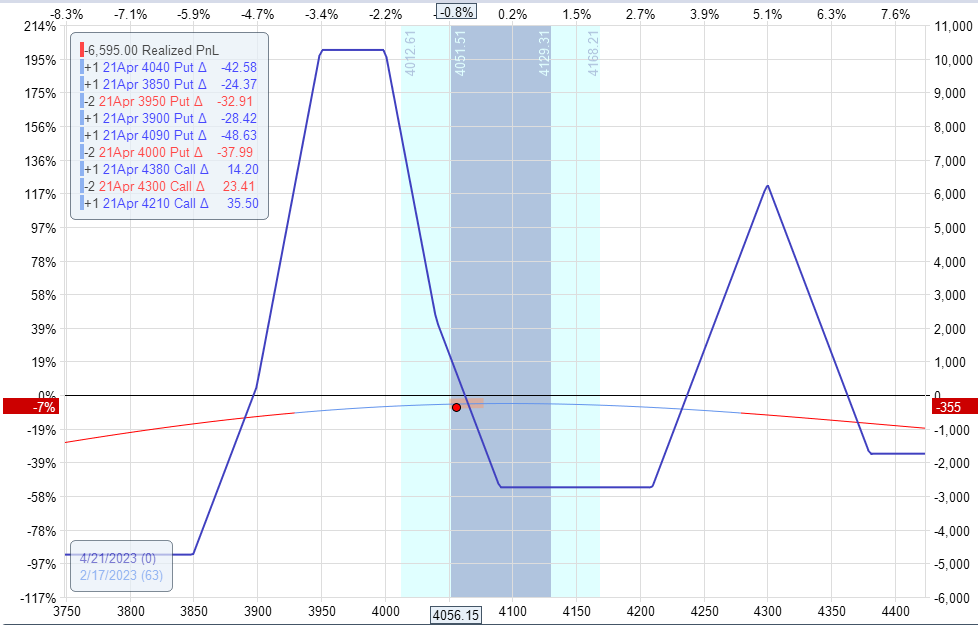

Below, you see a scaled SPX Rhino with a broken wing butterfly.

The price reversed and returned to the original base of the butterfly.

Delta: 2.1

Theta: 10.4

Vega: -92.7

By raising the lower leg of the call, fly from 4200 to 4210:

Sell a call on April 21, 2023, SPX 4200

Buy a call on April 21, 2023, SPX 4210

We adjusted and decreased our delta and increased our theta:

Delta: 0.71

Theta: 12.85

Vega: -101.30

First is the flexibility of adjusting the deltas by rolling the legs of the reverse butterfly.

Second, the bullish butterfly gains from both its positive delta and negative vega in the scenario where the price moves up towards the butterfly, as in the case here:

As the price rises, the implied volatility tends to fall

This drop in volatility is a boon for a negative vega butterfly.

