First, a quick question: take this 5-minute survey on martech composability. We will share the full results with everyone. I bet it will be very interesting. Thanks! Ok, back to today’s post…

I prefer empirical data to gut feeling predictions. For 12 years, I’ve been told that SaaS in general — and martech in particular — is going to consolidate dramatically. People can be quite keen on such predictions. However, year after year after year, the data consistently fail to show this effect.

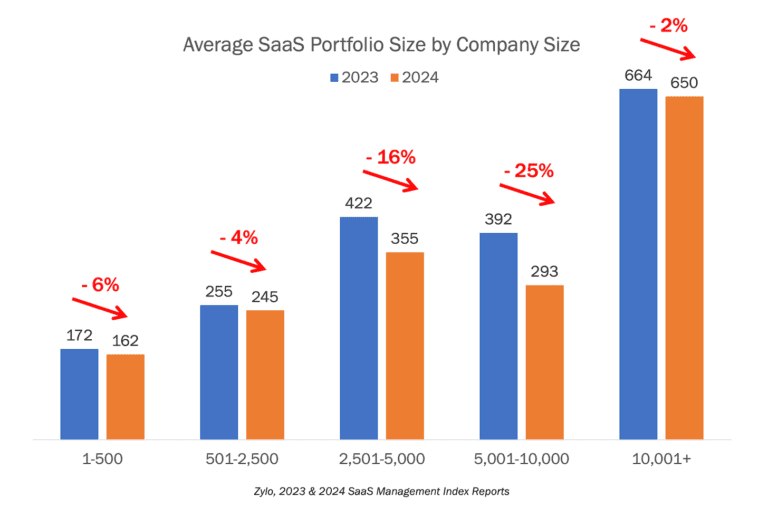

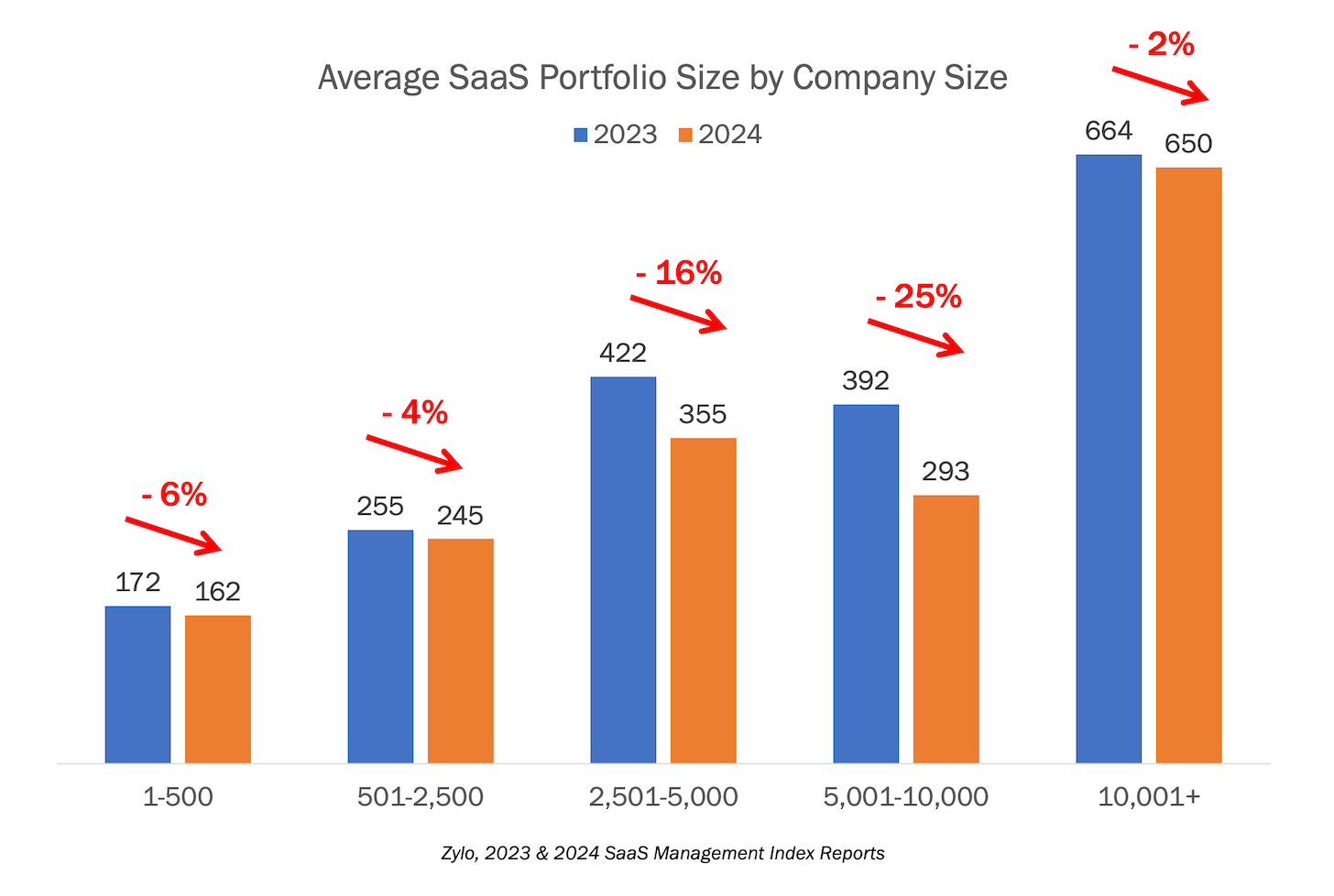

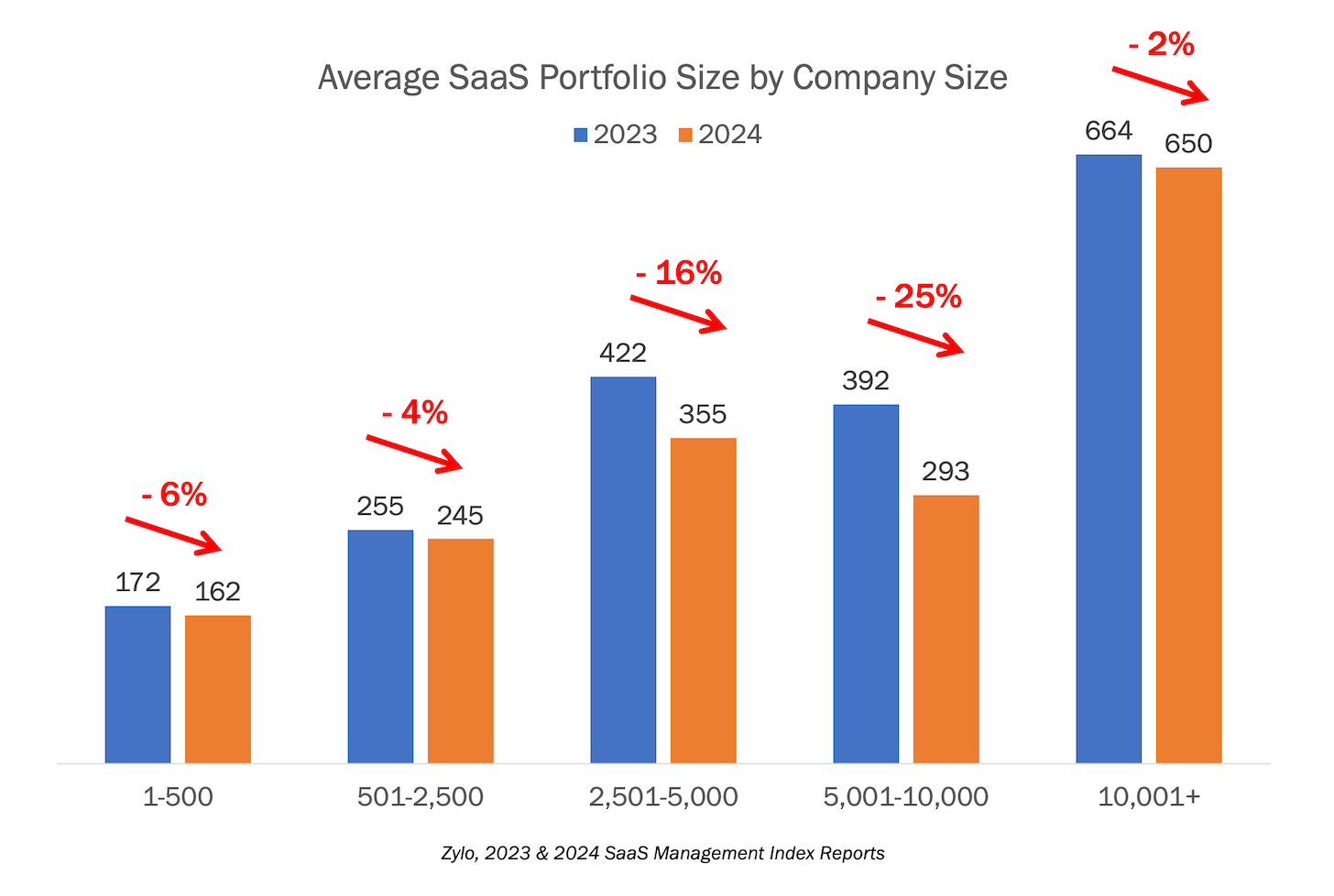

According to the just-released 2024 SaaS Management Index Report from Zylo, a leading SaaS management platform that manages over 30 million SaaS licenses for companies of all sizes, the average SaaS portfolio fell from 291 apps to 269, just a hair under 8%.

For context, 2023 was a brutal year for SaaS companies as customers looked for as many opportunities as possible to cut costs by canceling unnecessary application subscriptions. And indeed, average SaaS spending shrank closer to 11% over the past year.

However, the average stack size for SMBs with 500 or fewer employees is still 162 applications. For mid-market companies with 501-2,500 employees, it’s 245 apps. Yes, they are down 6% and 4% respectively, year-on-year. But this is not exactly the scorched-earth scenario that the prophets of unification promised we would see at this point.

I’m sure they’ll say, “Just wait until the end of it This year!” Maybe they’re right after all.

Don’t get me wrong. I’m all for companies that are cost conscious and proactively manage their stacks to maximize ROI. I also have no problem with market forces tending to drive a small number of competitors in a category to stand out from the crowd.

But the reality is that we live in an era of constant technological innovation. If anything, the pace of change in technology has accelerated—and is accelerating even faster now in the current wave of all things AI. In an environment like this, there are many new opportunities for startups. And the pressure for companies to adopt new technologies to keep up with their competition is real.

