merchants,

I’m excited to share my top swing trading ideas for next week. This week’s insights will once again differ from last week’s as the market takes a breather amid the semi-stock selloff.

While there are undoubtedly top swing opportunities out there, it’s not as simple as it has been in recent months, with several tech stocks breaking out of consolidations each week. Now, things are reset and it is necessary to adapt to it. Just like I did last week with the little swing idea in the semis.

But there is a catalyst with the potential to shake things up this week and cause major directional moves.

So let’s get right into it as I share my actionable ideas, plans and trade management for next week’s top swing trading ideas.

Nvidia’s annual GTC conference

After becoming somewhat parabolic, the semi/AI sector took a breather last week and retreated. This comes just before a major AI conference—Nvidia’s annual GTC conference—kicks off on Monday. With more than 300 exhibitors, including Meta and OpenAI, participating in the four-day conference, it is not only a catalyst for Nvidia but for the entire industry and market.

Thus, it will be necessary to stay up to date with the latest developments and headlines.

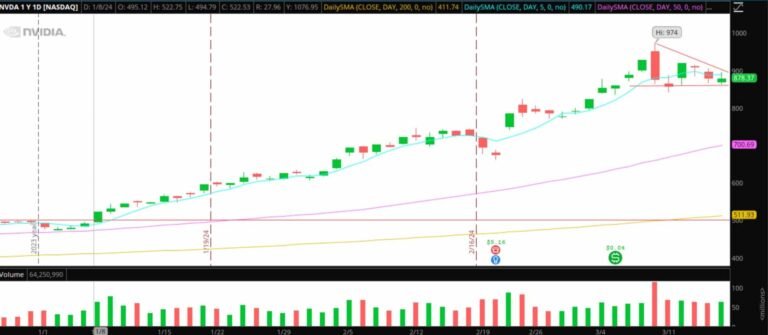

Regarding Nvidia, I’m not looking for a multi-day swing. However, the chart has curled up nicely in the past week, presenting a solid, directional, reactive opportunity for me.

*Please note that the prices and other statistics on this page are hypothetical and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and fees.

Here’s the plan:

In broad action, I look to go either long or short depending on the market’s reaction to Monday’s keynote. This is not a multi-day position, but a possible one-day trend representation after the stock has chosen a direction.

Long term: Multiple timeframes aligned, with $900 as breakout level for bulls. If the stock breaks this level on volume, I will either stop at the low of the day or below the 5 minute low (I will trade it at the 5 minute TF).

I will exit the position as the stock makes new intraday highs at the 5 minute TF. My high target is $950 and I will follow the stop using higher lows.

Long story short: It’s the same as the big idea, just flipped. If the stock breaks Friday’s lows with authority, perhaps with a subdued announcement, I’ll be short the previous lower high or resolution level if a serious moment occurs. As it works, I will scale to intraday lows, trailing the stop to lower highs.