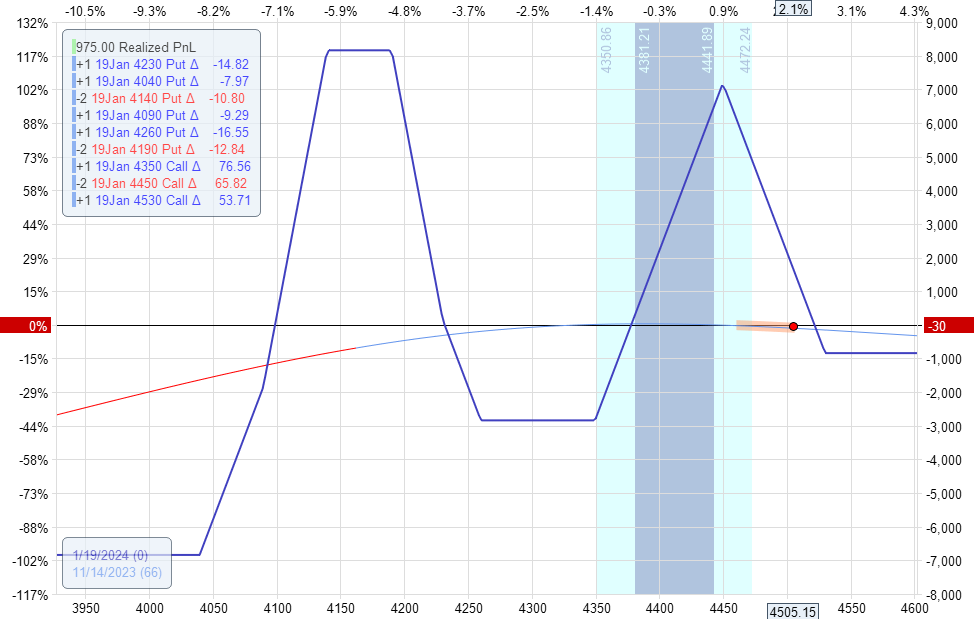

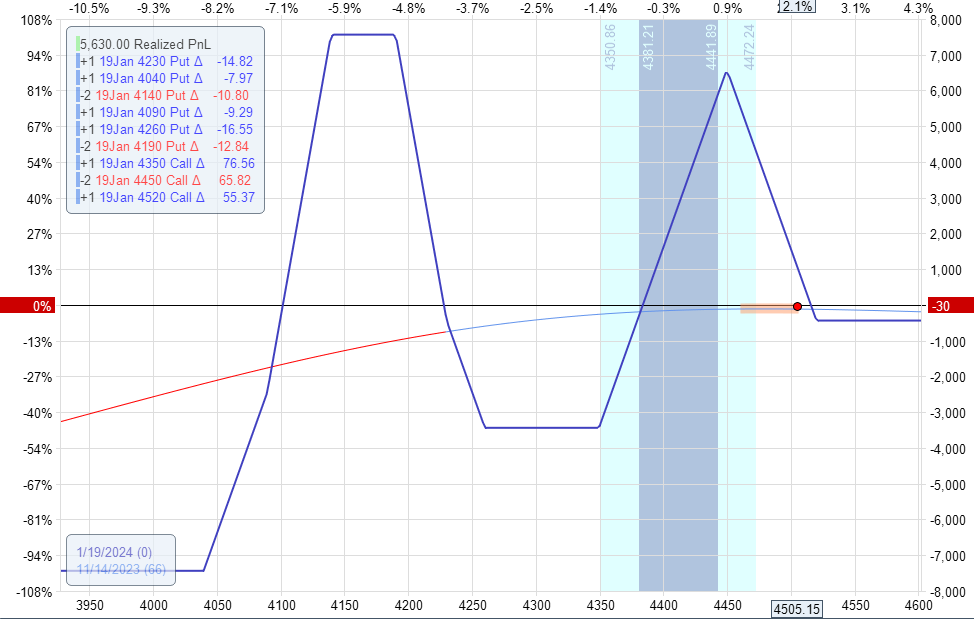

Here, the price of SPX has crossed the short strokes of the butterfly.

Delta: -1.93

Theta: 8.4

Vega: -62.66

If this was a calendar, we would have refreshed the calendar or added another calendar on top of the price.

With the fly having so many legs, we are reluctant to move the entire fly. And you don’t have to.

We can achieve the same effect by making the trade more bullish by rolling the top leg of the fly down:

Buy a call on January 19, 2024, SPX 4520

Sell a call on January 19, 2024, SPX 4530

Delta: -0.32

Theta: 7.33

Vega: -66.3

Yes always.

It will be very problematic if you don’t make it as such.

We use call options (as opposed to put options) because the butterfly is placed above the current price of the underlying.

Therefore, the call options will be outrageous.

If we had used put options, the options would have been in-the-money.

We use call options as out-of-the-money options tend to be more liquid with tighter bid-ask spreads.

Having the flexibility to use calendar or flight adjustments will allow you to choose between the two depending on the VIX.

In a high VIX (high volatility) environment, using a fly can be beneficial from a volatility perspective.

Flies cost less when implied volatilities (IV) are higher.

When the market is in a continuous uptrend, flight adjustments are much easier and have good downside risk reduction.

In a low VIX market, using a calendar can be beneficial if you believe IV cannot go lower.

I personally still have a slight preference for using calendars as an upward adjustment.

Aside from the positive vega balancing out the negative vega of the Rhino, the pictures below are worth a thousand words.