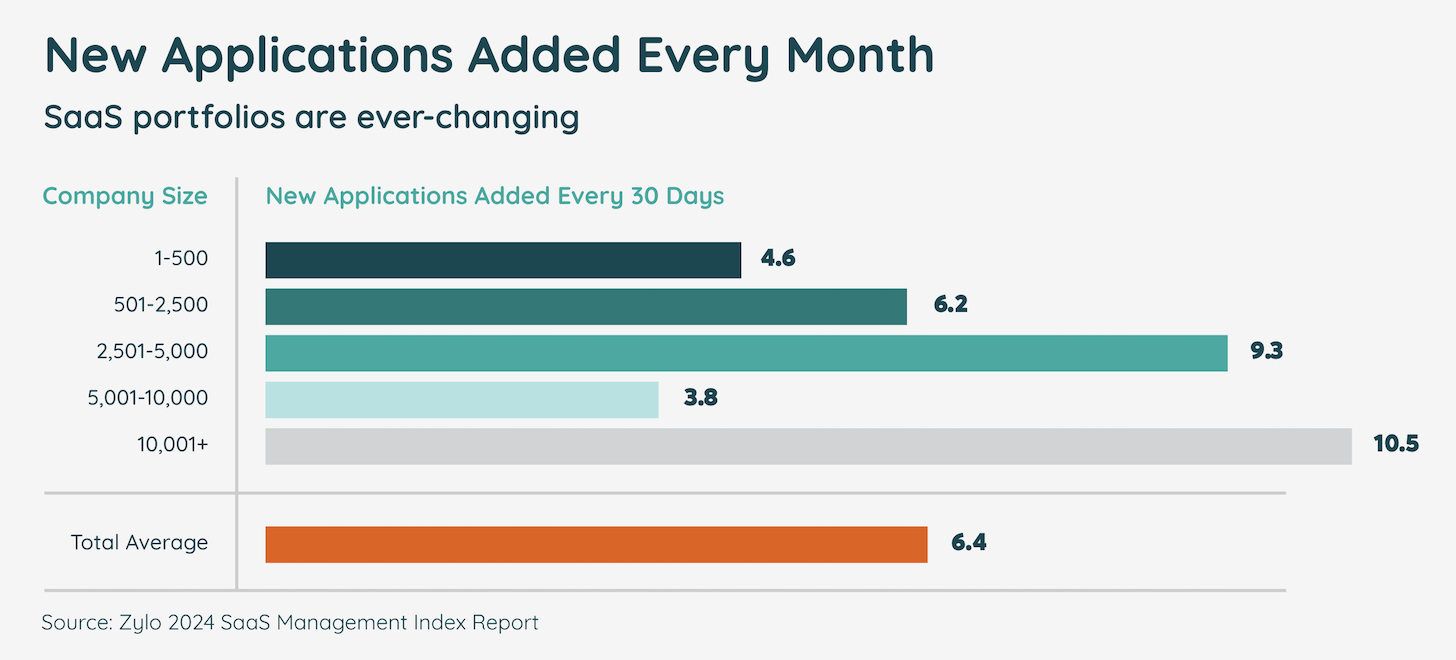

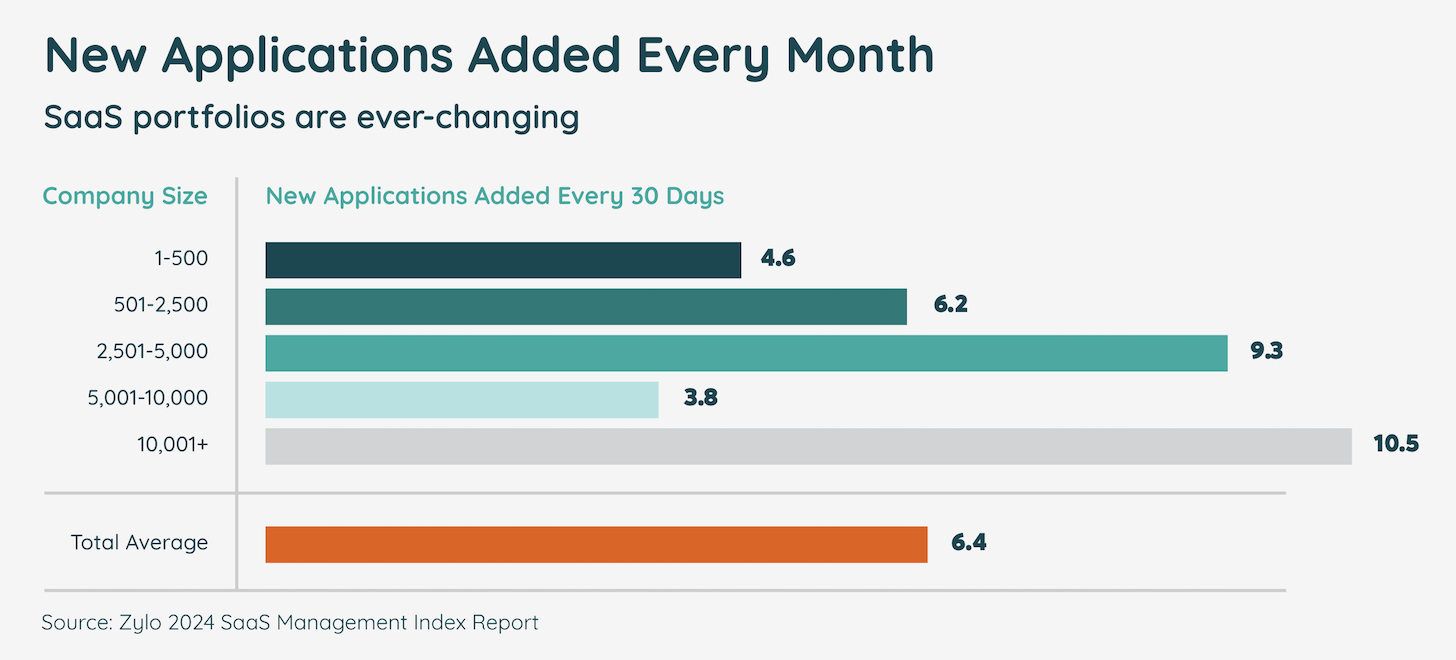

You can see proof of this from the number of new SaaS applications that are continuously introduced to a company’s SaaS portfolio each month:

This constant evolution is an important counterweight to the forces of consolidation.