Jump to SOXL

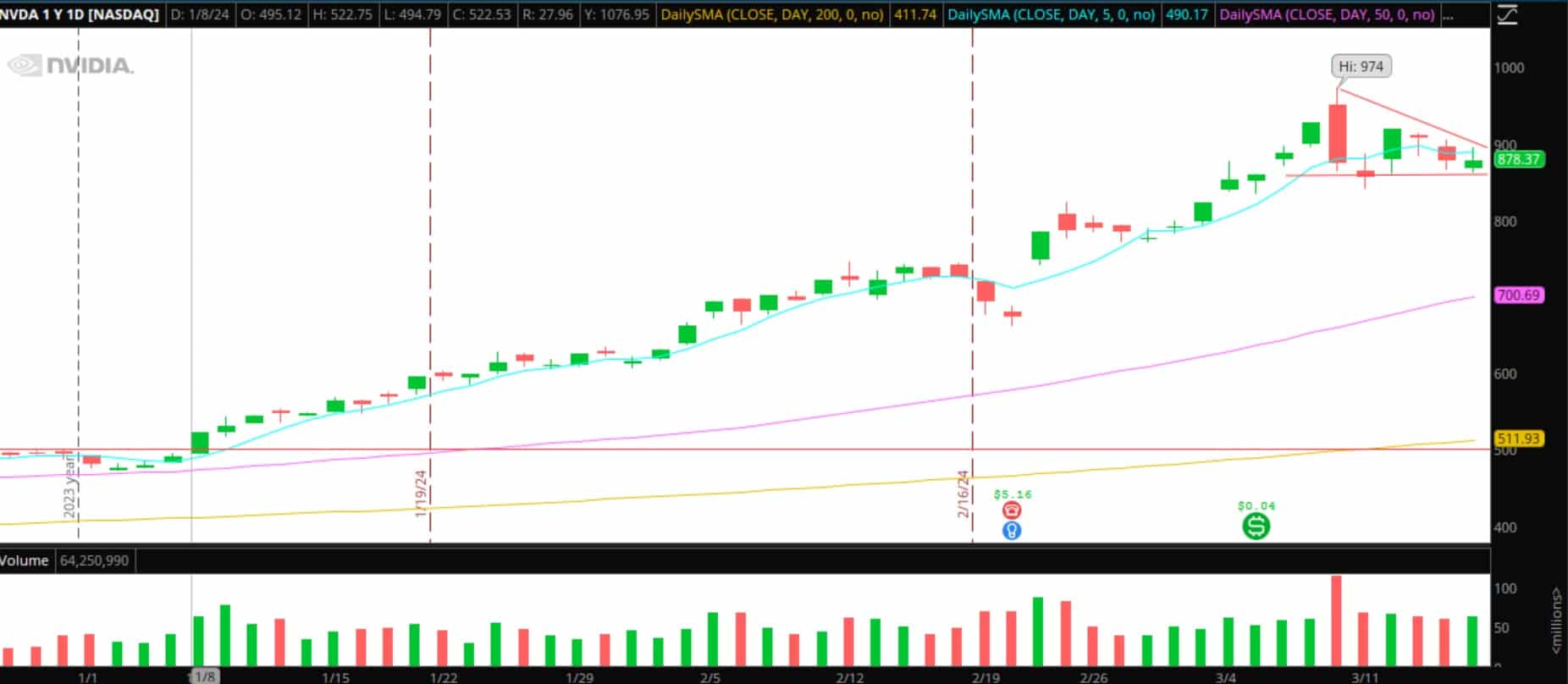

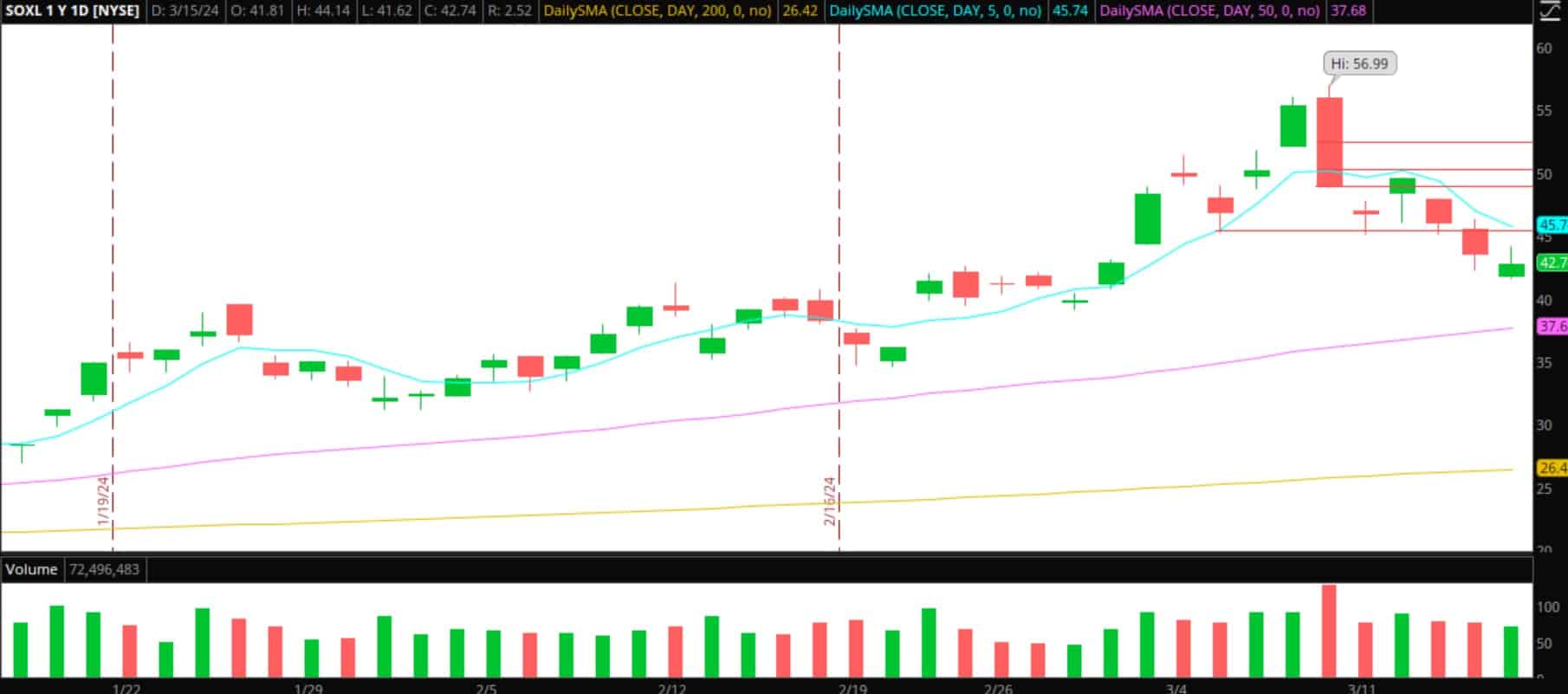

SOXL worked beautifully last week. It was undoubtedly the top idea on last week’s watch list. However, after a straight week of selling and well off the highs, I’ll be looking at it now for a bounce. It will be reactive to the action I see in NVDA and some other leading papers and industry heavyweights.

*Please note that the prices and other statistics on this page are hypothetical and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and fees.

Here is my plan:

With the catalyst this week, this will also be a reactive trade. But with many of its top holdings, such as AMD and AVGO, nearing key SMAs and well off their highs, if individual stocks in the sector find their footing and catch a bid, along with its momentum NVDA, I will take a lot of time for a multiple day bounce.

So if there is relative strength and positive flows in the sector, I will go long SOXL with a stop at the low of the day. My first target for a bounce would be either an uptrend ATR or $45.50 – $46, a momentum analysis level from last week. After that, I will exit the remaining position on the 5 minute time frame as the stock makes new higher highs. My stance will be followed on the 5-minute time frame, conservatively, as I suspect aggressive momentum and a clear trend. So I will unless it makes a clear pivot lower-lower on the 5 minute time frame and key holdings start to show weakness.

Two additional Backburner ideas:

SOUND: Incredible staying power and short spin. They will be presenting at the conference this week. I won’t be looking for long considering how much the stock has already gone up. Instead, I’m looking at $9 – $10 for a break and possible sell setup on the news.

VERB: Small cap stock with incredible volume increase on Friday. After Friday’s weak close, a ton of hawkers are now trapped and underwater. I will have alerts set for pushbacks to potential major resupply zones such as $0.65 – $0.80. If the stock pushes back into this area and fails intraday, I’ll look to short against the day’s high.

Important Disclosures