merchants,

I am excited to introduce many new ideas, all of which have the potential to make significant directional moves. I will share my thought process and feasible trading plans with you as always.

Just before I do, here’s a quick reminder. As the market continues to make new highs, it can be easy to find yourself in an overbought and everything is short mindset. As I said last week, I don’t want to step in front of a freight train. The ideas and settings I shared last week still work in this environment. Notably, the breakthrough in SNOW and MARA had fantastic directional momentum. PLTR and ARM delivered strong continued moves after earnings. As long as these settings continue to work, here is my caution from a swing perspective. It will be obvious when things change and then it will be time to react and adapt. Until then, stick to what works!

So, with that said, here are my favorite swing ideas for the coming week:

Unblock Netflix

The first two ideas I have are clear and replicate the outburst experienced at Amazon on Friday.

Post-earnings, Netflix has consolidated and now presents a simple, favorable risk: regulated reward should a breakout occur.

Here is my trading plan:

A lot of time frames align here, which I like. This meets the criteria for a classic continuation swing, similar to previous ideas I shared during earnings season last year, such as the long idea on CELH or DKNG.

Let’s assume the market remains strong or Netflix shows relative strength and breaks through resistance on the hourly time frame, around $570, with authority. In this case, depending on the entry setup, I will look to stay with a stop placed either at the low of the day or below the most recent intraday high low.

My first target to cut a slight portion of the position, cover the risk and raise my stop to a previous higher low would be around $580. After that, while the move towards $600 is the ultimate goal, I will cover more than half the position in a 1 ATR move up from the breakout level towards $585 – $590. The remainder of the position will be closely followed by the stock making new intraday highs on the 15-minute time frame and raising the stop using previous higher lows until the $600 high target is reached or the trailing stop on the balance.

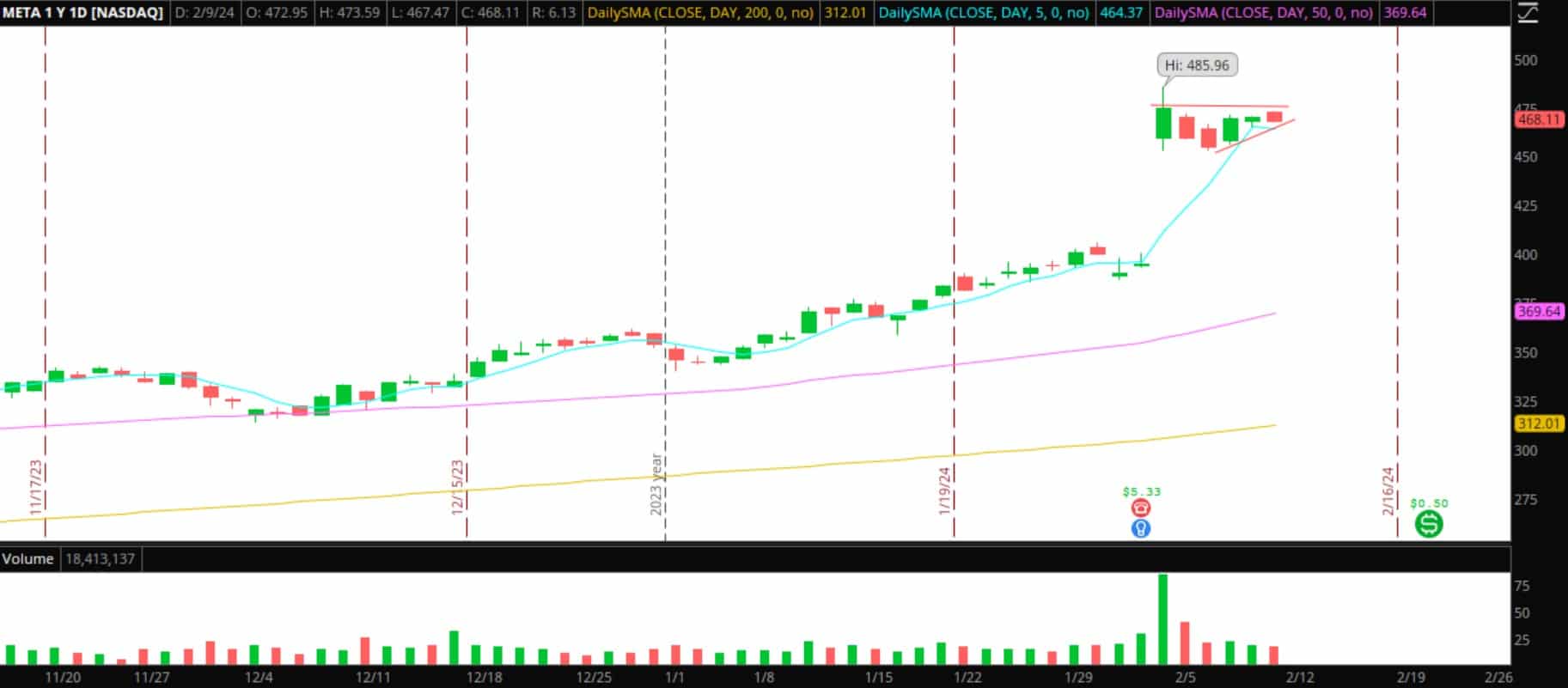

Continue to META

Similar to the pattern above, and as I said, this is a carbon copy of the Amazon breakout on Friday. Based on how extended the META is from the rising 200-day SMA and how elevated its RSI is, my time frame here would be a full day to 1.5 days should the all-clear occur. I will not aim to overstay my welcome and once the position works, I will follow it tightly using the intraday VWAP, especially if it starts to hold below that.

Here is my exact entry plan and the goals I have in mind:

Similar to the pattern at Netflix regarding total market power and/or relative power shown in the Meta. I will look for a move above Friday’s high and support confirmation will develop along with spending time above the $474 – $475 area. Upon achieving the above and establishing an intraday uptrend, I will go long with a stop placed below the intraday high low or low of the day. The first target is the high of the profit gap, near $486. After that, I’ll halve my position to a full ATR upside, near $490, and follow the stop the same way as planned on NFLX, with $500 as the final high target.

Backside Swing Short: Pops short in HKIT, TOP, MLGO

There were fireworks in small-cap and low-end Chinese stocks last week, as HOLO moved higher, squeezing into shorts on Wednesday and Thursday. This move brought a lot of sympathy plays to other small-cap Chinese stocks.

Now that the craziness has subsided, and many of the sympathies have returned the majority of their movement, I’ve set up alerts in case they reappear in areas of potential resupply / overhead / where they’re likely to fail. This is similar to previous setups and ideas I shared on TTOO and CYTO, among many others, if you remember.

Alerts are set to multiple names while keeping a close eye on the leader, HOLO.

For example, I would be interested in shorting TOP if it pushes towards $5.5 – $6 and fails. This would confirm a lower high, with a level of risk against the day. Once in, I would take out half the position towards the mid to low $4s and hold the rest for a move back to the $4 – $3.50s.

Important Disclosures