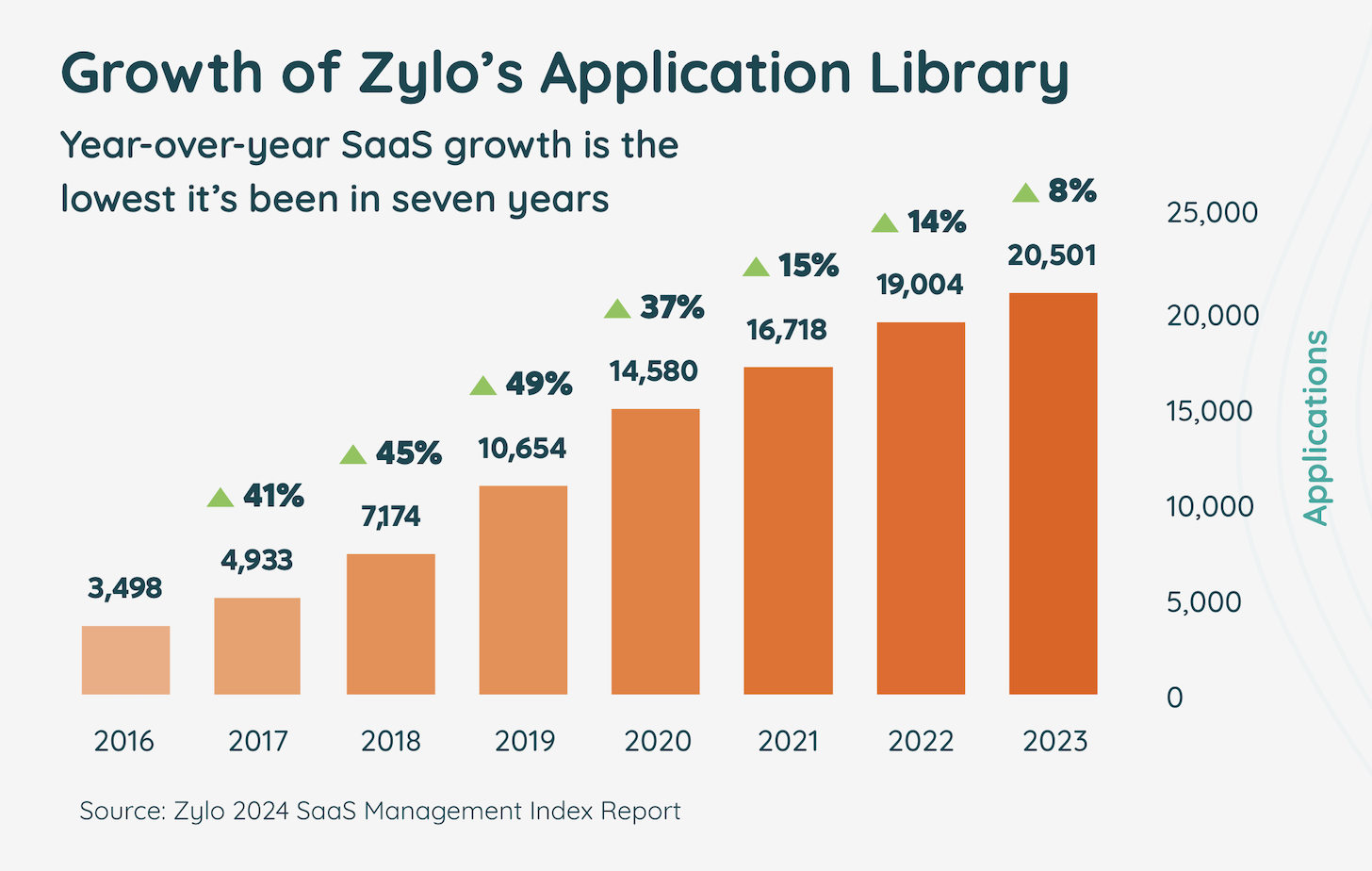

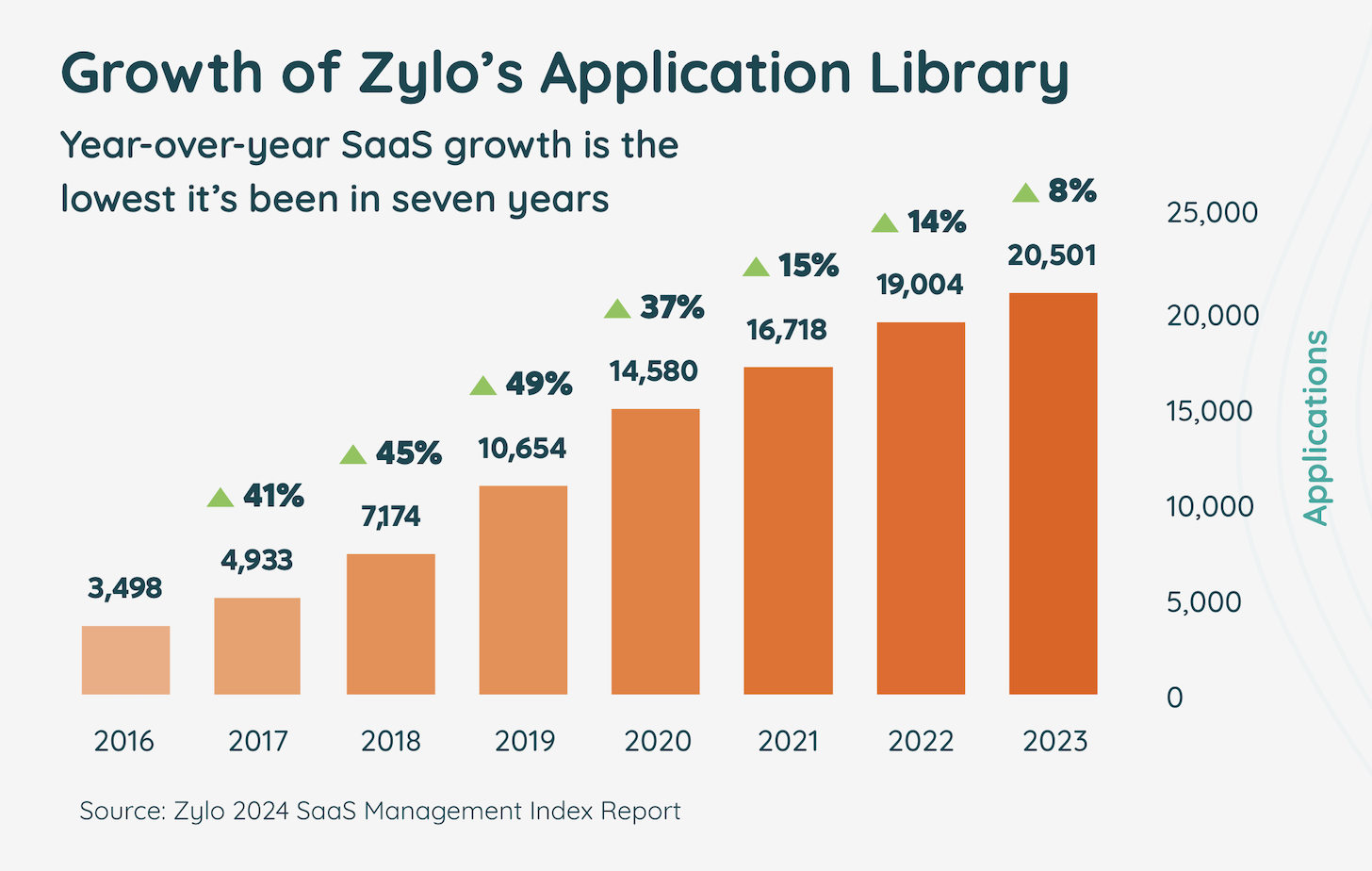

It’s worth noting that while average stack sizes have shrunk in recent years—albeit by relatively modest amounts—the number of different SaaS applications on the market has continued to grow. Of course, you’ve seen the upward trajectory of the martech landscape over the past decade. And a few years ago, review site G2 shared that they had over 100,000 SaaS products in their database.

However, as another source for triangulating app diversity, the chart above from Zylo shows the number of different apps they track. It’s just growing, now it has more than 20,000 apps. Yes, growth has slowed. But it’s still growing, even though average stack sizes have started to shrink.

There may be (slightly) fewer apps on stacks these days. But if you do the math, it’s an increasingly diverse collection of applications in these stacks.

Shadow IT, a shadow of what it once was?

Once upon a time, “shadow IT” was the derogatory phrase Any software application that did not belong to the IT department.