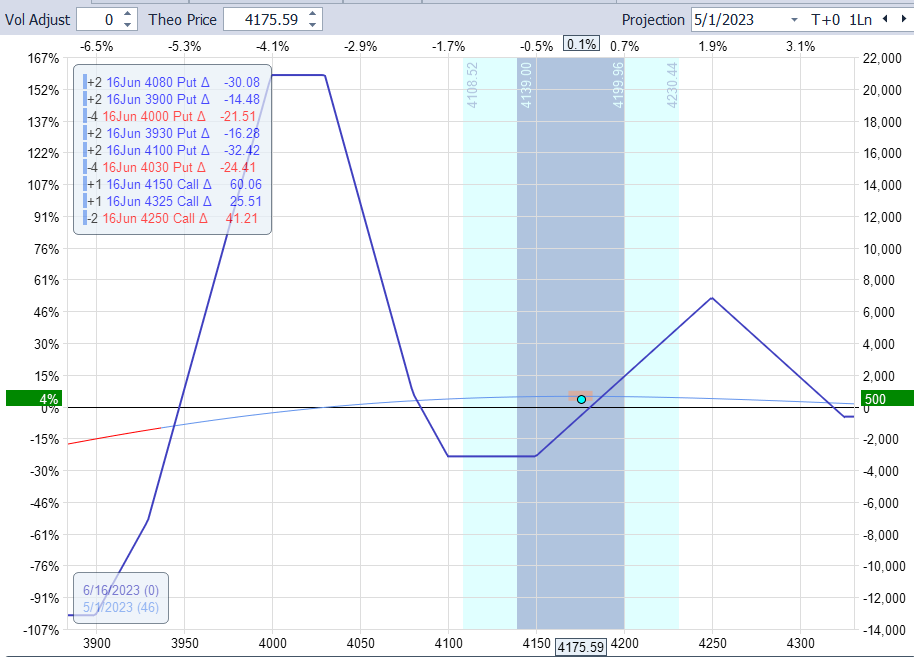

May 1, 2023, SPX Rhino with upside down fly.

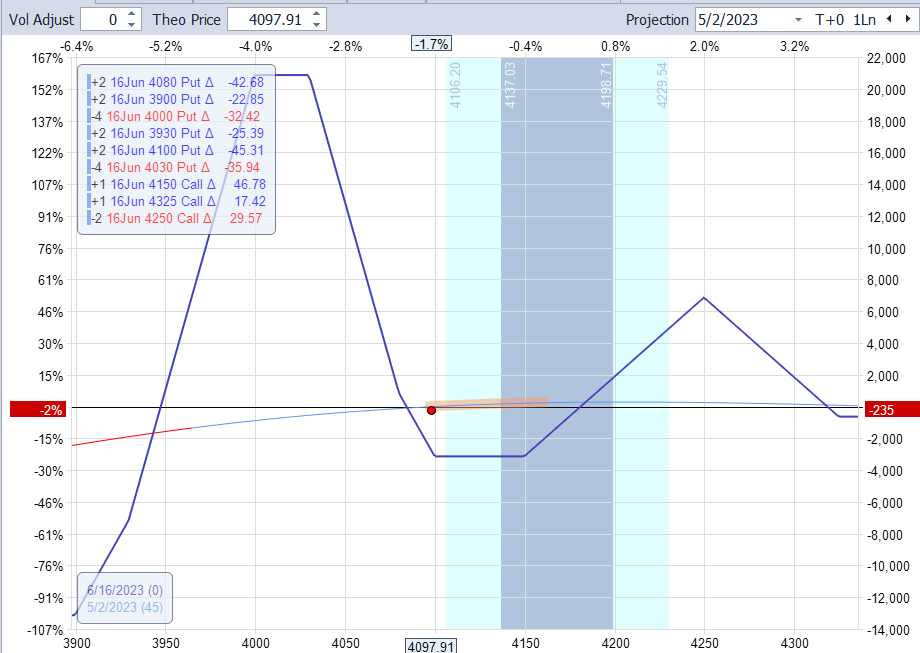

The next day, trading went from 4% in the green to -2% in the red as the SPX fell 78 points:

