merchants,

I’m excited to share my top swing trading ideas for next week. After the Fed’s rate decision on Wednesday, the market picked a direction after an eight-day period of consolidation and rest, and my top idea from last week did extremely well, with the semi-sector breaking out and trailing too much.

As the market continues to soar to new heights, my focus is on new breakouts and momentum trades. Although I’m being careful here, things start to get a bit over the top and a bit frothy. But until it stops working, my focus will remain on the long side and the setups that have been working for the past several months.

So let’s get right into it. I’ll share my top trading ideas and plans for stocks that could make major directional moves this week.

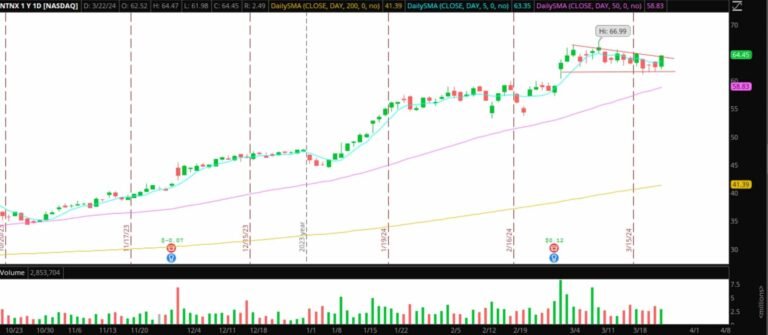

Breakout integration in NTNX

This is a manual consolidation pattern in a stock that has been in a solid uptrend for some time. The stock has a history of solid, sustainable breakouts and continuation, so my time frame here will be up to a full week, with an end, as I look for history to repeat itself.

*Please note that the prices and other statistics on this page are hypothetical and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and fees.

Here is the plan:

From the daily to the hourly chart, the time frames and critical levels align, which is what I look for in this setup.

$65 is breakout confirmation and I want to see the stock break above and hold above with authority. Once this is confirmed, I will place a stop at the low of the day or below the most recent high low on the 15 minute time frame. I will manage the position in the 15 minute time frame.

The high target is a move to $70. However, I intend to exit the position as the stock is trading an ATR. So I’ll cover half the position on a move to $67.50, and the rest will go down as the stock makes significantly higher highs in the trading time frame. The final output will be $70.

Breakout integration on ARM

Once again, it’s a fantastic integration that has shrunk significantly in scope. While all the talk was about the lockup ending and the bias shifted heavily in favor of the bears, the stock held steady and continued to consolidate. I am unbiased and try to react solely to price action here.

*Please note that the prices and other statistics on this page are hypothetical and do not reflect the impact, if any, of certain market factors such as liquidity, slippage and fees.

Here is the plan:

Again, a key $138 – $140 area on multiple time frames shines as resistance. Therefore, if the stock, with authority, breaks above this zone with volume and significant support, I would consider going long.

In particular, I will look to short once the stock confirms an intraday uptrend and holds firmly above the intraday vwap. I will enter long undersized and what I believe is a long stop near the low of the day (I would be wrong there). So it’s a smaller size and a wide stop to let the idea play without too much management.

My first target area is a move towards $145 – $150, where the stock could be in trouble. I plan to cover up to half the position there, thus locking in profits and removing risk. My stop will go up using the 15 minute time frame to higher lows. The ultimate target is a move towards $160 – $164, although I will also manually scale back as the stock makes new higher highs on the 15-minute time frame and use my discretionary trailing stops. automatic mode if the price action changes.

Two additional Backburner ideas:

YTEN: Targeting a push back into a .55 – .65 resupply zone for intraday failure and a short chance to pull it back into the .30s.

BACK: I’m keeping a close eye on the stock if it pushes back above $3, the resistance area from Friday, for an intraday breakout and short against the day’s high for a move back into the low $2s.

Important Disclosures