Which predictors of stock returns reflect mispricing and which reflect risk premia?

The degree of efficiency of the stock market is a fundamental issue of finance with important implications for the efficiency of capital allocation and hence for the real economy. Performance predictability is a cornerstone that allows investors to estimate their returns with varying precision. Some anomalies Allow one to exploit gaps in global markets and capture substantial alpha, which violates the Efficient Market Hypothesis (EMH). However, if this alpha comes from risk premiums or source of is incorrect pricing continues to puzzle academics around the world, and they are wrapping their heads around solving this difficult question.

In his work, Jonas Frey (2023) takes up his challenge determining whether some known stock predictors represent mispricing or risk. The overall results suggest that for at least 40% of them, predictable excess returns align with predictable changes in future earnings expectations, suggesting that they are at least partly due to mispricing. The analysis does not capture mispricing arising from biased beliefs about future required returns or market frictions and uses an imperfect proxy for future market earnings expectations. the true share of incorrect values among predictors is likely even higher.

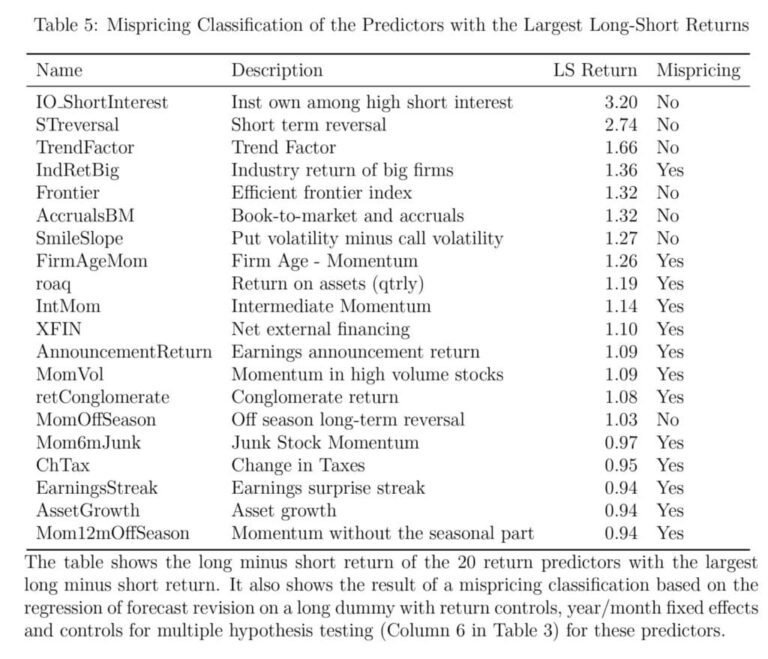

An individual-level overview of all mispricing predictors can be found in Table A7 in Appendix D. 172 of the 212 predictors (commonly used predictors such as momentum, profitability and investment) were found to be statically significant. Table 5 shows the mispricing ranking of the 20 predictors with the largest long-minus-short returns and can even be used to create simple HML (high minus low, classic long-short spread) portfolio strategies.

Furthermore, the results suggest that the excess returns of some predictors capture accumulation rather than the resolution of mispricing, implying that traders who capitalize on these predictors get worse rather than correct the mispricing. We would also like to emphasize Figure 2which shows the share of false-valued predictors in each category using the regression specification that controls for performance, includes fixed effects, and controls for the false discovery rate (Column 6 in Table 3 ). Taken together, the results suggest that the abundant evidence for cross-sectional predictability of returns does not simply mean that existing asset pricing models have not yet incorporated all relevant risk factors, but that there is widespread mispricing in the stock market.

Authors: Jonas Frey

Title: Which predictors of stock returns reflect mispricing?