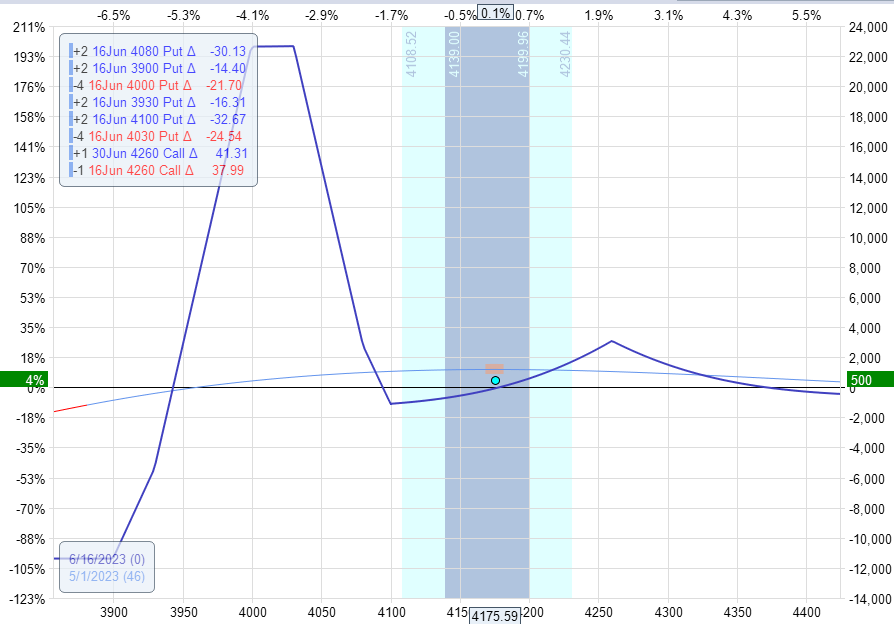

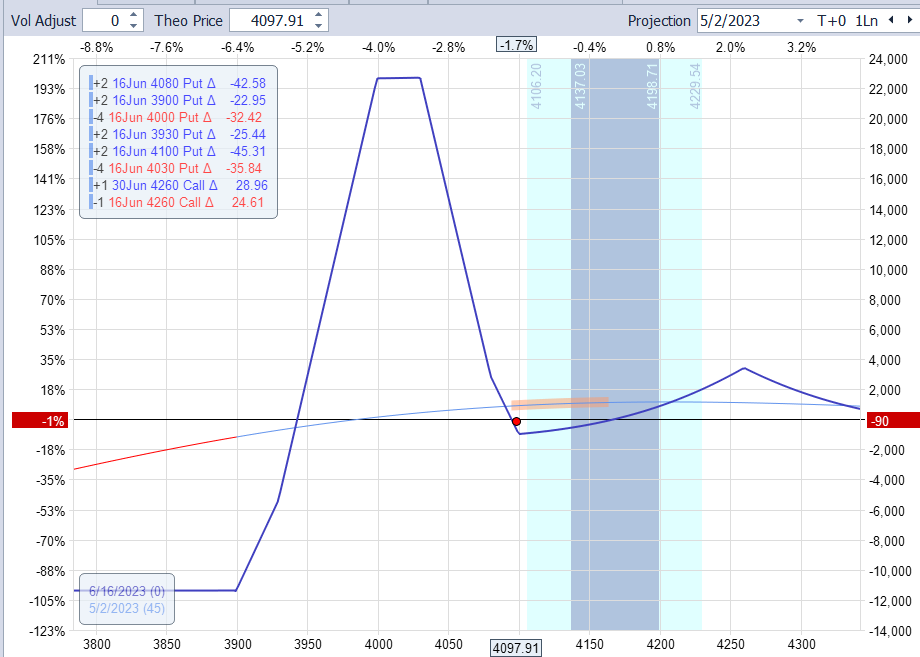

Here is the same trade with a bullish calendar:

The trade performed slightly better when volatility increased as the market fell:

An informal handbook backtest of the Rhino using the upside fly against the bullish calendar shows that both are profitable during the bearish year of 2022 and the bullish year of 2023.

Which did better in the backtest?

I wish I could tell you.

However, the numbers were so close that they were not statistically significant to determine which was better.

The reader is encouraged to try them out for themselves to see which one feels most comfortable.

It’s like trying on shoes.

Buy what feels most comfortable.

We hope you enjoyed this article on trading Rhino without calendars.

If you have any questions, please send an email or leave a comment below.

Trading Vault!

Disclaimer: The above information is about educational purposes only and should not be treated as investment advice. The strategy presented would not be suitable for investors who are not familiar with stock trading options. Any reader interested in this strategy should do their own research and seek advice from a licensed financial advisor.