In the 1920s, at a conference full of world-renowned physicists, an amazing revelation was made – The observer can collapse the wave function (influence the outcome of an experiment). So you’re right. Similarly, anyone looking at the same data set can draw their own conclusions… ![]()

1 I like it

I’m not sure I’ll make it, but I’ll be happy to try,

Tell me where to start? ![]()

Overtrading is definitely a way to lose money. Totally agree with @nithin . Also, it takes a lot of customer love for a realtor to say that. They will usually give you reasons to over shop.

We’ve done point-by-point analysis to see that you should be in a position no more than 20% of the time in the market and the remaining 80% should be spent analyzing it.

There is a theory called the fundamental law of active investing. I hate the name – as it implies that it is as accurate as physics – but still less so. It goes something like IR = IC*√Width

IC is the Information Coefficient

Width is the number of investment decisions in a year

You can apply it to any time scale. Basically this means that if your skills are less, you need more active bets in the market. The other way to look at this is that if you are doing a lot of trading – it usually means that your skills may not be up to par.

But what is overtrading?

For someone, trading 3 trades a day might be overkill. For someone else getting a multiple of that might still be fine. I take 1000+ trades a year on both my systems and I don’t consider it overtrading. If I take less – only the “best” brands say – it makes it worse in some major ways. I don’t scalp.

At the end of the day, it’s all a balance between benefit per transaction, returns, withdrawals, etc.

Trading is only overkill when it makes your system worse in some important metric or if it makes your system very fragile. A trader with an edge and understanding will not do this. I trade with a lack of control.

In India where other costs are so (unfairly) high, I don’t think brokerage costs (10/20) will make much of a difference to cost perception (leading to overbuying if brokerage is reduced) for anyone who has done even a little bit of work . Only people with low capital may feel the effect of very high cost even from Zerodha (high %), enough to move to other brokers.

Foreign studies are in the context of possibly extremely low execution costs where brokerage costs may be more significant.

3 I like it

If they start mtf facility they could charge interest on loan amount and what is the point in charging brokerage for mtf not cnc

all other brokers like dhan and iifl charge brokerage same as intraday for MTF

1 I like it

Asthatrade is fooling the customers. Their 3.99% is only up to 1 lakh. No serious businessman would borrow that much.

Their actual rate is 9.99%. Then 0.2% on equity delivery specifically for MTFs. This high return on equity for short term/swing traders, brings the effective interest to much higher close to 18% more.

These kind of scam brokers, I like to stay away. I don’t know what other traps are there! Zerodha is at least honest.

ICICI also charges 0.1% on both sides! 9.75% doesn’t matter unless you want to hold the stock for the long term.

1 I like it

Hey @nithin, pricing at Rs 20+gst per order may be cheap for larger quantities but is too much for traders trading in one to two lots. Will Zerodha be able to maintain the same pricing after the afternoon session?

Is mstock best for mtf? Torn between mstock and hdfc sky to choose. Others mostly have higher interest rates or % brokerage programs.

1 I like it

The MStock reference quality is garbage. You can’t even download transactions. I used the browser plugin to record the displayed transactions.

Yes, MTF is honest here and the fees are zero. You get a low rate as advertised and I figured you really do. They have a decent stock list for MTF.

But, you don’t have CDSL any easier. You cannot convert MTF to delivery. Their pre-pledge system is seriously flawed, because you can’t enter PMD order without commitment and you don’t have the ability to choose post-pledges from pre-pledges.

They also don’t have serious F&O. Without a lien system, who does F&O.