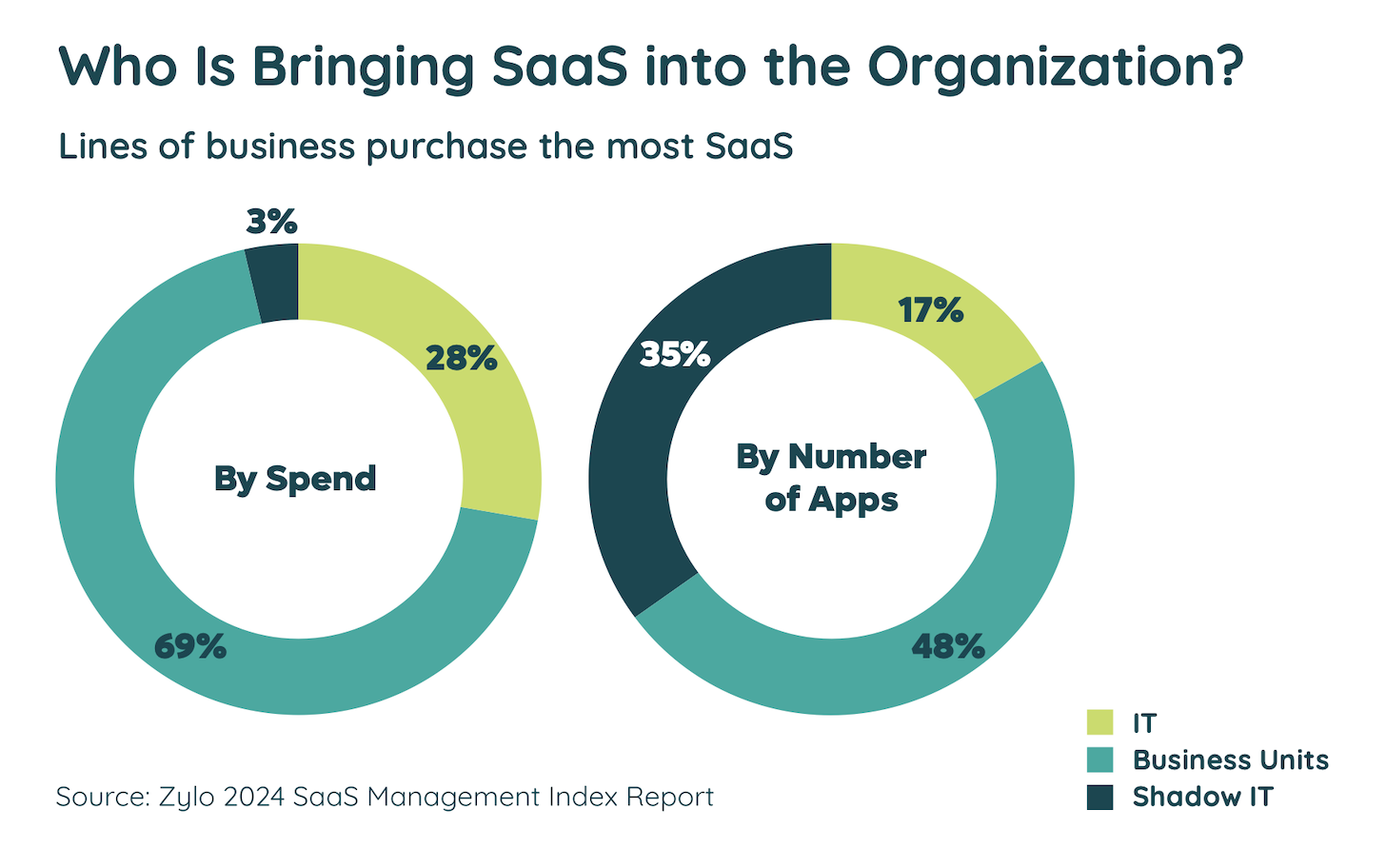

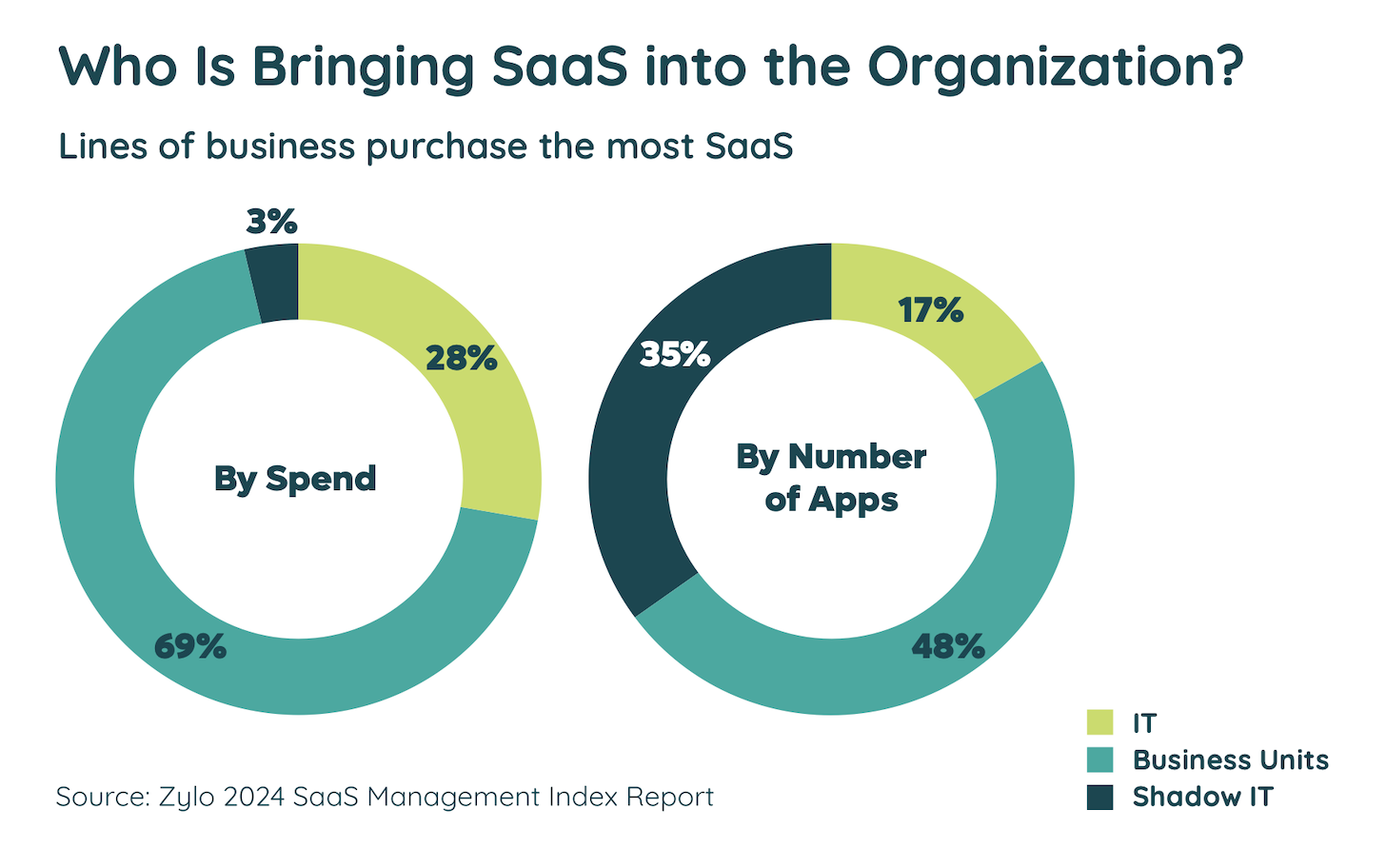

We have come a long way. Now, the majority of software—both by total number (48%) and by spend (69%)—is owned by enterprise groups. Marketing runs most of its own martech applications (although the amount of IT-owned, enterprise-wide data and aggregation infrastructure used by marketing is growing).