Link: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4584121

Abstract:

A large number of stock characteristics have been found to predict the cross section of returns. The predictability of returns can be due to risk or mispricing, and the nature of most predictive returns remains an open question. I use analysts’ earnings forecasts to determine whether a performance predictor is associated with mispricing. I find that at least 40% of the return forecasts from a data set of 172 significant predictors are associated with mispricing, including the momentum index predictor from the Carhart four-factor and the profitability and investment forecasts from the Fama-French five-factor model. I further study whether the abnormal returns of the forecast misfits capture the deviation of prices from the fundamental value (accumulated value forecasts) or their convergence back to the fundamental analysis forecasters. Aggregation predictors are less common than breakdown predictors, but they do exist, meaning that trading specific performance predictors can exacerbate rather than eliminate mispricing. Momentum relates to both accumulation and resolution of mispricing.

And, as always, we present many interesting facts and tables:

Notable quotes from the academic research paper:

“For my test, I use professional analysts’ earnings forecast as a proxy for the market’s dividend expectations1. Considering the above argument, I can say that a performance predictor is a mispricing (hereafter also called “mispricing”) predictor if it also predicts more positive earnings forecast revisions for the stocks for which it predicts more positive returns. In principle, a link between a performance predictor and biased expectations could arise from behavioral biases or information processing frictions. However, since forecasters use simple portfolio classifications based on widely available data, it is unlikely that frictions prevent market participants from incorporating the forecaster’s information into price.

My test provides four critical insights by identifying the return predictors associated with biased expectations, which are a subset of all return predictors associated with mispricing. (…)

First, mispricing of any kind is evidence of market inefficiency, whereas risk-return predictability is not. Thus, my test provides a lower bound on the share of performance predictability that results from mispricing. Understanding how much mispricing exists in the market is crucial because prices determine the allocation of capital and therefore can affect the real economy.

Second, mispriced return forecasts should only be used in descriptive asset pricing models and should not be used normatively, such as for calculating risk-adjusted returns.

Third, price mispredictions whose returns are at least partially determined by biased expectations suggest profitable trading strategies, which is not the case for frictional risk or mispricing. Therefore, the fact that my test only captures mispricing related to biased expectations and not mispricing due to friction can be seen as an advantage.

Finally, mispricing from biased expectations can be eliminated through trading once arbitrageurs perceive it, while return predictability from risk or market frictions should be persistent.

In summary, given the key differences between risk-based performance predictors and various types of error-based performance predictors, we arguably learn very little from knowing that a performance predictor exists if we do not understand its nature. Determining the nature of a predictor is challenging because predictor discovery is driven primarily by empirical research and it is difficult to determine the nature of the predictor from the return distribution without an economic model (Kozak et al., 2018). Thus, considerable disagreement about the nature of most predictors remains in the literature (see Holcblat et al., 2022, for a review), and arguably the CAPM market factor (Lintner, 1965; Sharpe, 1964) is the only predictor that is universally accepted to represent risk rather than mispricing. Therefore, it is crucial to develop portable empirical tests that can help understand whether a given predictor of performance is determined by risk or mispricing.

Applying the mispricing test to these 172 predictors, I find that about 40% of them also predict earnings forecast revisions and are therefore associated with mispricing. Importantly, my test cannot rule out that a predictor is also associated with risk in addition to being linked to mispricing.

Reassuringly, a large fraction of lead-loss forecasts, which are supposed to capture delayed reactions to news, are classified as incorrect values.

Table 8 shows the results of a regression of the forecast error on the day of portfolio formation on the long dummy. A positive dummy long indicates that analysts are more pessimistic about stocks in the long portfolio, which is predicted for consolidation predictors. I find that, in my preferred specification (6), in which I control for performance, include year/month fixed effects, and adjust for multiple hypothesis testing, 56.94% of the erroneous values are classified as analysis. All other specifications have generally similar results.’

Looking for more strategies to read? Subscribe to our newsletter or visit our Blog or Screener.

Want to learn more about the Quantpedia Premium service? Check out how Quantpedia works, our mission, and our Premium Pricing offer.

Want to learn more about the Quantpedia Pro service? Check out its description, watch videos, check out our reporting features and visit our price quote.

Looking for historical data or backtesting platforms? Check out our list of Algo Trading discounts.

Or follow us at:

Facebook Group, Facebook Page, TwitterLinkedin, Medium or Youtube

Notification toLinkedInTwitterFacebookRefer a friend