1 I like it

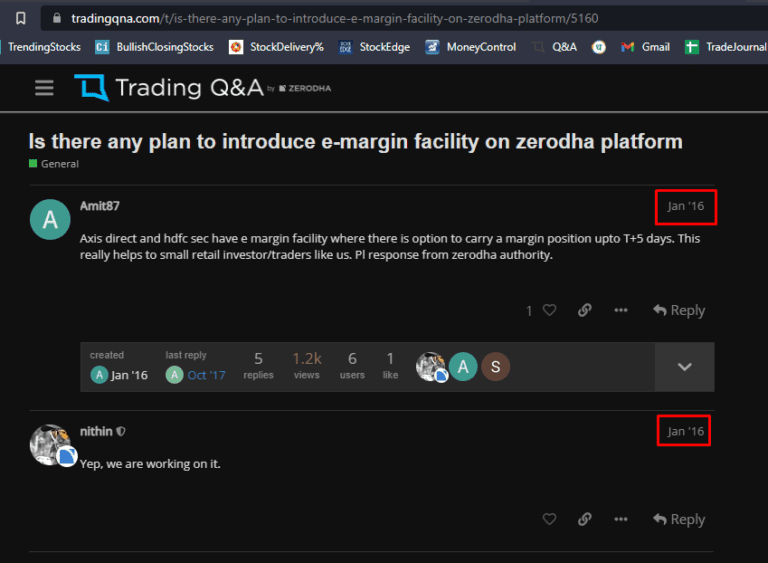

hi @nithin @ShubhS9 any plans for mtf release.

1 I like it

Yes, we are undertaking this project now. It will probably be a hidden feature, however, as we wouldn’t want all customers to borrow to invest.

1 I like it

EXCEPTIONAL!!

Many swing traders will appreciate this move. ![]()

I think it should be the customer’s choice.

1 I like it

Also, keep the option to select the margin when placing the order. I find MTF very useful, but I always try to limit leverage to <= 2x.

3 I like it

@nithin – While his nobel to mention the following “Also, maybe the reason we didn’t prioritize is because we fear that all of our clients today are not leveraging while investing and might start doing so if we launched this feature. Leverage is the biggest culprit for investors or traders not making money. Although this will add revenue, that’s probably why we spent so much time on it.” However, you offer options and according to SEBI survey 90% people. Maybe Zerodha should also stop options then.

Anyone I have moved to AngelOne since EMF installation is not available with Zerodha. Although I will be happy to transfer my money to Zerodha when EMF is available.

Also, you still charge for small account changes like linking a new bank account and all, which other brokers don’t charge, so in the interest of our big clients statement still doesn’t make sense.

1 I like it

@nithin

Questioning this low margin requirement led to rampant speculation, dramatically increasing leverage, and when the market crashed, many margin investors could be wiped out. Finally increase the market crash.

We already have a 99% loss rate in derivatives and other speculative trading. Are we going to turn Swing and Long term investing into another kind of failed speculative trading? .

MTF bridges the gap between the delivery of futures and equity.

The rate it’s becoming popular, I think it’s going to be the next normal pretty soon.

@Abhi_001 Correctly placed. A lot of futures is worth an average of ₹7 lakhs for a margin of an average of ₹1.5 lakhs.

Now say TraderX, he doesn’t want his exposure to be ₹ 7 lakh but just ₹ 3 lakh. He could easily bring in the cash or hedge his holdings to get margin and make the ₹3 lakh exposure.

This is much healthier and safer. @nithin @VenuMadhav

In fact, this is what I have been doing for the past 6 years and this strategy has performed well both during the lows of COVID and the highs of 2023.

@itsadam Yes, but the interest rate, borrowing limit and holding period have to be good for it to work.

In Mstock there is no cap on holding period and fund amount, plus the interest rate is lower compared to any other brokerage, that’s why they recorded the highest growth in their MTF bucket, despite their poor platform .

Hi Angelone convert your MTF pledged shares to delivery if you meet cash margin in your account. I haven’t figured out how to use it in angelone until today. It’s just an eye wash. Yes, you can try upstox (although margin is only 1x, not bad to start with).

Disc : I haven’t tried MTF yet, not sure how to manage risk per trade with it. Once, it is clear that we will try in the future.