These business-owned SaaS applications are no longer considered shadow IT because even though business teams foot the bill and run these applications, IT still has full visibility and can enforce their compliance with governance and security requirements . In many ways, this is the best-of-both-worlds scenario we’ve been looking for in martech for a long time. It balances centralized control and distributed empowerment.

But shadow computing still exists. However, its definition has narrowed and now mostly refers to SaaS applications that individual employees or teams spend on their credit cards, outside the watchful eye of IT governance.

As you might expect, most of these shady IT apps are small enough — or at least cheap enough — to fly under the radar as credit card spending. According to Zylo, only 3% of total SaaS spending falls into this category. What’s fascinating, though, is how many of these little apps there are. While they make up only 3% of spend, they are 35% of the number of apps in users’ stacks.

Yes! Over 1/3 of a company’s SaaS applications are ungovernable shadow IT! This sounds like a four-alarm crisis.

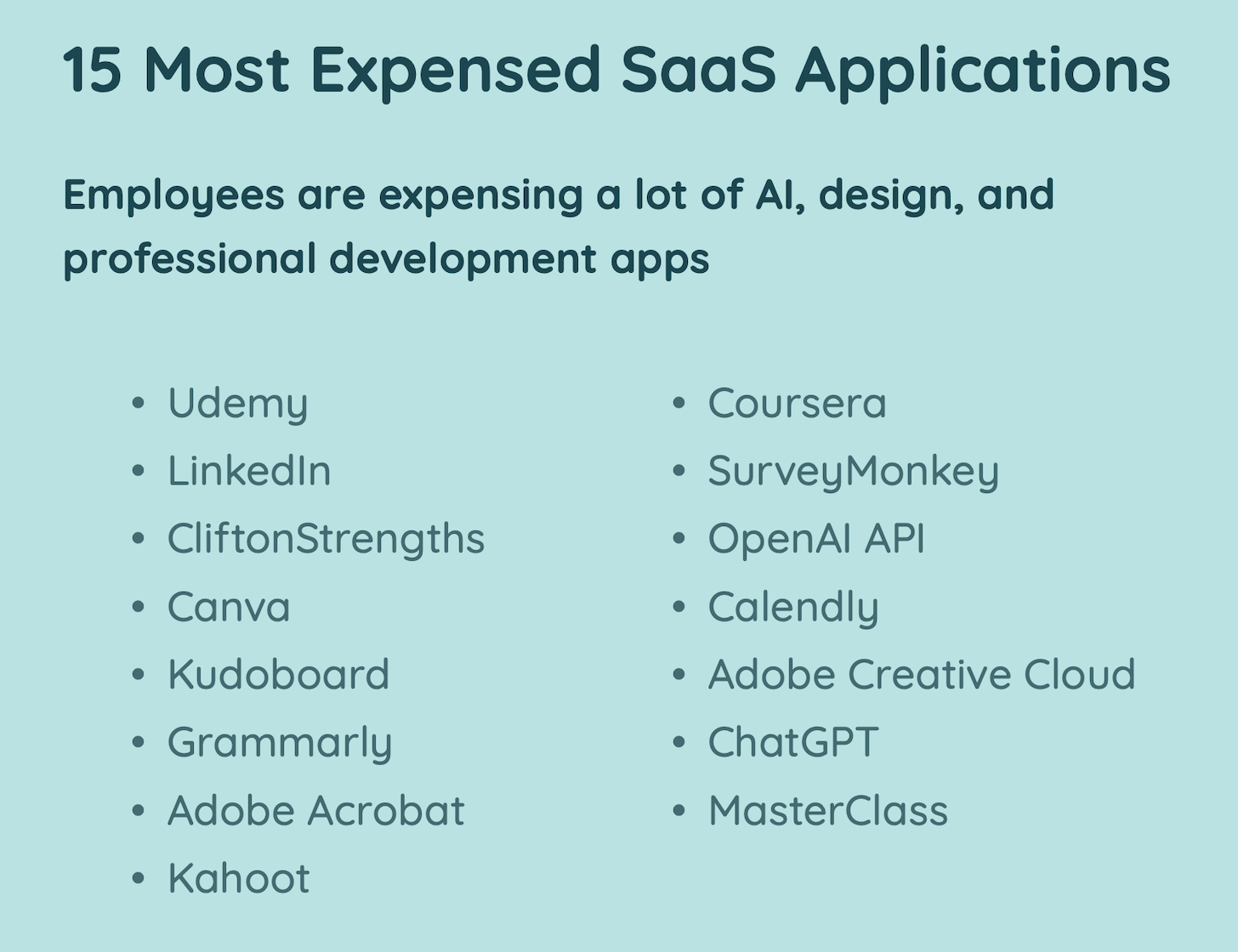

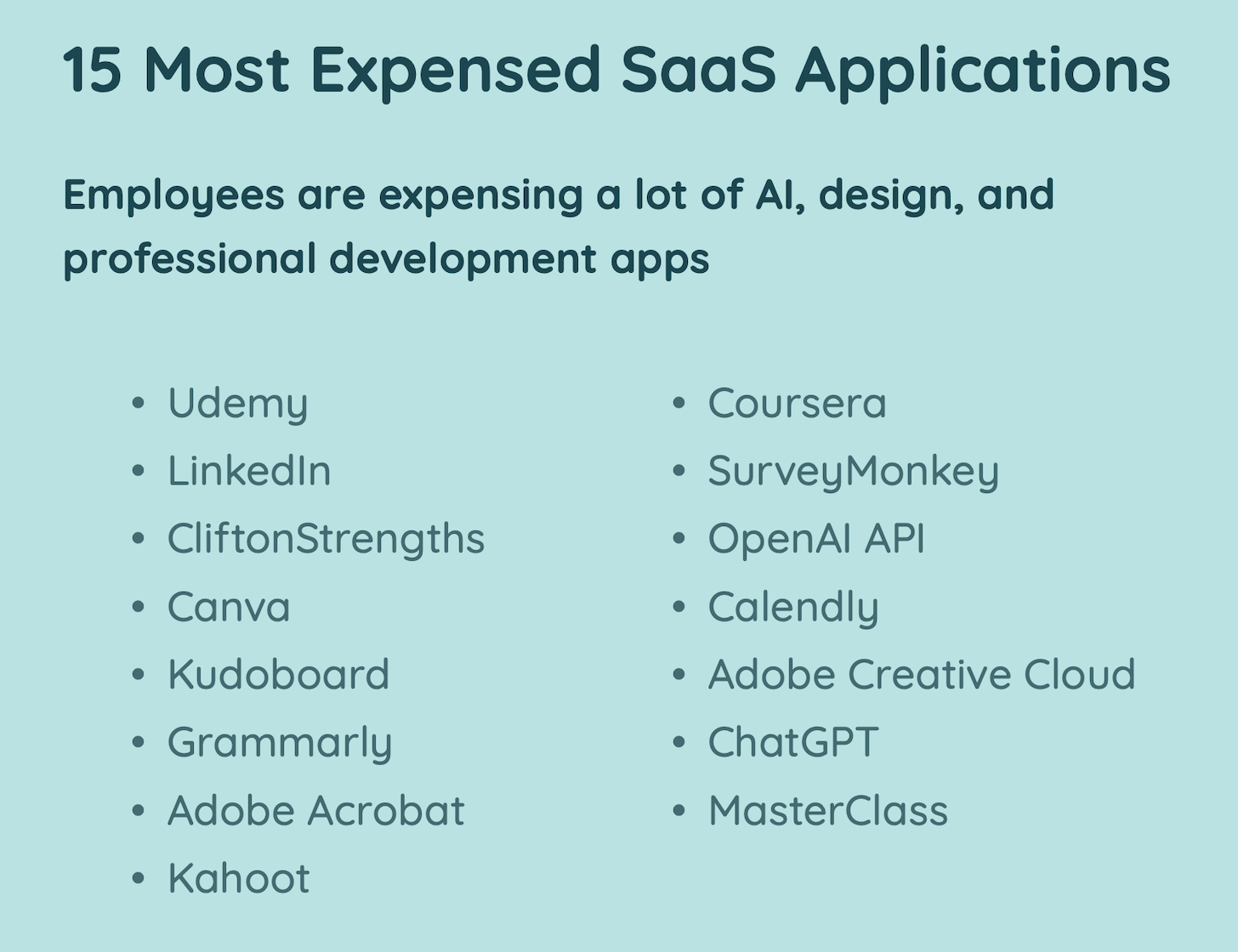

It might be. But when you look at the most popular shady IT apps, most seem relatively harmless. Udemy, LinkedIn, CliftonStrengths — as an aside, I’m a big fan of StrengthsFinder and highly recommend it — Kudoboard, Coursera, MasterClass, etc.

Yes, there would be advantages if all these subscriptions are official “daylight IT” instead of shadow IT. Mainly to reduce costs by getting rid of unused licenses or negotiating company-wide discounts. (Although I will note that these two levers are often trade-offs of each other.)

