It has been quite some time since I dealt with the CPF website.

I remember visiting the site very often in the days when I was actively planning how to fully utilize the CPF system.

Anyway, as I turn 55, I decided to revisit the CPF website.

That’s when I set up a retirement account.

I thought it would be a good idea to check what my full retirement amount would be by then.

This is what I found:

So that would be $220,400 for me.

My CPF-SA has more than that right now and will continue to grow based on interest earned only annually.

So I’m not worried.

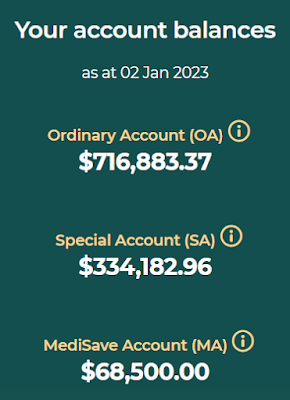

This is how it looked at the beginning of the year:

I then checked how much I would get when CPF LIFE starts for me at 65.

For this, I used the CPF LIFE Estimator: HERE.

I had to tell the AI that I am 55 now for it to work and then enter the FRS for my age group.

It’s a fun calculator to use because I was able to use sliders to change the payment age and also the amount of funds to see how things would look.

Anyway, if I stuck with the FRS of $220,400 and automatically started paying at 70, I would be paid $2,380 monthly.

If I ask for payments to begin at age 65, I would be paid $1,760 per month.

In 2014, I published a popular blog post that has received almost 50,000 page views so far.

It was “Retire by 45, have a plan.”

In that blog post, I said that I wanted to retire by 45, and I thought I’d be pretty comfortable with $2,500 a month in passive income.

I factored in inflation and by age 65, I would need $5,081 a month in passive income.

I calculated the required monthly passive income until age 75.

If you are interested in seeing all the numbers at various ages, please go to the blog post and I have linked the title earlier.

So what’s the point I’m trying to make?

For me, at least, the Full Retirement Amount is not enough to retire comfortably.

At age 65, there would be an estimated shortfall of $5,081 – $1,760 = $3,321 one month.

Please don’t misunderstand me.

I think CPF LIFE is a very good idea because many people are not very good with money and even worse at planning for retirement funding.

So with CPF LIFE, at least there is some sort of minimal safety net.

However, this is it.

ONE minimum Secure Network.

In case you’re wondering what sparked this blog post, it was a news article about how Singaporeans are lagging behind in savings and that more can only afford basic expenses.

See article in The Business Times: HERE.

“Most Singaporeans can only afford essentials, don’t have enough savings, OCBC survey finds”.

“Most do not have adequate ’emergency funds’ or enough savings to meet the needs of their families in the coming year.”

We really want to take action early to ensure pension funding is adequate.

In good times, don’t be complacent because bad times can hit us where we least expect it.

Always have a judgmental mindset.

It may not be fun, but we should do better than those who don’t.

If AK can do it, so can you!

Note: Figures are based on CPF LIFE Model Scheme.

Recently Posted:

Yield 3.75% per annum on bonds.