But we’re only talking about 3% of total SaaS spend. So even if you cut those costs in half, it would only be a 1.5% savings. Hey, 1.5% here, 1.5% there, next thing you know, we’re talking real money. But it is not a white whale.

Some of them are more problematic. Are you using SurveyMonkey to collect customer data? This must be governed. Using Grammarly with confidential documents and emails? This must be governed. Are you using ChatGPT and the OpenAI API? Hell yes, this should be managed!

But this seems like a gap that can be filled by putting in place streamlined mechanisms for the official purchase of approved “personal productivity and development” apps (which is how I’ll generalize most of this list).

In fact, the void is closure. In 2022, Zylo reported that 20% of employees were spending SaaS in this shady way. By 2023 the number had dropped to 15%. And here in 2024 it drops to 7%.

Summarizing:

- Tech stacks are still large, albeit healthily trimmed.

- The universe of different applications in technology stacks is still expanding.

- Business teams ultimately own most of their applications, although they are governed by IT.

- Shadow IT fades into the shadows, mostly because we redefined it.

Lots more great stats in the Zylo report. We highly recommend picking up a copy.

One more reminder: please take the martech composability survey. When you see the questions, I think you’ll be as curious as I am to see what the results will reveal. But we need your participation to have statistical significance. It’s my humble request in return for the free content I post. Thanks!